Dollar falls sharply as US inflation slows from peak

( 3 min )

- Go back to blog home

- Latest

Wednesday’s softer-than-expected US inflation print provided some relief for markets, sending the US dollar lower and risk currencies sharply higher.

Summary:

- Dollar falls sharply against peers as US inflation data comes in short of expectations. Headline CPI measure fails to post monthly increase for first time since May 2020.

- EUR/USD breaks out of its recent narrow range, rallying above 1.03 mark and its highest level since early-July.

- Financial markets dial back bets in favour of Federal Reserve interest rate hikes amid hopes that US inflation may have already peaked. 50bp hike from FOMC in September now more likely than 75bp one according to futures.

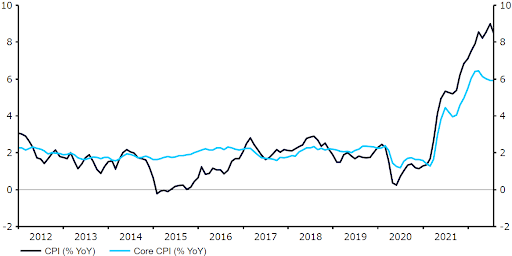

Arguably the key theme in the global economy in the past twelve months or so has been the persistence of the inflation overshoot, and the continued surprise to the upside in indicators of price growth. Prior to yesterday’s report, twelve of the past sixteen US inflation prints have come in above economists expectations (3 in line and just one below). Yesterday’s data was, therefore, quite a big surprise for investors, as both the headline and core measures of consumer price growth fell short of consensus. Headline inflation eased to 8.5% from 9.1%, partly a consequence of lower petrol prices, and was actually flat month-on-month – the first time without a monthly increase in prices since May 2020. Meanwhile, the core indicator of inflation, which strips out the volatile components, was unchanged at 5.9% (6.1% expected), and continued to show signs that it may have already peaked.

Figure 1: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 10/08/2022

The reaction in FX to yesterday’s US inflation print was a rather aggressive one, ending a period of relative quiet in markets that has caused most of the major currency pairs to trade within very narrow ranges. While an easing in US inflation should alleviate concerns that the world’s largest economy could be set for a prolonged and painful recession, which would be a bullish signal for the dollar, it also clear implications for Federal Reserve policy. The FOMC has already indicated that it would need to see clear signs of a slowdown in inflation before it stops the tightening cycle, but evidence that price pressures may have peaked could be enough to convince policymakers to return to smaller hikes. At the time of writing, markets are now pricing in not much more than a one-in-three chance of a 75 basis point rate increase at the Fed’s September meeting, down from almost 70% prior the the inflation number. This repricing can explain the move lower in the dollar, which sold-off by more than 1% on both the euro and the pound.

As mentioned, it has been a rather quiet period in the FX market in the past couple of weeks, which is fairly typical during the traditionally uneventful month of August. That said, the rest of the week will far from be devoid of any market moving action, with a handful of economic data prints set to keep investors on their toes. In the UK, we will be paying particular close attention to Friday’s Q2 GDP print. Markets are bracing for a bleak number, with economists pencilling in a 0.2% contraction, which would be the first since the first quarter of 2021. If anything, we think there is room for modest upside in the data. Given the strength of the May GDP print, we would need to see a very sharp downturn in the June GDP number to tip the economy into a quarterly contraction – a 1.3% MoM downturn is expected, but this would be by far the largest contraction since the winter lockdowns were imposed early last year.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk