Dollar crashes as markets eyes 50bp Fed hike in December

( 10min )

- Go back to blog home

- Latest

A relatively dovish speech from Fed chair Powell, and the prospect of a pivot away from zero-COVID in China, put some fuel into the risk asset rally last week.

This week will be a quiet one in terms of data releases and policy news, and markets will likely mark time as they wait for the big three central bank meetings that will take place in the span of less than 24 hours next week. The Federal Reserve will kick things off on 14th, followed by the Bank of England and the ECB on 15th.

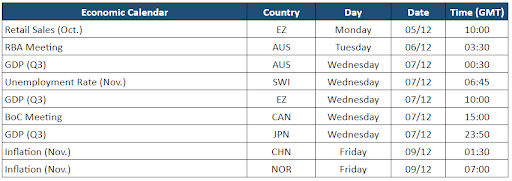

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 05/12/2022

GBP

Sterling continued its strong rebound from the depths of the fiscal crisis, as markets become more confident that sane fiscal policies will be followed and the backdrop becomes more friendly to risk taking in general. Macroeconomic data releases also continue to come in slightly better-than-expected, notably the recent PMI prints, further raising hopes that the downturn in UK activity may not be as severe or prolonged as some of the worst-case scenarios.

Talk of a Swiss-style model for relations with the EU also soothed nerves last week, and some hawkish comments from MPC members probably mean that sterling will have an easier time going up than down. That is, at least until the Bank of England clarifies (or further muddies!) its position at the December meeting in 10 days hence. A 50 basis point rate hike is widely expected by investors, so attention will likely be largely on the bank’s rhetoric on the pace and extent of additional tightening in 2023.

EUR

The drought of market moving news out of the Eurozone last week and this one means that the common currency is mostly moving in reaction to news elsewhere, notably the US and China. Both were positive last week, with Powell telegraphing a rate hike of only 50bps in December and Chinese authorities signalling that lockdown measures will be relaxed.

Hopes that the zero-COVID policies may soon be a thing of the past has helped risk assets in general in the past week, and allowed the euro to bounce around the top of the 1.00-1.05 range where it has been trading for the past few weeks. Q3 GDP data will be released on Thursday, though this is merely the revised print, so volatility in the euro may be rather low around its release. Expect ECB member speeches to garner far more attention leading into next week’s highly important European Central Bank meeting.

USD

Markets were desperate for a sign that the Fed is ready to pivot away from massive 75bp hikes, and it got its wish last week. A 50bp rate increase in December is now priced in, and while in previous hiking cycles this would have been considered a jumbo move, this passes for good news on the rate front nowadays.

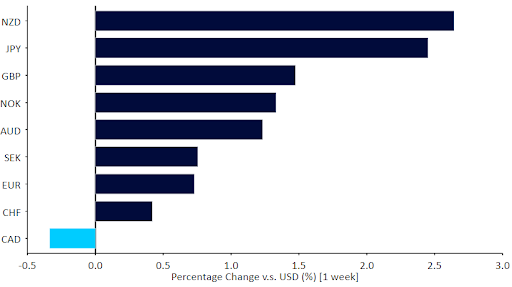

News out last week was positive for the economy, and mixed for inflation. Actual activity numbers are so far strong in the US, and labour markets remain taut. While the PCE inflation report confirmed the good news from the earlier CPI one, wages in October rose considerably more than expected and seem to be trying to catch up with inflation, raising the prospect of second-round inflationary effects. For now, all is forgotten in celebration that 75bp are done with. Bonds rallied in tandem with risk prices and the dollar continued to retrace its 2022 gains.

Figure 2: US PCE Inflation Rate (2012 – 2022)

JPY

The yen has continued its strong recovery in the past few weeks, and was once again one of the better performers in the G10 last week. An improvement in risk sentiment would ordinarily be perceived as bearish for the safe-haven Japanese yen, though the recent sell-off in the currency and intervention efforts from the Bank of Japan has left it prone to recovery rallies. Last week’s move propelled the USD/JPY pair below the 135 level for the first time since August.

A slew of economic data releases will be closely watched by currency traders this week. Today’s services PMI came in slightly stronger-than-expected, although printed only modestly in expansionary territory (50.3 vs 50.0 expected). Revised third quarter GDP data on Wednesday could also shift the yen if we see a significant deviation from the initial estimate.

CHF

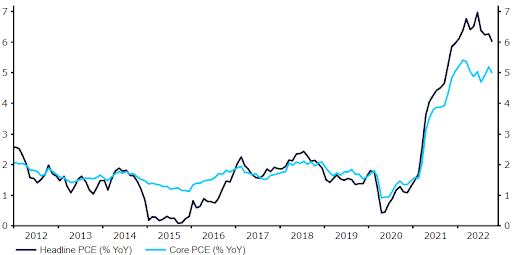

Improved risk sentiment meant that the safe-haven franc trailed most of its G10 peers, ending last lower against the euro. News from Switzerland failed to help the currency, with most readings disappointing expectations. Third-quarter GDP growth was unimpressive at +0.2% QoQ, and the Q2 reading was revised down to just +0.1%. Real retail sales dropped sharply in October (-2.5% YoY) and the forward-looking sentiment indices dipped as well, suggesting a slowdown ahead.

Figure 3: Switzerland GDP Growth Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 05/12/2022

The centre of attention was, however, inflation. As expected, the headline rate stabilised at 3% in November, with core price growth ticking up to 1.9%. The Swiss economy is slowing and the data seems to send some disinflation signals. However, considering that price growth remains far above the central bank’s comfort threshold, we think that the poor economic numbers won’t deter the SNB from hiking interest rates next week – our base case remains for a 50bp hike.

AUD

Signs of a move towards easing the zero-covid policies in China should be disproportionately bullish news for the Aussie dollar, though the currency lagged behind most of its high-risk G10 peers last week, including the New Zealand dollar. Expectations that the RBA will deliver no more than a 25bp rate hike at its meeting on Tuesday has partly held back the rally in AUD – indeed markets see almost a 30% chance of no hike at all.

There will be no policy meeting in January, so Tuesday meeting could lay the groundwork for an end to the tightening cycle. Markets are pricing in 70bps of hikes through to the middle of next year, so any hints that hikes could end in Q1 would be perceived as dovish for AUD. Third-quarter GDP data out on Wednesday, and trade balance figures on Thursday will round out an unusually busy week in Australia.

NZD

The New Zealand dollar was the best performer in the G10 last week, with the kiwi receiving headwinds from both easing Fed rate hike bets and positive headlines out of China – New Zealand’s largest trading partner. Domestic economic news out of New Zealand last week, notably housing, terms of trade and business confidence data, was actually unambiguously bearish for NZD, although it was largely overlooked by investors.

Weaker business confidence, sky-high inflation and ongoing labour shortages do present near-term risks to the economy, and could lead to a correction in the recent dollar rally in the coming week. There will be no real major economic data releases out of New Zealand this week, so NZD could be driven largely by events elsewhere, notably covid news out of China.

CAD

CAD once again trailed behind its major peers last week, ending roughly unchanged versus the US dollar. Data out of Canada last week was rather mixed, with slightly softer-than-expected GDP figures offset by modest surprises to the upside in the November PMI data and employment reports. High uncertainty heading into this week’s Bank of Canada meeting has partly contributed to this underperformance, with markets torn between a 25bp and 50bp rate hike. While economists are pencilling in a 50bp move, markets only see a one-in-four chance of one, which opens the door to a hawkish surprise.

On balance, we think that a 25bp hike is more likely. Excess demand and a lack of a clear peak in core inflation may encourage a larger move, though we think that heightened growth concerns could tip the balance towards less tightening. This would be a bit of a disappointment for investors, but would probably only lead to a small sell-off in CAD given current market pricing.

SEK

The Swedish Krona ended last week slightly higher against the euro, in line with other risk assets, which rose as investor risk appetite improved. Economic data released last week was rather mixed. GDP data showed that the Swedish economy expanded by 0.6% quarter-on-quarter in Q3, slightly less than expected (+0.7%). Consumer confidence rose to 55.8, up from the lowest level since 1993. While this remains at historically low levels, this improvement makes us marginally more optimistic about the outlook for the Swedish economy.

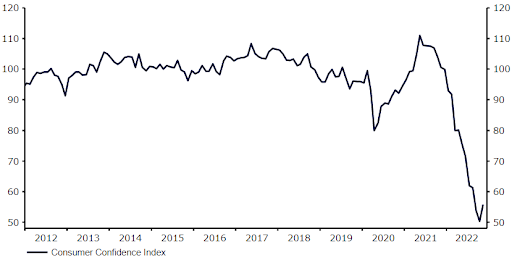

Figure 4: Sweden Consumer Confidence (2012 – 2022)

Source: Refinitiv Datastream Date: 05/12/2022

On the other hand, retail sales fell by 1.3% month-on-month in October, the third consecutive monthly drop and the steepest since June. No major data will be published this week, so we suspect that SEK will largely trade in line with other risk assets.

NOK

In the absence of relevant data last week in Norway, the Norwegian krone traded in line with risk assets, ending the week higher against both the US dollar and the euro.

This week’s focus will be on the November inflation data to be released on Friday. Headline inflation is expected to ease slightly from the 35-year high recorded in the previous month, but core inflation is expected to remain unchanged at a very high 5.9%. If confirmed, thi would cement our view that Norges bank will need to keep raising rates in the coming months in order to control inflation. In the event of an upside surprise, there is a possibility that the central bank will again discuss the possibility of raising rates by 50 basis points, which could support the Norwegian currency.

CNY

The Chinese yuan traded higher against the US dollar last week, with the USD/CNY pair falling below the key psychological threshold of 7.0 for the first time since September. Signs of a move towards a reopening of the Chinese economy has helped CNY. The COVID protests appear to have been largely contained, and have forced authorities to rethink their zero-COVID approach. A number of cities have announced an easing of curbs and Chinese officials appear to be moving towards further easing. Last week, Vice Premier Sun Chunlan, mentioned ‘decreased pathogenicity’ of the omicron variant and stated that the country is entering a ‘new stage’ in its fight against COVID. China has also announced an acceleration of efforts to vaccinate the elderly, targeting one of the main roadblocks to a full reopening.

Investors will continue to focus on COVID news this week. Largely disappointing November PMI data suggests that this remains key for the Chinese economy. Aside from COVID policy signals, consumer and producer inflation data for November, out on Friday, will be worth watching.

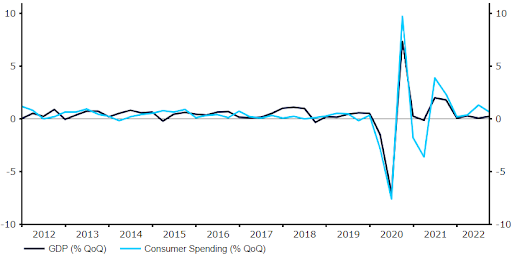

Economic Calendar (05/11/2022 – 09/12/2022)