Currency markets take hawkish central banks in stride

- Go back to blog home

- Latest

The world’s central bankers annual meeting at Jackson Hole delivered an unmistakably hawkish message, led by Fed´s chair Powell in a very short and clear speech.

Traders continue to focus on the incredibly volatile gas and electricity prices in Europe, which have already led to emergency declarations from EU officials hinting at price caps and rationing. The full details of this plan will emerge in the coming days and we expect them to be key market movers. Eurozone inflation data and the Chinese PMIs on Wednesday, plus the US labour market report Friday will provide fresh reads on the state of the tradeoff between inflation and economic growth worldwide.

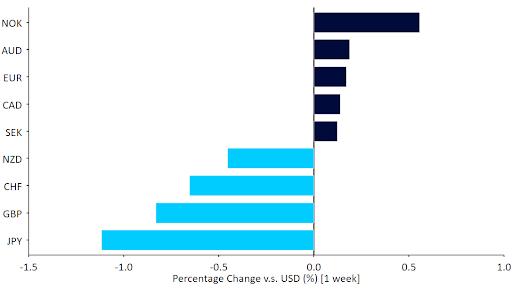

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 30/08/2022

GBP

The UK economy, like most G10 ones, is showing a sharp divergence between a resilient services sector that is buoyed by full employment and strong household balance sheets, and ailing manufacturing, hurt by massive hikes in energy prices and lingering supply chain issues.

The economy is not in recession as of now, and the Bank of England is focusing squarely on containing inflation. The UK is now the second G10 economy where markets expect overnight rates to go above 4%, after New Zealand. This should be supportive for sterling over the medium-term, though for now markets are focusing on the negatives. With no major economic or policy news on tap, expect the pound to track euro trading closely against the US dollar.

EUR

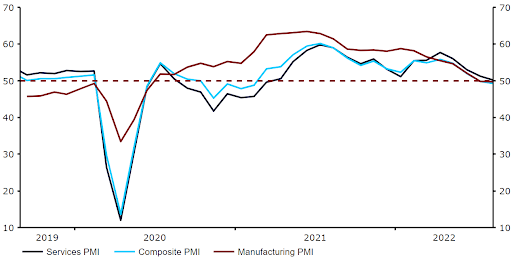

The PMIs of business activities were weaker than expected last week, and are now consistent with a modest contraction in economic activity. Natural gas and electricity markets continue to set new record highs on fears of gas shortages and, as this is written, the EU announced what appears to be the beginning of de facto rationing in those markets. None of this is phasing the ECB, whose officials are preparing the markets for large, sustained increases in interest rates, which could start with a massive 75 basis point move in September.

Figure 2: Euro Area PMIs (2019 – 2022)

Source: Refinitiv Datastream Date: 30/08/2022

The euro continues to hover around parity, weighed down by the threat of recession, but buoyed by the closing gap between European and US interest rates. All eyes this week will be on the flash inflation report for August on Wednesday. The ECB can expect little relief, with both the headline and (more worrisome) the core number expected to print at fresh multi-decade records.

USD

The dichotomy between business confidence and labour market strength was evident in the US as well last week. The PMIs were dismal, although weekly jobless claims remain very low and a testament to labour market strength. The Federal Reserve remains squarely focused on inflation, in spite of some early signs of relief on the inflation front, and Chair Powell made that clear at his short and to the point Jackson Hole speech.

The key this week will be the August payrolls report, which is once again expected to show solid job creation, a labour market at or above full employment and strong wage growth, though not strong enough to keep up with headline inflation. Meanwhile, rates continue to march higher, and there is still room for the US to join the UK and New Zealand and price in peak Federal Reserve rates above 4%.

CHF

The EUR/CHF cross hit another multi-year low last week, although a broad recovery in the euro triggered a reversal in pair, which has so far extended into this week. While the Swiss National Bank has indicated it is increasingly more comfortable with a stronger franc, interventions in the FX market suggest that there are limits to this tolerance. SNB sight deposits have continued to increase throughout August thus far, indicating to us that policymakers are keen to put a floor under the EUR/CHF exchange rate at current levels.

This coming week or so will be a busy one in Switzerland, with those economic data releases held back during the second half of August set to be dumped on investors in the coming days. Thursday’s inflation data is expected to show a modest acceleration in price pressures, with the July retail sales print set to show largely flat growth on the previous month. The initial release of the Q2 GDP numbers on Monday will also be closely watched.

AUD

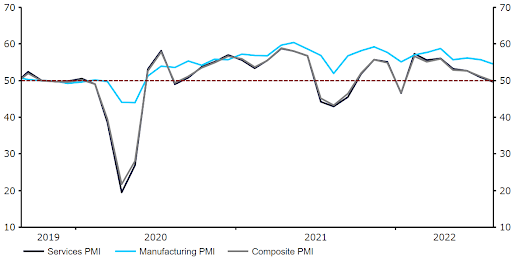

The Australian dollar held up reasonably well last week against the broadly stronger USD, despite the release of some rather downbeat domestic macroeconomic data, with flows out of the safe-haven yen into high-risk currencies seemingly supporting AUD. Last week’s business activity PMI numbers for August came in well below expectations, extending a slowdown evident since May. While the manufacturing index remains above the level of 50 separating expansion from contraction, the key services PMI unexpectedly slipped to 49.6 this month, its lowest level since the reintroduction of COVID protocols in January. Monday’s retail sales data was far more encouraging, although this was for July, so runs on more of a lag.

As things stand, markets are torn over whether the Reserve Bank of Australia will raise interest rates by 50 or 25 basis points at their meeting next week. There will be no major data releases between now and then, so it could be touch and go right up until the meeting, which may provide some volatility to AUD.

Figure 3: Australia PMIs (2019 – 2022)

Source: Refinitiv Datastream Date: 30/08/2022

CAD

A lack of major economic data releases during the typically quiet August trading period means that the Canadian dollar is trading roughly unchanged on the USD in the past week. CAD has continued to trade within a relatively narrow range on the US dollar in the past couple of months or so, perhaps given the close economic ties between the two countries, and the similar tightening paths adopted by the Federal Reserve and Bank of Canada.

Next week’s Bank of Canada meeting will be a highly important one for CAD. Markets are erring towards another 75 basis point move, although we think that this is far from guaranteed. This week’s GDP data for June may help guide those policymakers currently on the fence, so expect a high degree of volatility in the Canadian dollar around its release on Wednesday afternoon.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports