Dollar bounces back after monster employment report

- Go back to blog home

- Latest

The ‘big three’ central bank meetings came and went last week, rates were hiked in accordance to market expectations, and the market interpreted communications as generally dovish.

With the Fed ready to ease off the brake, while the ECB still has a lot of tightening to do, the environment should remain generally euro-positive, in spite of last week’s pullback. However, uncertainty is high and all central banks will be poring over upcoming inflation data obsessively. No such data from the major economic areas is on tap this week, so the focus will instead be on a raft of speeches from officials at the Federal Reserve, ECB and Bank of England. The sole exception will be the January CPI data out of China on Friday, where we expect inflation to rise rapidly and converge with levels prevailing elsewhere now that the COVID lockdows are a thing of the past.

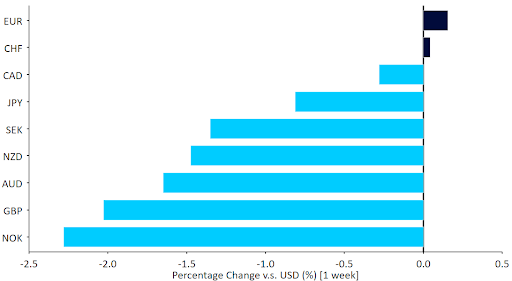

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 06/02/2023

GBP

The Bank of England’s communications were interpreted by markets as a dovish pivot last week, and gilt yields ended the week down nearly 30bps. The strikes may have added to the gloomy sentiment, and sterling ended the week down against every G10 currency, save the Norwegian krone.

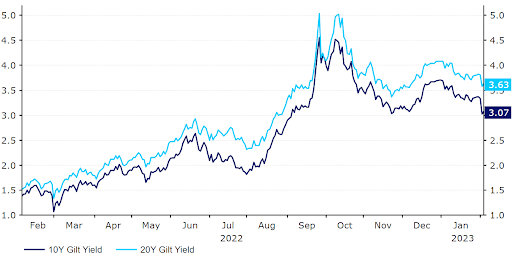

Figure 2: UK Gilt Yields (2022 – 2023)

Source: Refinitiv Datastream Date: 06/02/2023

We think that investors may be overreacting to this ‘dovish pivot’, since the Bank of England’s views have proven quite erratic over this tightening cycle. Core inflation in the UK has yet to show any sign of easing, and growth prospects were revised higher once again. At any rate, incoming inflation data will be even more important than before. No such data is on the docket this week, so the focus will instead bw on MPC speakers and the provisional numbers for fourth-quarter GDP growth.

EUR

The Eurozone seems to have avoided a recession in the last quarter of 2022. The ECB acknowledged as much by hiking rates 50bps, as expected. We were a bit puzzled by the market’s interpretation of last week’s meeting, which was perceived as dovish by investors. Another jumbo hike was telegraphed for the March meeting, and Lagarde made repeated references to the resilience of core inflation, an issue that we have been highlighting for some time.

At any rate, as elsewhere, the key in the coming months will be upcoming Euro Area inflation prints. We note that this week’s January report brought yet another upward surprise, with core inflation remaining at the all-time high of 5.2%.

USD

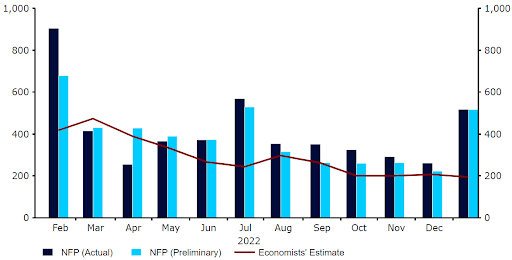

Chair Powell’s press conference after the FOMC meeting was interpreted as dovish, but the strong data out on Friday quickly rendered such disquisitions obsolete. The US jobs market appears to be actually accelerating. In addition to Friday’s blockbuster job creation and unemployment numbers, record high job openings and record low jobless claims indicate that it has, if anything, become tighter in spite of the significant rate hikes by the Federal Reserve. ISM business sentiment numbers also rose sharply to levels consistent with boom conditions.

Figure 3: US Nonfarm Payrolls (2022 – 2023)

Source: Refinitiv Datastream Date: 06/02/2023

Rates actually ended the week higher in the US, and the dollar’s retreat seems to have stopped for now. As elsewhere, we think that the next inflation numbers will be far more important than overinterpreting central bank communications.

JPY

The yen managed to hold its own against the broadly stronger US dollar last week, as markets continue to see the currency as a good buy opportunity given the expected shift in policy stance from the Bank of Japan later this year. Fears of a recession in Japan also eased slightly last week following some marginally better than expected macroeconomic prints, notably on consumer spending. Retail sales bounced back in December, rising by 1.1% on the month, following a contraction in November. Industrial production fell again, although the downturn was modest (-0.1%), and there is a general sense that economic activity is holding up reasonably well relative to the rather dire expectations.

This week looks set to be an important one for the yen, as nominations for the next Bank of Japan governor are set to begin on Friday. Existing governor Kuroda is set to leave the post in April, and there is a consensus that his replacement will herald a long-awaited tightening in BoJ monetary policy. Current deputy governor Amamiya seems to be the front runner among the major news outlets. He is perceived as slightly more dovish than some of the alternatives, so his appointment may be bearish for the yen, though he is still viewed as a hawk on the council so we suspect the market reaction could be rather contained.

CHF

EUR/CHF dipped following last week’s ECB announcement, although the impact on the exchange rate was short-lived. In the end, the pair ended the week little changed, with the franc one of the best performers in the G10, after the US dollar.

The latest economic news from Switzerland was mixed. Retail sales contracted sharply in December (-1.7% MoM), indicating weakness in consumer demand at the turn of the year. The manufacturing PMI disappointed as well, falling below the expansion threshold for the first time since July 2020. At the same time, however, the service PMI moved in the opposite direction, climbing above the 50 level, after a slight contraction at the end of the year. This index, which is more oriented toward domestic consumption, offers hope that there is a silver lining when it comes to the domestic demand landscape.

AUD

The higher the rise, the harder the fall can largely explain the sharp sell-off in the Aussie dollar last week, which fell back below the $0.69 level following Friday’s US payrolls data. All eyes are turning to this Tuesday’s Reserve Bank of Australia meeting. Following the hotter-than-expected Q4 inflation print, economists are pencilling in another 25bp hike, although markets are not yet fully pricing this in, so something may have to give.

We expect another 25bp hike from the RBA, though we suspect that there may be some division among committee members and, perhaps, discussions on the possibility of a larger 50bp move. In its communications, we also expect the bank to hint at additional tightening at the next meeting in March, with the line that it ‘expects to increase interest rates further in the period ahead’ likely to be maintained in the statement. As things stand, markets are only fully pricing in two more 25bp hikes during the rest of the year, so any hint of more would be a clear bullish signal for AUD.

NZD

The New Zealand dollar was among the underperformers in the G10 last week. Aside from the currency’s high sensitivity to risk, there was no real clear rationale for this performance. Last week’s fourth quarter labour report was on the soft side, yet markets largely took the news in stride. The unemployment rate ticked up modestly, although remained near historic low levels at 3.4%, while employment rose by 0.2% on the quarter (+0.3% expected) – all in all, still in line with tight labour market conditions.

There will be no major economic data released in New Zealand this week, so the dollar may largely be driven by expectations for the RBNZ’s next policy decision later this month (23/02). Another 50bp rate hike is eyed, but not fully priced in by markets, which could present some room for upside in the kiwi.

CAD

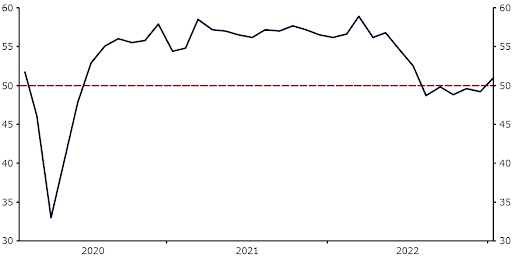

CAD continues to trade in lockstep with the US dollar, and was therefore one of the best performers among the G10 currencies last week. Some generally encouraging macroeconomic news helped the dollar on its way, notably the surprise November GDP expansion and move back above 50 in the manufacturing PMI for the first time in six months (51.0).

Figure 4: Canada Manufacturing PMI (2020 – 2023)

Source: Refinitiv Datastream Date: 06/02/2023

This Wednesday will see the release of the Bank of Canada’s January meeting minutes, though we see little room for any surprises here, or in governor Macklem’s speech on Tuesday, given that the BoC has effectively brought its hiking cycle to an end. Friday’s labour report for January may be a bigger market mover this week, particularly should it follow a similar pattern to last week’s US payrolls number.

SEK

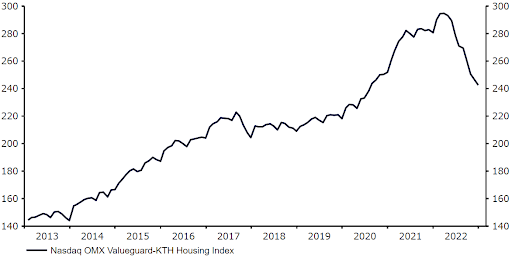

In line with other risk assets, the Swedish krona depreciated last week, with the EUR/SEK pair extending its move to more than 5% since mid-December and jumping to its highest level since April 2009. Concerns surrounding Sweden’s property market have partly contributed to the krona sell-off. House prices have now slumped by almost 20% in the past year, with investors concerned that more pain may be the way as domestic rates continue to march higher.

Figure 5: Sweden House Prices (2013 – 2023)

Source: Refinitiv Datastream Date: 06/02/2023

There is a possibility that the Riksbank could deliver an aggressive surprise to markets at its meeting on Thursday. We expect the Riksbank to raise rates by 50bps, while announcing that further hikes may be on the horizon, as the central bank remains committed to bringing down inflation, which has risen to its highest level in more than three decades. Some central bankers have recently expressed dissatisfaction with the weak SEK, which opens up the possibility of a larger rate hike on Thursday, or even direct intervention in the foreign exchange market. This could ease pressure on the krona, though concerns surrounding the property market may keep any advances in check.

NOK

The Norwegian krone has continued to come under heavy depreciating pressure in the past few sessions, and is currently trading around its lowest level on the euro since October 2020. We attribute this move largely to the recent drop in gas and oil prices, and the moderation in stance from Norges Bank, which has already paused its tightening cycle.

Focus this week will be on Norwegian inflation data for January, out on Friday. After two consecutive months of easing, both headline and core inflation rates are expected to rise again. However, given Norges Bank’s dovish stance, we think that we would need to see a significant surprise to the upside for it to change the bank’s rhetoric, and any support for the krone on the back of the data could be relatively limited.

CNY

The yuan was in the top half of the EM performance tracker last week, although it ended lower against the broadly stronger US dollar. Macroeconomic data from China last week was overwhelmingly positive, with the vast majority of key indicators of business activity jumping above the key level of 50 that separates expansion from contraction in January. This marks a sharp change in economic conditions following the country’s move away from zero–COVID, and gives a strong indication that an economic recovery is well underway.

That said, China’s already difficult relations with the US do not appear to be improving anytime soon, with the ‘spy balloon’ scandal leading to the postponement of US Secretary Blinken’s trip to China. These tensions have weighed on sentiment towards the yuan so far this week, and may continue to cast a cloud on the currency in the near-term. Looking ahead, we will keep an eye on inflation data from China, as well as any US-China noises. Both the consumer and producer inflation rates are expected to have risen in January, although the latter should still remain below zero, dragged down by the base effect.

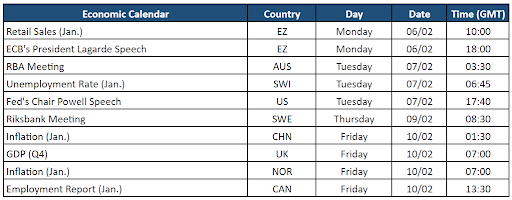

Economic Calendar (06/02/2023 – 10/02/2023)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports