US Dollar slumps after Trump claims currency “getting too strong”

- Go back to blog home

- Latest

The US Dollar fell sharply to its weakest position in a week against its major peers during New York trading yesterday evening after US President Donald Trump claimed that the Dollar was “ getting too strong”.

Meanwhile, Sterling rose back above the 1.25 level against the US Dollar on Wednesday after the release of a fairly encouraging set of labour data in the UK. Yesterday’s report from ONS showed a welcome increase in wage growth and unemployment remaining around at its lowest level in a decade.

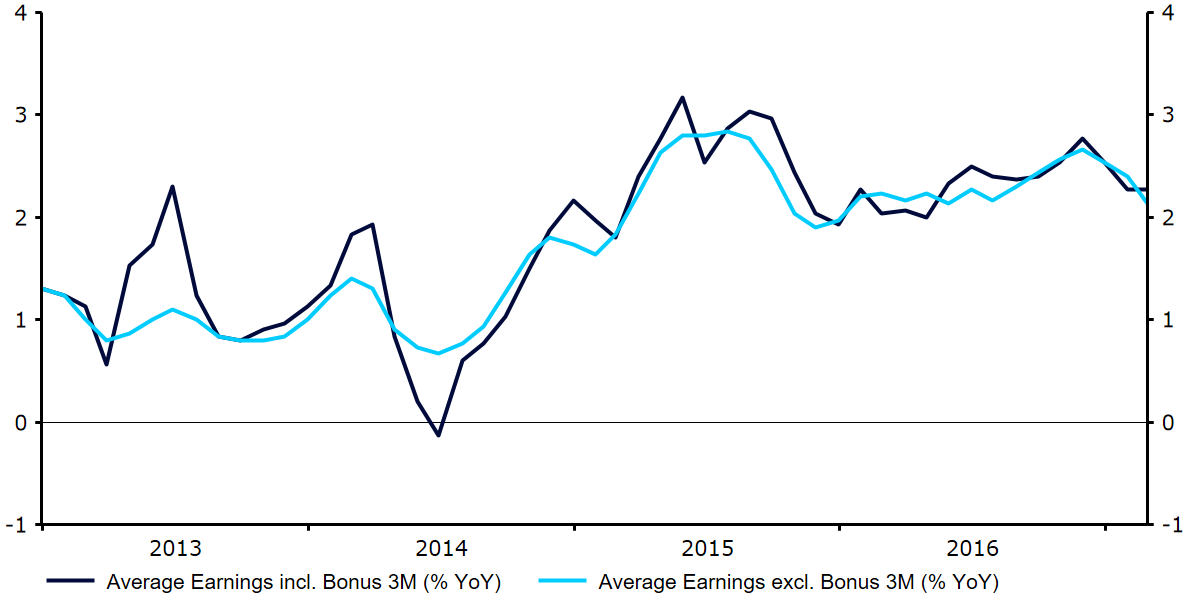

Wages in the UK grew more than expected in the three months to February, in another sign that the Bank of England may be justified in raising interest rates in the UK for the first time in ten years. Earnings rose 2.3% including bonuses, compared to the 2.2% consensus, while wage growth excluding bonuses also came in at a better-than-expected 2.2% (Figure 1). This is now back in line with inflation, meaning real earnings in February were essentially flat.

Figure 1: UK Average Earnings Growth (2013 – 2017)

In France, far-left ‘Unsubmissive France’ leader Jean-Luc Melenchon continues to close the gap with the other main candidates ahead of this month’s Presidential Election. Support for Melenchon has grown in the past few weeks and he has gone from rank outsider to credible candidate in the last few days, helped in part by a strong showing in the latest TV debate where he came out on top of the snap poll.

The latest poll from Opinionway showed support for Melenchon had grown to 18% from closer to 10% less than a month ago. There is now a realistic possibility that the two candidates, both of which have pledged to hold a referendum on France’s future within the European Union, could make it through to the second round of voting.

Major currencies in detail

GBP

Governor of the Bank of England Mark Carney spoke for the second time in a week on Wednesday, although failed to touch on monetary policy, as expected. Despite this week’s encouraging economic news on the state of the UK economy, financial markets are now placing around a 15% probability that interest rates will be raised in the UK this year, considerably lower than the 40% priced in a matter of weeks ago. We think this is far too low, and expect long term gains for the Pound as rate hike expectations become more in line with economic fundamentals.

With no economic or political announcements in the UK today, Sterling will largely be driven by events elsewhere.

EUR

An especially quiet session of currency trading in the Eurozone caused the Euro to end London trading more-or-less unchanged against the US Dollar.

The single currency continues to trade around its lowest level since the middle of March amid concerns that Marine Le Pen is likely to make it through to the second round of voting in the French Presidential Election next month. While we think there is a very good chance this will be the case, current odds currently give her less than a one-in-three chance of being named as the next President in the runoff election next month.

USD

The Dollar remained fairly soft against its major peers yesterday, with US bond yields continuing to fall amid the risk off mode induced by both the French Presidential Election and growing geopolitical risks in Syria and North Korea. Yields on the benchmark 10 year government bond in the US has dipped to a near three month low this week as investors flee to safer assets.

The US economic calendar is fairly barren today, with producer price data and initial jobless claims unlikely to have a significant impact on the US Dollar. Inflation and retail sales data on Friday will be the main economic releases in the US this week.