Dollar sell-off continues as risk appetite returns

- Go back to blog home

- Latest

Stock markets and risk markets in general rebounded strongly last week, while US rates did not.

Macroeconomic data out of the main currency areas will be front and centre this week. The Eurozone flash inflation report for May is out on Tuesday, and the key payrolls report out of the US will cap the week on Friday. As for the former, markets expect yet another increase in both the headline and core index, which should seal the deal for an ECB rate hike no later than July. As more and faster ECB hikes are incorporated into expectations, the euro should receive a significant boost, and its recent rebound may have further to run.

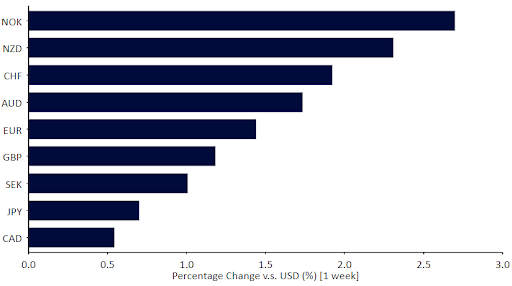

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 30/05/2022

GBP

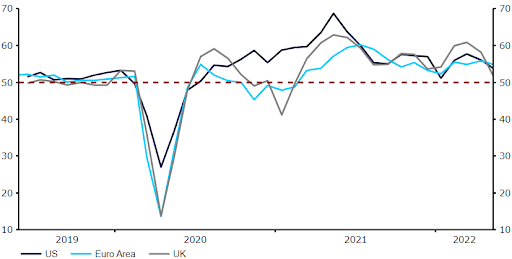

The PMIs of economic activity were softer in the UK in May than in continental Europe, a puzzling divergence that bears watching. Any forecasts for sustained Bank of England interest rate hikes presupposes healthy readings in this key indicator, certainly no lower than the disappointing 51.8 number we saw in the composite index. Sterling did, however, take the data in stride, as did rate markets, with the pound partly supported by the more generous than expected fiscal package announced by the UK government designed to allay the ongoing cost of living crisis.

This week’s data out of the UK will be mostly second tier and/or lagging, so expect the pound to trade off developments elsewhere. The shortened trading week in the UK due to the Jubilee celebrations may also limit activity.

Figure 2: G3 PMIs (2019 – 2022)

Source: Refinitiv Datastream Date: 30/05/2022

EUR

Last week’s Euro Area PMIs for May held up much better than either the UK or the US, in a sign that the economy there is more resilient than it’s given credit for. The clearly expansionary numbers dispelled the notion that a recession is near, and what we are left with is monetary policy settings completely out of line with the inflationary and economic backdrop.

Inflation data this week will likely show yet another all-time record level. The number will be key to decide the actual size of the incoming July rate hike, which ECB President Lagarde all but confirmed during her communications last week. A nasty upside surprise in inflation would probably increase the odds of a 50 basis point hike and be supportive of the common currency.

USD

A slew of second-tier data came out mostly below expectations last week. Weakness in the housing market, in particular, helped the US bond market continue its rally and the 12-month spread between US and Euro rates is now lower than it was at the end of March, which no doubt explains much of the euro’s recent rebound. With inflation still far above the Fed target, we do not expect this incipient weakness to do much to stay the Fed’s hand.

This week, we get the last key data point before the June Federal Reserve meeting – the labour market report for May. Markets are expecting a pull back in wages, which are still lagging prices. A positive surprise here may trigger markets to start pricing in three back to back 50 basis point hikes from the Fed.

CHF

Despite an improvement in risk sentiment, the Swiss franc maintained a strong momentum last week, outperforming most other G10 currencies. This can be attributed to rising yield differentials with the US and some hawkish noises from the country’s central bank.

In an interview published last Monday, SNB Board member Andrea Maechler said that the bank won’t hesitate to tighten policy should its medium-term expectations for inflation fail to return to the 0-2% target range. SNB President Thomas Jordan also struck a hawkish tone later in the week, acknowledging the tightening in monetary policy globally, and added that the bank will monitor the effect of global inflation on Switzerland.

This hawkish turn puts an added emphasis on the next SNB meeting on 16th June. While we think that an rate hike is unlikely, we’ll be keeping an eye on the new inflation forecast and any signs that the bank has changed tack on its approach to interest rates. In the meantime, markets will be focusing on macroeconomic data from Switzerland. The first-quarter GDP print (Tuesday), May PMI (Wednesday) and inflation data (Thursday) will be particularly worth observing this week.

AUD

The Australian dollar was one of the better performing currencies in the G10 last week, boosted by a weaker US dollar and the release of a broadly encouraging set of domestic macroeconomic data.

Despite declining from the previous month, the PMIs for May continued to indicate that the economy is in expansionary territory for the fourth consecutive month. Retail sales also increased by 0.9% in April, in line with expectations. The data provides an indication that the Australian economy is continuing to hold up rather well, despite the recent increase in inflation. This has reinforced expectations for another interest rate hike from the Reserve Bank of Australia at its June monetary policy meeting – indeed markets are already fully pricing in a 25 basis point move, with a non-negligible chance of a half a percentage point hike.

The most important event for AUD this week will likely be the release of the first-quarter GDP data on Wednesday, which is expected to show a slowdown from the boom in growth witnessed in Q4.

CAD

An increase in commodity prices and expectations for an aggressive tightening cycle by the Bank of Canada provided only modest support for the Canadian dollar last week. CAD ended the week higher against the US dollar, although was one of the worst performers in the G10.

The Bank of Canada is expected to hike interest rates by another 50 basis points at its meeting this Wednesday, as it attempts to curb more than three-decade high inflation. Communications from BoC rate-setters have been increasingly hawkish of late, notably from members Gravelle and Rogers, who have warned over more forceful action and an overheating in the Canadian economy. With that in mind, we think that risks for CAD are skewed to the upside going into the meeting, with a possibility that the BoC hints at the possibility of additional 50bp moves in the coming months.

First-quarter GDP data will be released on Tuesday, ahead of the Bank of Canada’s monetary policy meeting on Wednesday.

CNY

After a mixed week, the yuan is strengthening again, jumping by around 1% against the US dollar this morning. Investors’ hopes for economic revival are up, as the country’s push towards reopening gathers pace and authorities announce more support measures.

Shanghai has begun to ease its lockdown, while Beijing recently lifted some of its restrictions, allowing a partial reopening of offices and stores. Moreover, authorities appear determined to revive growth, with the PBoC urging banks to lend and the State Council presenting 33 new measures designed to aid the economy, including those that ease some Covid restrictions. The most recent declaration came from Shanghai, where authorities announced on Sunday a package of 50 stimulus measures aimed to help the local businesses and workers.

This week we’ll focus on the May PMI readings, with official data out on Tuesday and Caixin manufacturing PMI out on Wednesday. Markets expect an increase in the indices, albeit not to the extent that would imply an expansion of the sectors. Hopefully, the easing of restrictions will allow a move back into positive territory next month, as it seems that the worst may now be over for China’s economy.

Economic Calendar (30/05/2022 – 03/06/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports