Dollar rebounds on hawkish Fed officials

( 10min )

- Go back to blog home

- Latest

The dollar recovered somewhat from its recent drubbing on the back of a steady drumbeat of hawkish Federal Reserve speeches.

With the US trading week shortened by the Thanksgiving holidays, the financial calendar will be dominated by the release of the PMI indices of business activity. We’ll be paying particularly close attention to those in the Eurozone and the UK. Consensus forecasts are gloomy, opening the possibility of a positive surprise. The calendar for central banker speeches is unusually busy this week, including several from the European Central Bank and no fewer than four from the Bank of England.

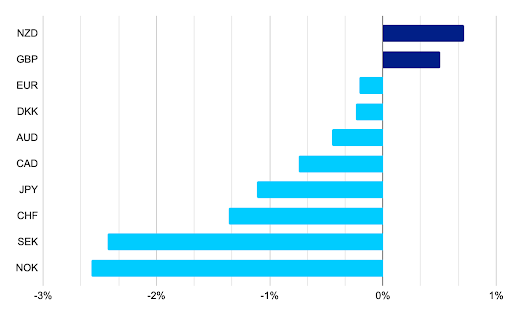

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Bloomberg Date: 21/11/2022

GBP

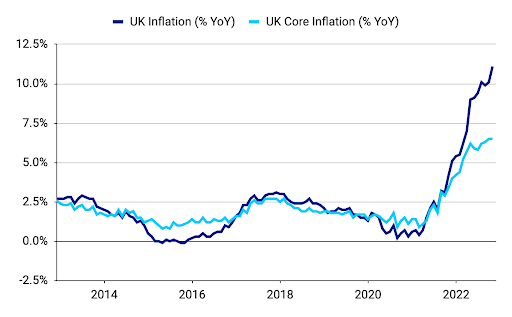

The labor report last week out of the UK supported our view that the UK recession will be short and shallow. Payrolls continue to increase at a healthy pace even while unemployment numbers are consistent with an economy at or perhaps above full employment, with no hint of job destruction as yet. Inflation soared more than expected in October, to 11.1%, its highest level since 1981. It would have been even higher if not for the government’s Energy Price Guarantee which capped household energy bills.

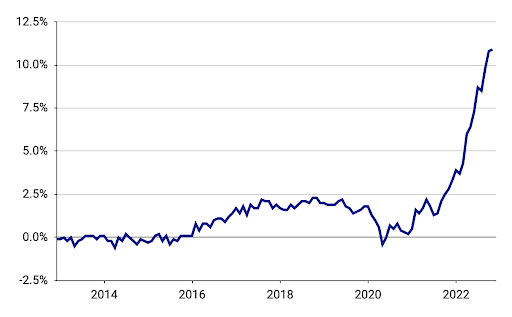

Figure 2: UK Inflation (2013 – 2022)

Source: Bloomberg Date: 21/11/2022

The Fiscal Statement contained aggressive deficit cuts, as expected, but for the most part, they were back loaded and should have little effect in the short and medium term. We think market expectations that the Bank of England can stop hiking rates well short of 5% are fanciful and expect the sterling to outperform as market consensus moves closer to our view.

EUR

Last week we had no macroeconomic or policy news of note out of the Eurozone, so the common currency was left to bounce around aimlessly to end near the middle of the rankings, nearly flat against the US dollar after its record rally the week prior.

All eyes now turn to the PMI indices of business activity, perhaps the most reliable leading index there. Expectations are for another drop further into contractionary levels. Other sentiment indices have outperformed expectations, and the mood appears to be better than it was last month. A positive surprise there would go a long way to pushing the euro rally further.

USD

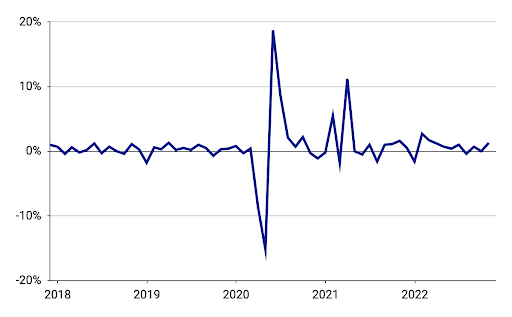

As in the Eurozone, economic data was mostly second tier last week, but what there was really belied the notion that the US economy is in recession. Retail sales blew out expectations growing 1.3% in the month of October. Meanwhile, producer inflation also took a turn lower, after the CPI did so the previous week.

Figure 3: US Retail Sales [% MoM] (2017 – 2022)

Source: Bloomberg Date: 21/11/2022

On Monday, the latest GDP figures showed that the Japanese economy contracted by 1.2% annualised in Q3 (+1.1% expected), though there was an upwards revision to the Q2 data. While this would vindicate the bank’s current stance, Thursday’s data showed that inflation rose to a new three decade high (3.7%). Whether this is enough to change the BoJ tune remains to be seen. We suspect that it won’t, although continued signs of an acceleration in domestic price pressures would likely pressure policymakers into at least considering a hawkish pivot.

CHF

The Swiss franc was among the underperformers last week, selling off by about 1% against the euro and the US dollar. Attention in Switzerland is increasingly turning towards the Swiss National Bank December meeting. Following his hawkish comments in the week previous, SNB chairman Thomas Jordan again suggested that further policy tightening may be required. Later in the week, SNB member Andrea Machler stated that the bank will indeed continue hiking if the forecast points to inflation above 2%. After a string of hawkish signals from the central bank, we have little doubt that these words will be followed by actions and another hike in December is all but certain.

Meanwhile, declines in SNB sight deposits have been more limited in recent weeks, compared to the sharp drops witnessed in late-September and early-October. This suggests that the SNB has been less active in absorbing excess liquidity. In the coming days, our focus will be primarily on outside news, as Switzerland’s economic calendar is almost completely empty.

AUD

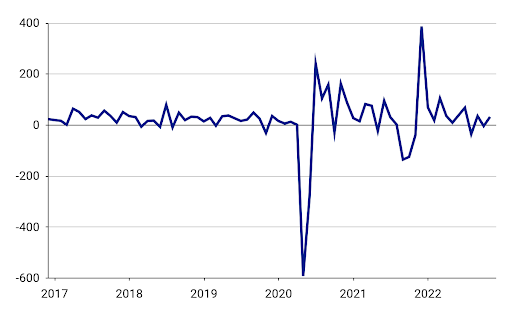

A rather quiet week by recent standards in global financial markets allowed for consolidation in the Aussie dollar last week. Somewhat surprisingly, we saw little reaction in AUD to last week’s rather strong October labour report. Another 32.2k net jobs were added in the Australian economy last month, all in full-time positions and well above expectations, while the unemployment rate also unexpectedly dropped back to 3.4%. Meanwhile, the RBA’s latest meeting minutes didn’t offer too many clues as to the direction of the bank’s next policy move, leaving the door open to both a pause in the hike cycle and larger hikes should data dictate.

Figure 4: Employment Change in Australia [‘000] (2016 – 2022)

Source: Bloomberg Date: 21/11/2022

We suspect that activity in AUD could pick up in the first half of this week. On Tuesday, the latest business activity PMIs will be released, which are expected to ease modestly from the previous month. A speech by RBA Governor Lowe (Tuesday) will also be closely watched.

NZD

One of the main event risks in the FX market this week will be Wednesday’s Reserve Bank of New Zealand meeting. This week’s meeting is a very difficult one to call, with markets torn between a 50bp and 75bp rate hike. On the one hand, the uncertainty of global growth and the recent downturn in the domestic housing market could elicit a more cautious response. On the other, however, New Zealand inflation remains far too high for comfort, the labour market is in good shape and indicators of economic activity are holding up reasonably well.

On balance, we think that the RBNZ will deliver a jumbo 75bp rate hike, though it is a very tough call that could go either way. Markets are pricing in around 65bps of tightening, so a 75bp move would be bullish for the New Zealand dollar. Much will, of course, depend on the bank’s accompanying communications. We suspect that these will strike a hawkish note, stressing the need for additional hikes into 2023, and we see risks to NZD as skewed to the upside heading into the meeting.

CAD

A drop in global oil prices toward the end of last week weighed slightly on the Canadian dollar, though the currency managed to largely hold its own against the USD. Brent crude oil briefly dropped back below the $86 a barrel level on Friday, its lowest level since late-September, as investors feared weaker demand from China and continued increases in US rates following hawkish comments from Federal Reserve officials.

There was actually very little major macroeconomic developments out of Canada last week, which partly contributed to the relative lack of volatility in the USD/CAD pair. This week looks set to be similarly quiet. Retail sales data (Tuesday) could garner some attention among market participants, though this will likely go under the radar. Expect the Canadian dollar to be largely driven by events elsewhere.

SEK

The increase in market risk aversion at the end of last week, due in part to escalating geopolitical tensions, weighed on the Swedish krona, which depreciated by almost 3% against the euro. This meant that SEK, which is one of the higher-risk major currencies in the world, ended the week as one of the worst performers in the G10.

Figure 5: Inflation in Sweden [% YoY] (2012 – 2022)

Source: Bloomberg Date: 21/11/2022

Rising domestic inflation, which soared to a 31-year high of 10.9% in October, perhaps contributed to this depreciation, as markets perceive this as further deteriorating the already bleak economic outlook. That said, we believe that the continued rise in inflation may force the Riksbank into raising its base rate aggressively at its meeting on Thursday. Our base case is for a 75 basis point rate hike, which could support the krona this week as this is not yet fully priced in. However, should the central bank suggest that it is increasingly concerned about the growth outlook, rather than fighting inflation, this could point to a moderate in the tightening cycle, which would be bearish for SEK.

NOK

In a similar fashion to SEK, the Norwegian krone did not have a good week, depreciating by more than 2% against the euro and the US dollar. Last week’s better-than-expected growth data limited some of the currency’s losses, although it was clear that investor sentiment remained one of the main drivers in markets.

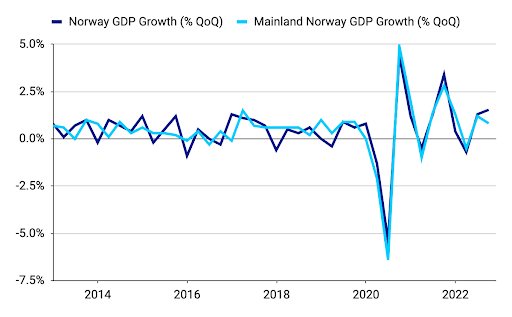

Figure 6: Norway GDP Growth (2012 – 2022)

Source: Bloomberg Date: 21/11/2022

The Norwegian economy advanced 1.5% in Q3, following an upwardly revised 1.3% growth in Q2 – the largest expansion in a year. Mainland GDP, our preferred measure of growth that strips out the volatile oil and gas production component, also increased by a larger-than-expected 0.8% in Q3. In our opinion, the resilience of the Norwegian economy, together with the lack of a peak in domestic price pressures, suggest that Norges Bank may have to raise rates higher and deeper into next year than currently expected, which could support the krone. With no relevant domestic data out this week, we think that risk sentiment will be the main driver of NOK.

CNY

The Chinese yuan was little changed against the US dollar last week and ended roughly in the middle of the EM dashboard. Plans to ease some of China’s Covid restrictions, and efforts to support the country’s property sector, from the week before seem to have continued to work towards stabilising sentiment towards the yuan last week. Hard data for October released on Tuesday was largely on the weaker side, but not too different from expectations.

While some of last week’s yuan fixings were rather strong, it seems that the easing pressure on the currency has allowed a shift towards a less aggressive stance from the PBOC. However, monetary authorities seem to be mindful of the exchange rate and don’t appear willing to engage in further policy easing, despite the economic slowdown. China’s MLF rate was left unchanged last week but, contrary to expectations, not all maturing loans were rolled over. This week, the loan-prime rates were also left unchanged. In the coming days, we’ll focus primarily on the coronavirus situation, as a recent increase in infections pushed the authorities to introduce local restrictions, dampening sentiment towards the yuan at the turn of the week.

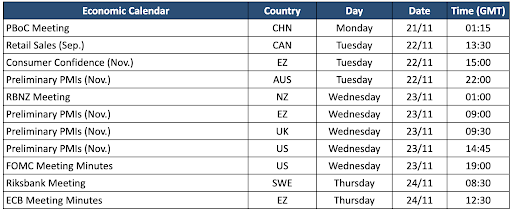

Economic Calendar (21/11/2022 – 25/11/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports