Dollar mixed ahead of all-important US inflation report

- Go back to blog home

- Latest

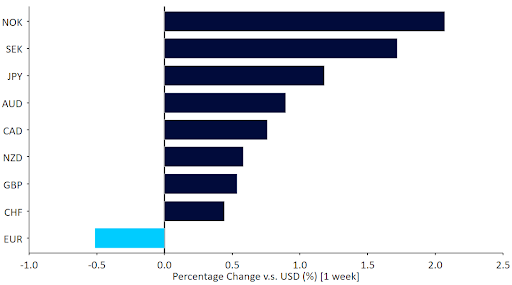

The recent rally in the US dollar eased against most major currencies last week, as markets somewhat tempered bets in favour of higher Federal Reserve rates.

The week was mixed overall. The dollar rose against most emerging market currencies following the surge higher in US yields, although it ended lower against almost all of its G10 counterparts, with the clear exception of the euro. Expectations for future Fed rate cuts continue to be pushed into the future, though FOMC chair Powell last week failed to acknowledge the possibility of a higher terminal rate than had been previously outlined. Meanwhile, a handful of currencies, such as the Swedish krona and the Mexican peso, outperformed on the back of respective central bank guidance toward higher rates in 2023. The FX market continues to be driven primarily by central bank stances and the resulting expectations for terminal short term rates in the different currency areas.

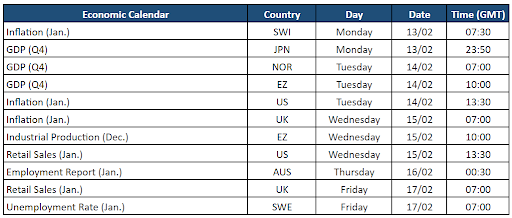

All eyes now shift to the data point that is itself the main driver of central bank expectations: the US inflation report for January, out on Tuesday. It is difficult to overstate the importance of this single data point, as traders and the Fed look for confirmation of the gradual downward trend of the past few months. The European flash GDP report for the fourth quarter (Tuesday), UK labour report (Tuesday) and inflation (Wednesday) are also on tap, but none of these reports will come close to the US inflation print in terms of market impact.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 13/02/2023

GBP

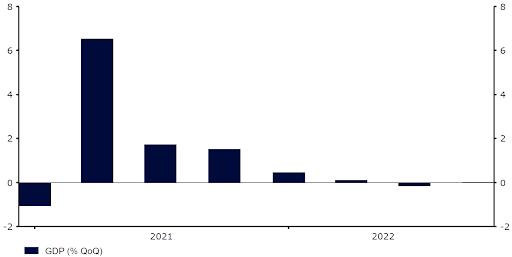

Investors have taken some comfort from the confirmation that the UK avoided recession in the last quarter of 2022. The UK economy posted flat growth in the final three months of the year, although the sharp downturn in December activity is a concern, and the outlook remains far from rosy. Sterling subsequently held its own against the dollar last week, while rising on the euro.

Otherwise, data was rather light last week. This week is very different, and we expect to see some fireworks mid-week between the release of the US inflation report on Tuesday and the UK one on Wednesday. The UK labour report on Tuesday is also important, but for now markets remain focused on inflation prints. Consensus for a core inflation print (excluding food and energy) well above 6% bodes ill for the Bank of England latest attempt at a “dovish pivot”, in our view.

Figure 2: UK GDP Growth Rate (2020 – 2022)

Source: Refinitiv Datastream Date: 13/02/2023

EUR

It was a very light week in terms of economic news out of the Eurozone last week. Retail sales were a touch on the soft side, and the German inflation print fell short of expectations. A handful of ECB members made public appearances, although none of them really delivered the hawkish messages that perhaps markets were bracing for, and the euro actually ended the week as the worst performer in the G10.

This week should be similarly light in terms of news, as the fourth-quarter GDP report has been preceded by most individual countries’ reports and should not add much new information. In addition to the CPI print out of the US on Tuesday, President Lagarde’s speech this week should be the main drivers of market action.

USD

Second-tier releases out of the US, including weekly jobless claims and consumer sentiment and CPI revisions were all consistent with the picture of strength painted by the payrolls report the prior week. Markets did, however, perceive Powell’s latest speech as dovish, as he failed to hint that the Fed was on course to raise rates higher than outlined in the bank’s December ‘dot plot’.

We note, in particular, the slight upward revision to the December core inflation print. This, together with the recent rebound in high-frequency measures like used cars, means markets are bracing for another +0.4% monthly print in this key core index. This is roughly consistent with a 5% annual rate of inflation, far too high for comfort for the Fed, and we expect that rates will continue to see upward pressure as expectations for a 2023 rate cut fade further.

JPY

Attention in Japan this week will be almost entirely on the appointment of the new Bank of Japan governor, with an official announcement expected on Tuesday. Kazuo Ueda is expected to be given the top job, with messrs Uchida and Himino set to be named as deputies. The yen jumped on reports of Ueda’s potential appointment on Friday, as markets grew increasingly confident that he would herald an end to the years of ultra-loose monetary policy in favour of higher rates. Markets will await confirmation of this possible hawkish pivot in upcoming communications from Ueda and his team. For now, investors are pretty confident that this change in stance is indeed on the way, and are continuing to price in a long-awaited rate hike in July.

Preliminary fourth quarter GDP data will be released in Japan just before midnight on Monday UK time. Economists are pencilling in a modest rebound in activity and, once again, the avoidance of a technical recession – Japan has teetered on the brink of one since early-2021.

CHF

EUR/CHF ended the week more than 1% lower last week despite little news of note from Switzerland, with the pair moving away from the parity level. Focus this morning was on the Swiss CPI print for January, which rose more than expected to 3.3% from 2.8%. Core inflation also increased, coming in at 2.2%, having hovered at or below 2% in the past six months – it was, however, flat on the month.

While inflation was expected to rise as a result of the annual utility price adjustment, and the core index momentum is rather weak, inflation continues to print at levels that are uncomfortably high for the Swiss National Bank. We continue to expect another interest rate increase at the bank’s March meeting. In the meantime, we’ll keep an eye on macroeconomic data. Producer price figures for January (Tuesday) and fourth-quarter industrial output data (Friday) will be the focus of our attention in the coming days.

AUD

The Reserve Bank of Australia delivered a hawkish pivot during its communications last week. Rates were raised by another 25bps, with the bank maintaining in its statement that additional hikes (plural) were likely on the way. Governor Lowe struck a concerned note on the inflation outlook, and appeared to confirm that at least a couple more 25bp rate increases were likely needed in order to ensure that inflation expectations remain well anchored. This rhetoric led to a sharp repricing in rate expectations last week, and markets now see rates topping out at around 4.2% later in the year.

RBA governor Lowe will be speaking again on Wednesday, and markets will be hoping for further clarity on last week’s remarks. Thursday’s labour report for January is also likely to be a market mover. Economists are eyeing a rebound in job creation following the surprise contraction in December.

NZD

A complete lack of major news out of New Zealand contributed to the minimal volatility in NZD last week, which traded within a very narrow range and ended more-or-less unchanged on the US dollar. Business activity PMI data out on Thursday will likely be closely watched by markets, though investors will already have one eye on the next Reserve Bank of New Zealand policy meeting (23/02).

A weaker-than-expected Q4 inflation print and the growing downside risks to growth suggest that the RBNZ may take on a slightly less dovish stance. A 50bp hike is more than fully priced in by investors, so anything but a 75bp move may be seen as bearish for the dollar.

CAD

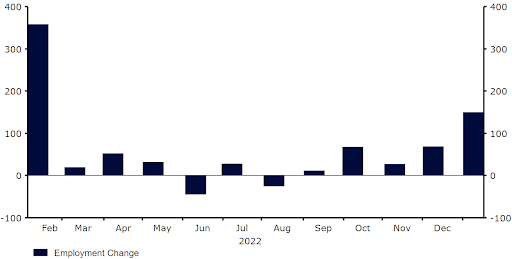

Last week’s Canadian labour report came in much stronger than anticipated, lifting interest rate expectations and CAD, which ended as one of the better performers in the G10. A net 150k jobs were added to the Canadian economy last month, well above the 15k consensus, and the most since the boom following the removal of lockdown restrictions in early-2022.

The Bank of Canada has already made it pretty clear that it doesn’t expect to hike rates again – the strength of last week’s report will certainly test this resolve. Markets are bracing for a possibility that the BoC goes again at some point in the next two or three meetings, although we think we would likely need to see a few surprises to the upside in inflation data in the interim for this to be the case.

Figure 3: Canada Net Employment Change (2022 – 2023)

Source: Refinitiv Datastream Date: 13/02/2023

SEK

A more aggressive than expected Riksbank rescued the Swedish krona from its 2009 lows last week. Indeed, the krona was one of the best-performing currencies last week, ending the week around 2.5% higher against the euro. The Riksbank raised rates by 50 basis points to 3%, the highest level since 2008. According to the Riksbank’s new governor, Erik Thedéen, inflation is too high and has continued to rise. He added that for inflation stabilise around the target within a reasonable period, the policy rate is likely to increase further during the spring. The Riksbank also announced the start of quantitative tightening from April, at a rate of 3 billion SEK per month in nominal government bonds and 500 million SEK per month in inflation-linked government bonds.

The bank’s updated projections also now put the terminal rate at 3.33% versus 2.84% previously. This is a more aggressive stance than the bank had anticipated, and the krona subsequently rallied against most currencies worldwide as a result. Focus this week will be on the unemployment rate for January, out on Friday, although expectations for future rates will likely be the main driver of the krona this week.

NOK

Another upside surprise in Norwegian inflation boosted the Norwegian krone last week, which appreciated by around 2% against the euro. Norwegian inflation accelerated to 7% in January from 5.9% in the previous month, and above market expectations of 6.5%. The core inflation rate, which is of greater importance for future central bank policy, also rose more than expected to 6.4%, its highest level since December 2003.

In our view, this sharp increase in inflation is unlikely to change the dovish stance adopted by Norges bank. There remains the possibility that Norges bank could hike rates by another 25bps at its March meeting, although this is not our base case scenario. As in all other major economic areas, upcoming inflation data will be key for these expectations, and the krone.

CNY

The yuan outperformed most of its peers last, rising to its highest level since October in trade-weighted terms, although it still ended the week lower against the US dollar. Last week’s data from China was largely positive, but somewhat ambiguous. Credit data was better than expected, showing new bank loans jumped to 4.9 trillion yuan in January (+922.7 billion yuan YoY). At the same time, muted household activity suggested there is still a long way to go to rebuild consumer confidence. Price data was mixed, with consumer inflation ticking up to 2.1% at the start of the year, while producer prices unexpectedly deepened deflation, falling by 0.8%.

Looking ahead, we’ll be watching rates. The 1-year MLF rate will be set on Wednesday, while key loan prime rates next Monday. Any change to interest rates would be a surprise. Aside from that, we’ll keep an eye on the ‘balloon saga’, which so far provided lots of headlines, but little useful information.

Economic Calendar (13/02/2023 – 17/02/2023)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports