What to expect in the currency markets in 2020

- Go back to blog home

- Latest

2019 was another eventful year in the currency markets.

The Federal Reserve embarked on a sharp U-turn in policy in the US, cutting interest rates on three occasions last year. The European Central Bank followed suit in September, while also restarting its large-scale quantitative easing programme. Central banks in Australia and New Zealand have eased policy aggressively, with many others in the G10 either hinting at the possibility of cuts or stating that higher rates remain a long way off. The notable exceptions being Norges Bank and the Riksbank, both of which hiked rates last year.

The Brexit saga has also continued to drag on longer-than-expected as MPs squabbled over the contents of the UK’s withdrawal agreement. The Article 50 exit date was delayed not once but twice from 31st March to 31st October and then again to the end of January 2020. The decisive Conservative Party victory at December’s general election does, however, ensure that the UK will now finally leave the European Union in an orderly fashion at the end of the month.

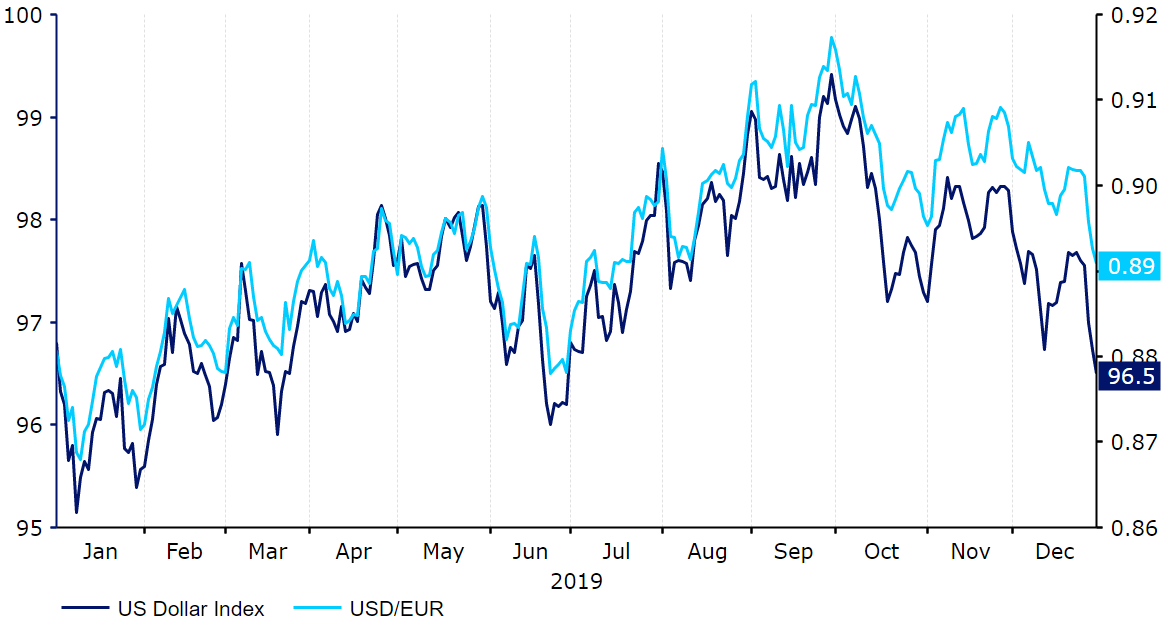

As far as emerging market currencies are concerned, the flight from risk induced by the trade war contributed to a volatile year. A handful of the more vulnerable sold-off to all-time lows versus the US dollar, though the emerging market FX indexes ended 2019 not far from where they started. The dollar itself has actually ended the year modestly higher in trade-weighted terms, despite the aforementioned Fed cuts and trade war uncertainty (Figure 1).

Figure 1: US Dollar Index (2019)

2019 Best Performers*:

- Ukrainian hryvnia 16.5%

- Russian ruble 12.5%

- Egyptian pound 11.7%

- Israeli new shekel 8.6%

- Thai baht 7.6%

2019 Worst Performers*:

- Argentinian peso -37.1%

- Angolan kwanza -35.9%

- Haitian gourde -19.4%

- Zambian kwacha -15.6%

- Sierra Leonean leone -13.9%

*% change versus US dollar.

Source: Bloomberg

So what do we think is in store for the currency markets in 2020? We outline below the main themes and underlying driving forces we expect to influence the foreign exchange market this year:

- Federal Reserve on hold for the foreseeable future

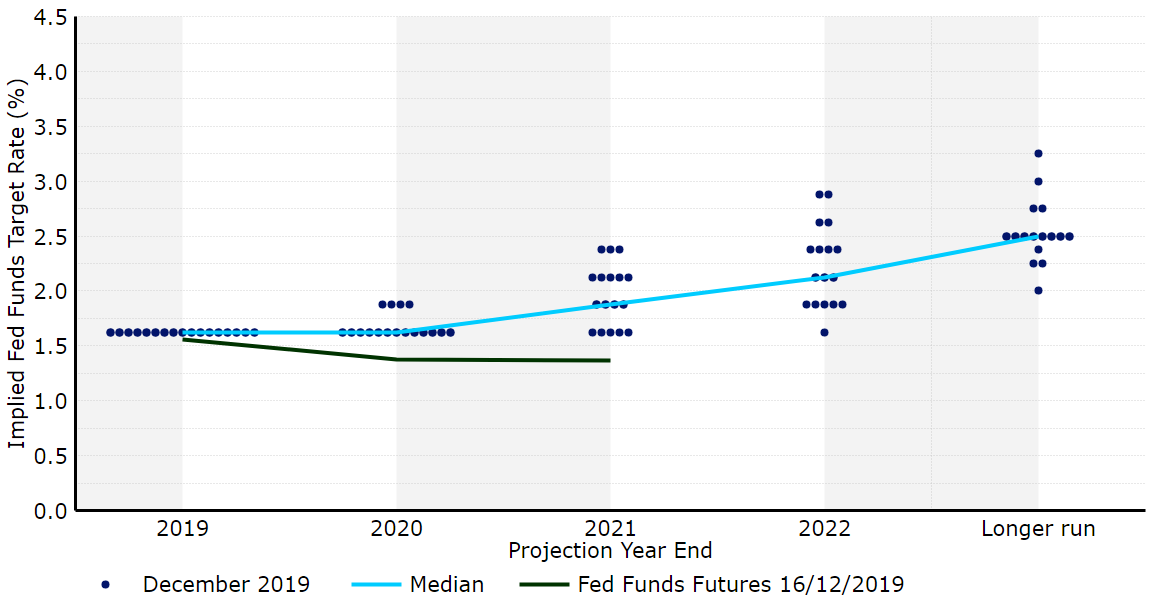

At the December FOMC meeting, Chair of the Federal Reserve Jerome Powell gave a clear indication that rates are likely to be unchanged in the US for the foreseeable future. Powell stated that the outlook was ‘favourable’, although the bank would need to see a ‘persistent’ jump in inflation to warrant higher rates. The median projection in the latest ‘dot plot’ also showed flat rates this year, with only four members seeing one hike in 2020 (Figure 2).

Figure 2: FOMC December 2019 Dot Plot

, As things stand, we think that the recent positive signs of progress on trade and robust US macroeconomic data ensure that additional Fed cuts are unwarranted in the near-term. Yet, with the Fed’s preferred measure of inflation, the PCE index, still comfortably below the 2% target, there is also clearly little need to raise rates any time soon. We therefore expect the Fed to pause at least through the first half of 2020 as it awaits additional data to determine the impact of its recent cuts before it decides on the direction of its next policy move. This, in our view, would probably entail the gradual return to hikes at some point in 2021.

- ECB in no rush to ease policy again any time soon

The Mario Draghi era of the European Central Bank was brought to a close in October, with former IMF chief Christine Lagarde delivering her first press conference as the new President in December. In a nice change of pace from Draghi’s relatively dour and downbeat tone, Lagarde struck a pretty optimistic note, stating that there were signs the recent downturn in Eurozone manufacturing had bottomed out.

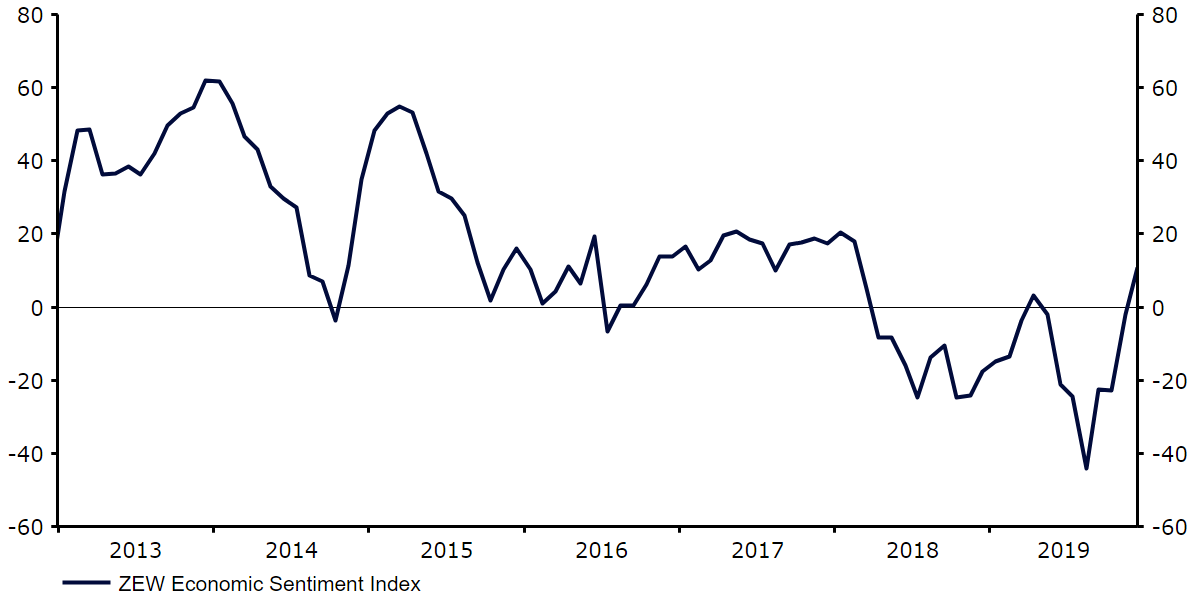

We think that there are reasons to be modestly optimistic about the outlook for the Euro Area in 2020. The PMIs appear to have stabilised, particularly the services index that is now back at a comfortably expansionary 52.4. Recent sentiment data out of Germany also appears to have turned a corner, with the ZEW economic sentiment index back at its highest level since early-2018 (Figure 3). An easing in global trade uncertainty should also be good news for the currency bloc, given that the Eurozone economy is dependent on export demand for 20% of its overall GDP. While the ECB is forecasting growth of just 1.1% this year, we think that risks here are skewed to the upside.

Figure 3: Germany ZEW Economic Sentiment Index (2013 – 2019)

, Our expectations for an improvement in European data this year imply that the ECB will likely hold policy steady for the foreseeable future, likely throughout the entirety of 2020. Stable rates from both banks combined with the improvement we expect in Eurozone growth will be modestly supportive of a higher EUR/USD this year, in our view.

- Trade war resolution likely, but challenges remain

Currency traders finally had some good news to digest on the trade front in December, with President Trump signing off on the ‘phase one’ deal with China that was initially struck back in October. China has agreed to buy an additional $200bn worth of US goods in the next two years as part of the deal, with the US foregoing additional tariffs and rolling back previous ones.

Despite recent progress, there is still a fair way to go before a full agreement can be reached. Chinese officials appear less enthusiastic about the ‘phase one’ deal than President Trump. We do remain confident that a full deal will be struck at some point in the coming months, given our view that Trump’s recent protectionist rhetoric is largely a negotiating tactic rather than a move to disturb long term trade patterns. This should be supportive of EM currencies in general this year, particularly those in Asia.

- UK to finally leave the EU: what’s next?

Boris Johnson’s revised Brexit withdrawal agreement has finally passed through the House of Commons, ensuring that the UK will leave the European Union by the end of January deadline. The key this year will now be whether or not a full agreement can be reached in time for the end of the transition period, or if an extension beyond 31st December 2020 is required. Boris Johnson has taken a very hard-line stance regarding the duration of the transition period, with the Tories stating in their manifesto that they would not be seeking an extension. There is, however, a general feeling among political analysts that a year is an insufficient amount of time in order to formalise a full agreement.

The Prime Minister has until the end of June to ask for said extension, or risk crashing out of the bloc at the end of December. Should it become clear that a cliff-edge exit is back on the table at the end of the year then we may see a retracement in the pound in the second half of 2020, although this is not our base-case scenario. We expect either a deal to be reached by year-end or, more likely, for the Tories to renege on their existing promise and ask for a delay to the transition period. This is, however, unlikely to be decided until just before the end of June extension deadline.

- Trump seeks re-election at November vote

While still almost a year away, November’s US Presidential election will come around quickly. Donald Trump still remains the front runner, despite his recent impeachment. Betting markets continue to show around a 50% implied probability of his re-election, with his nearest rivals Joe Biden and Bernie Sanders some way off. The outcome of the election is likely to hinge on the final result in a handful of states, given the peculiar US presidential electoral system. This makes it particularly hard to predict.

It is still too early to have a precise view on how the election will impact the FX market. The House is, however, quite likely to remain in Democratic hands, while the Senate stays Republican, so either way dramatic changes in spending or tax policy are unlikely regardless of the outcome.

- Emerging market currencies due a rebound

We think that the aforementioned conditions should be broadly supportive of emerging market currencies in 2020. Low global interest rates, a resolution to the trade war and an alleviation of the Brexit risk should, we think, help improve risk appetite and lead to a modest unwinding of 2019 safe-haven flows.

We believe that the EM currencies that outperform will be those with the most solid macroeconomic fundamentals and whose central banks are either in the process of hiking rates or approaching the need for higher rates.