FX Market Update – Dollar eases back on Fed stimulus, jump in US virus cases

- Go back to blog home

- Latest

The main trend in the FX market yesterday has continued into Tuesday trading thus far, with the US dollar easing back against most major and emerging market currency.

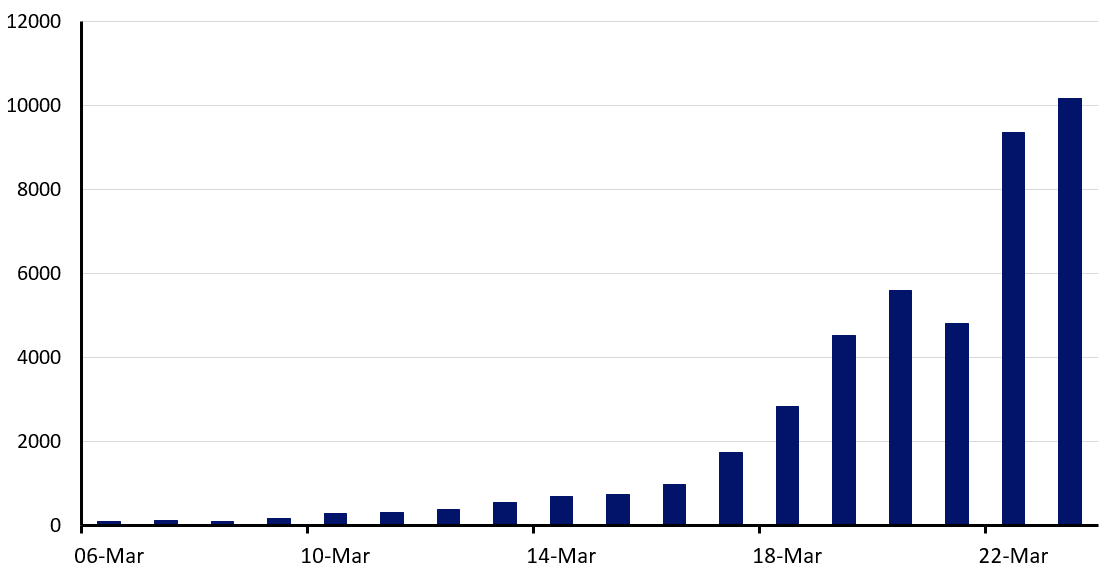

According to the latest data from Worldometers, a little over 46,000 cases of the virus have now been confirmed in the US (around 12% of global total), almost half of which are in the state of New York. The pace of growth in new daily cases in the US has doubled in the past couple of days compared to the previous two-day period, acting as a catalyst for investors to unwind some of their long USD bets.

Figure 1: US New Daily COVID-19 Confirmed Cases (06/03 – 24/03)

Monday’s unprecedented stimulus announcement from the Federal Reserve also halted the dollar rally in its tracks. The Fed announced yesterday that they will be buying $250bn in MBS and $375bn in US Treasuries this week, while also re-introducing its term asset backed securities loan facility in order to support consumer and business debt. Moreover, they announced that their QE programme, which was re-launched last week, will run without a limit. While this comprehensive package should help support equities and drive down treasury yields, it has allayed fears of a dollar funding crisis in the market, thus sapping appetite the greenback.

In the equities markets, the Dow Jones index was up around 7% as markets opened today on hopes that the US government’s (up to) $2 trillion economic stimulus package was close to passing – it may even pass through Congress later today. Whether this large-scale package is enough to provide any more than temporary relief for stocks remains to be seen, although it is unlikely.

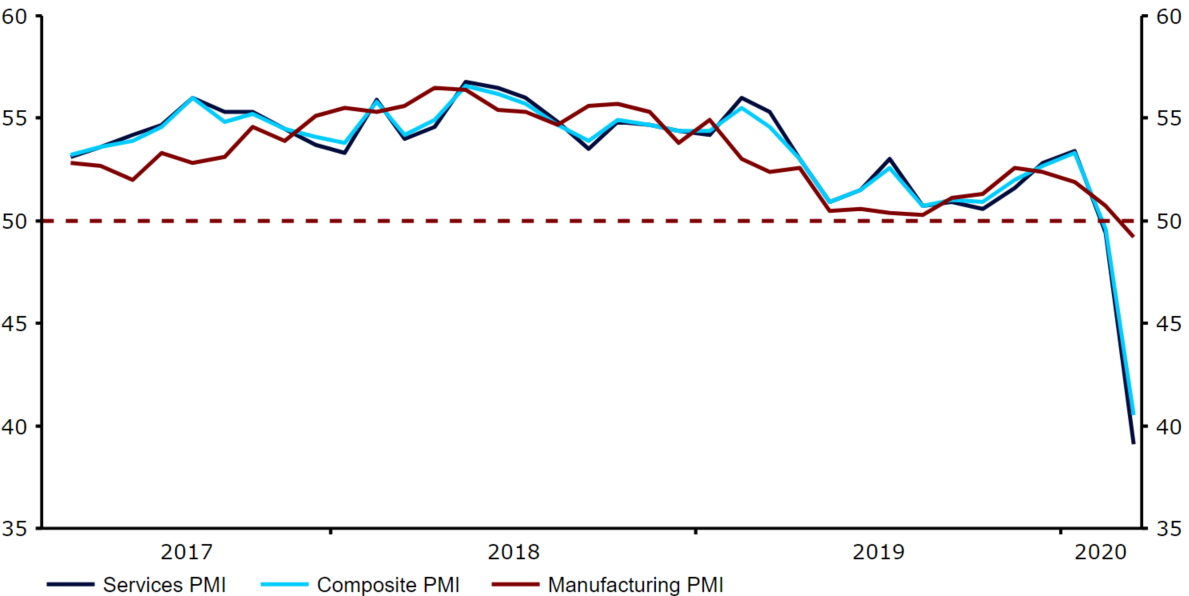

Despite the best efforts of both the Federal Reserve and US government, we think that a US and indeed global recession this year is inevitable. This afternoon’s US PMI data provided a glimpse of what’s to come. The composite index from Markit sank to just 40.5 in March following a monsterous decline in services activity that more than overshadowed a bump in manufacturing.

Figure 2: US PMIs (2017 – 2020)

According to Markit’s chief business economist Chris Williamson, ‘U.S. companies reported the steepest downturn since 2009 in March as measures to limit the Covid-19 outbreak hit businesses across the country. The service sector has been especially badly affected, with consumer-facing industries such as restaurants, bars and hotels bearing the brunt of the social distancing measures, while travel and tourism has been decimated.’