Dollar reversal continues during highly volatile trading week

( 3 min )

- Go back to blog home

- Latest

The US dollar retreated against its major peers for the second straight day on Thursday, while the pound jumped back above the $1.10 level during another highly eventful day in financial markets.

Summary:

- US dollar retreats from two decade highs, trading lower against major peers for second straight day.

- Euro buoyed by rising bets in favour of higher ECB interest rates, after German inflation rises into double-digits for the first time since WWII.

- Sterling rallies back above $1.10 level as BoE bond buying calms UK financial markets.

- Implied volatility in GBP and EUR rise above pandemic levels.

Undoubtedly the main theme in FX since the start of the year has been the relentless move higher in the US dollar, which has jumped to two decade highs on a hawkish Federal Reserve and growing downside risks to global growth. We have, however, seen a bit of a retracement in the greenback in the past couple of trading sessions – indeed the move lower in the US Dollar index on Wednesday was the largest (or at least one of the largest) witnessed since March 2020. We’ve not necessarily seen one main catalyst for the sell-off, although rising bets in favour of higher ECB interest rates, a stabilisation in UK financial markets and perhaps a bit of profit-taking have certainly contributed to the move.

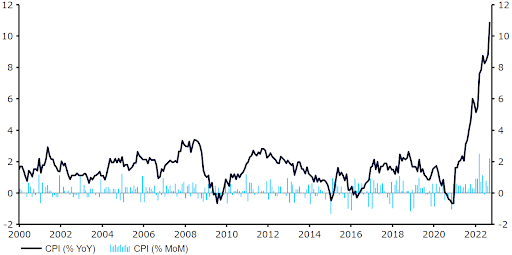

Volatility levels among the major currencies have, on the whole, jumped this week, with investors no doubt struggling to catch their breath and keep up with the slew of political headlines, macroeconomic data releases and central bank announcements. In the Euro Area, the release of yesterday’s underwhelming economic sentiment index initially weighed on the common currency, although a significant surprise to the upside in the latest German inflation figures provided the euro with some impetus, as it rallied back towards the $0.98 level. German headline inflation unexpectedly spiked to 10.9% in September, well above the 8.8% in August and the 10.0% priced in by markets. This was also the first time that inflation has risen into double digits in Europe’s largest economy since as far back as World War II.

We think that Thursday’s inflation data means two things. Firstly, there is now a good chance that today’s Euro Area inflation data (out at 10am CET) surprises to the upside. Secondly, markets are now increasingly convinced that the European Central Bank will need to raise interest rates by another 75 basis points at their next meeting in October – swaps are now pricing in 85bps of hikes through the next meeting, up from around 70 earlier in the week. ECB President Lagarde seemed to tee up such a move during her communications earlier this week, saying ‘we will do what we have to do, which is to continue hiking interest rates in the next several meetings’. Anything but a 75bp move from the ECB in October would now be seen as a massive disappointment.

Figure 1: Germany Inflation Rate (2000 – 2022)

Source: Refinitiv Datastream Date: 29/09/2022

Meanwhile, the pound remained firmly in the headlines yesterday, a few days after falling to a record low and suffering from one of its worst one-day sell-offs in a number of years. By our reckoning, Friday was the worst day for sterling since the early-1990s once excluding the 08/09 crisis, the Brexit vote and the early days of the COVID-19 pandemic. The UK currency has, however, recovered at least some of its losses, and at the end of the London session on Thursday it was back trading above the $1.10 level. While PM Truss has stuck by her drastic tax cut plans, UK financial markets have at least been buoyed by the Bank of England’s efforts to stem the rout in credit markets. That said, volatility in the pound, and indeed the euro for that matter, remains sky-high. Measures of both 3- and 6-month implied volatility in GBP are now above at their highest since the global financial crisis in 2009, with the same indicators for the euro at their highest levels since the European debt crisis in 2012. Expect markets to remain sensitive to large moves in either direction as the highly volatile trading week draws to a close on Friday.

Figure 2: GBP/USD 3M Implied Volatility (2000 – 2022)

Source: Refinitiv Datastream Date: 28/09/2022