Dollar bounces back as risk aversion returns to markets

- Go back to blog home

- Latest

The dollar and the euro both rallied together against most other major currencies last week.

Markets continued to be driven by the tension between dismal, record-shattering economic releases and the hopeful news of tentative reopening and dropping coronavirus caseloads in most countries. The Fed minutes on Wednesday will be somewhat out of date. More timely will be the PMI reports on May business activity in the Eurozone out on Friday, which are expected to bounce back somewhat from their historical lows of last month.

GBP

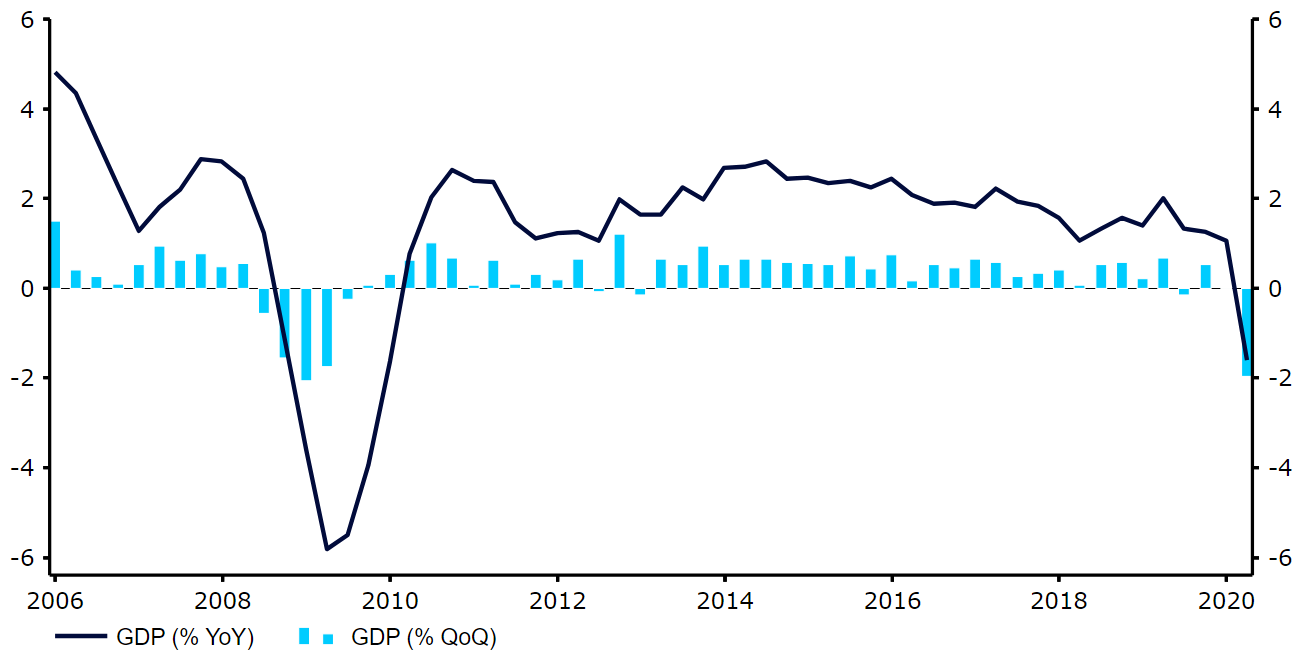

The GDP news from the first quarter was slightly less dismal than expected, but they reflect only the contraction in March and the fact that the UK lagged most European nations going into lockdown. Sterling was hurt by the sense that the Bank of England is looking at unconventional ways to ease monetary policy further, and expects to monetise the massive fiscal deficits that will be rendered inevitable by the economic contraction.

Figure 1: UK GDP Growth Rate (2006 – 2020)

Source: Refinitiv Datastream Date: 18/05/2020

The lack of progress in the Brexit negotiations has also reappeared as a factor weighing down sterling. Focus this week will be on Tuesday’s UK labour report, particularly the increase in the jobless claimant count, the most timely official gauge of the state of the labour market.

EUR

Eurozone industrial production for March and GDP contraction for the first quarter were more or less as dismal as had been expected. We think that Eurozone activity has reached a bottom, and as different countries start easing their restrictions on movement and work, we should see a rebound in activity.

The first test for this theory comes Friday, as the PMIs of business activity for May are released – the most timely read of the state of the economy. The bounce back, albeit from truly dismal levels, could well surprise markets and provide some upward impetus for the common currency.

USD

In our view, the main news from last week was that the enormous sales of Treasury bonds were absorbed by markets with little discernible impact on yields. The world’s appetite for debt from the main sovereigns is far from sated, which is good news for the US government given the massive fiscal deficits it is expected to incur in the near term.

This week, the minutes of the last Fed meeting will be published on Wednesday, but we think Chair Powell’s testimony to the Senate Banking Committee will contain more timely information on the state of mind of Federal Reserve officials.