Dollar suffers on soft data, Yellen testimony; emerging market currencies soar

- Go back to blog home

- Latest

Last week’s mix of macroeconomic and monetary policy news was not kind on the US Dollar.

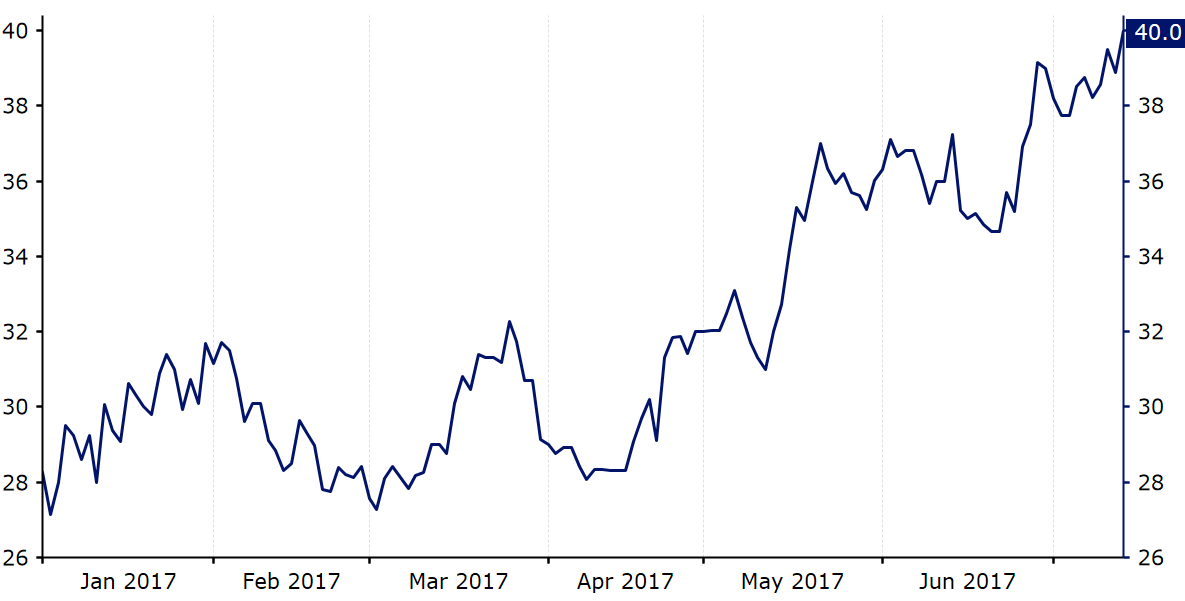

Remarkably, last week’s Dollar weakness was not accompanied by Euro strength. The common currency barely eked out again, and it underperformed against every major currency except the Dollar. Speculators appear to be betting on long Euro positions (Figure 1).

Figure 1: EUR/USD Net Long Positioning (January ‘17 – July ‘17)

The opposite was true of emerging market currencies. The retreat in US yields sent investors out chasing the higher returns still available there. As a result almost every major currency ended up anywhere from 1% to 3% against the US Dollar and the Euro.

Given this surprising price action in the Euro, Thursday’s ECB meeting takes on added importance. It is the last opportunity for President Draghi to shape perception of the prospects for monetary policy in the Eurozone before the summer vacations start. In particular, markets will scrutinise the Council’s reaction to the considerable recent appreciation in the Euro and resulting tightening of financial conditions in the Eurozone.

Major currencies in detail

GBP

The labour market report last week was the first unambiguously good news on the UK economy for some time. Employment increased by 175,000 jobs in the three months to June, unemployment ticked down to 4.5% and wages provided a modest but pleasant positive surprise, rising 2%. Sterling celebrated the news, outperforming all other non-commodity G10 currencies and breaking convincingly above the 1.30 level against the Dollar.

On Tuesday we get inflation data for June. Markets are expecting essentially the same readings as last month, which would imply that inflation is peaking and likely to pull back. An upward surprise would really catch the market wrongfooted and would unleash a serious Sterling rally, particularly against the Euro.

EUR

The sole important data out last week in the Eurozone, industrial production, provided the latest confirmation of the solid uptick in economic activity there. Markets did not pay much attention, however, as they remain focused on the timetable for gradual removal of the monetary stimulus.

This week’s ECB meeting on Thursday afternoon, as always, will provide a critical look at the council’s plan. The Euro has appreciated significantly so far this year in trade weighted terms, and the move has picked up steam since Draghi’s June speech in Portugal. Should he try to talk down market expectations we could see a significant pullback given how unbalanced speculative positions have become in favour of bets for Euro appreciation.

USD

Fed Chair Yellen sounded fairly cautious in her semiannual testimony to the US Congress. Her remarks suggest that raising inflation to the Fed target is a priority, and that the Federal Reserve sees that outcome as more uncertain than it did just a few months ago. This message was reinforced by Friday’s release of June inflation data. The headline number came in more or less in line with market expectations. The more meaningful core data, which excludes volatile food and energy components, rose just 0.1% in the month, against a consensus for a 0.2% increase.

A lot of this appears to be driven by one-off factors such as a significant fall in hotels, airfares and wireless communications. Nevertheless, our call for another hike in 2017 is contingent on core inflation remaining at or above 1.5% or so on an annualised basis. We still expect the one-off factors keeping down core inflation to ease up in the next few months and a resumption of 0.2% monthly prints, consistent with inflation that is headed above 2.0%.