Dollar pauses for breath as recession concerns ease

( 3 min )

- Go back to blog home

- Latest

A quiet start to the trading week brought a modest recovery in risk currencies against the safe-haven US dollar.

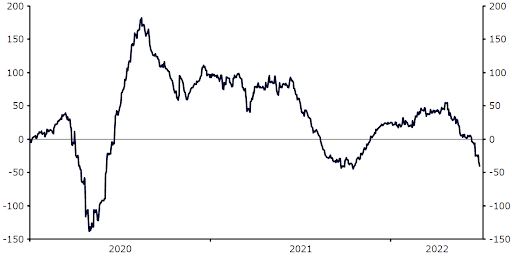

Figure 1: Citigroup Economic Surprise Index (2020 – 2022)

The result of the above has been another bout of strength in the dollar, which remains the safe-haven currency of choice among investors. The dollar traded higher against pretty much every major and emerging market currency last week, with the US Dollar Index just shy of its 20-year highs at the time of writing. Whether the greenback is able to hold onto these gains is likely to be dependent on two things:

- The pace of interest rate hikes from the Federal Reserve during the remainder of the year.

- Extent to which global recessions fears are materialised.

As far as the former is concerned, upcoming US inflation and economic activity data will be key to determining whether the Fed hikes by 50 or 75 basis points at the next FOMC meeting at the end of the month. We suspect that they will revert to a 50bp move given the stabilisation in last week’s PCE inflation numbers, although this week’s ISM PMIs (Wednesday), and nonfarm payrolls report (Friday) may change this view.

Among the major currencies, the euro appears to have found a temporary floor around the 1.04 level, which has provided a pretty strong resistance level for EUR/USD in the past few weeks. While the ongoing energy crisis in Europe and signs of a deterioration in economic data, notably out of Germany, provide reason for pessimism, we would argue that recent hawkish comments from European Central Bank members have not yet been fully reflected in the common currency. A handful of members appear to be coming around to the possibility of a 50 basis point rate hike at the July Governing Council meeting. Whether this will be an opinion shared by the majority of the council by the time of the meeting remains to be seen, although strong PMI (Tuesday) and retail sales data (Wednesday) would certainly raise the possibility of such a hawkish shift.

It’s been a similar story for the pound in the past few days, which has languished around the 1.20-1.21 level against the broadly stronger US dollar. With UK inflation potentially set to peak later and higher than many of its peers, sterling has proved particularly sensitive to recession concerns – fears that we think are slightly overdone. There will be no major economic data releases in the UK this week in order to support this view, although we will get a handful of Bank of England member speeches, including members Cunliffe, Tenreyro, Pill and Mann. Any indication that policymakers are erring towards raising rates by 50 basis points at the next MPC meeting in August would be positive for the pound and may trigger a recovery rally from currently suppressed levels