Dollar rally continues as markets fear global growth slowdown

( 3 min )

- Go back to blog home

- Latest

Investor concerns surrounding a possible slowdown in global growth continued to dominate the narrative in the foreign exchange market on Tuesday, leading to further sell-offs in most risk currencies.

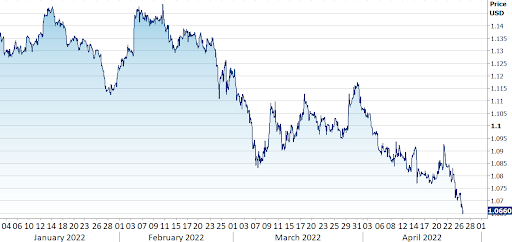

Among the major currencies, the euro fell below the 1.07 mark, ending London trading around the lowest level it has traded in the past five years. A confluence of factors have conspired against the common currency in the past few weeks. Risk sentiment has worsened, the war in Ukraine continues to rumble on with no signs of a resolution and the European Central Bank has largely stuck by its dovish rhetoric in recent official communications. ECB President Lagarde will be speaking again in Hamburg this afternoon, with markets set to watch closely for any comments on monetary policy that could spark some life into the euro. Until we see that long-awaited hawkish pivot from Lagarde, the common currency may find gains hard to come by.

Figure 1: EUR/USD (YTD)

Source: Refinitiv Datastream Date: 26/04/2022

Sterling has also dropped like a stone in the past couple of trading session. The GBP/USD pair made a march towards the 1.26 mark on Tuesday (a 21-month low), extending its sell-off to more than 3% since markets opened on Friday. A mounting cost of living crisis in the UK, and a surprising dovish turn from the Bank of England despite the inflation overshoot, is not providing a particularly attractive proposition to investors at present. There’s no real macroeconomic data of note out of the UK this week, so markets will likely already have one eye on the MPC’s policy announcement next week. While another 25 basis point rate hike is widely expected, the big uncertainty surrounds the bank’s view on the possible pace for additional hikes beyond next week’s meeting. This is shaping up to be a key event risk for sterling.

With concerns over future growth dominating the headlines, economic data has largely taken a back seat so far this week. Tuesday’s US durable goods order data was mixed although, on the whole, mostly encouraging. We may see some reaction in the dollar to Thursday’s first quarter GDP data, which is expected to show a relatively marked slowdown on the previous quarter, although risk appetite is likely to remain the main driver of currencies.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports