Dollar sinks on softer US inflation report

( 10min )

- Go back to blog home

- Latest

The news that markets had been desperately hoping for finally arrived last week.

This week the focus will be on a raft of inflation reports for the month of October in several G10 countries including Sweden, Canada, the UK, and Japan. These will be scrutinised for signs that inflation is peaking, though we think that the positive surprise out of the US last week cannot be extrapolated to other economic areas. We will also be paying attention to two scheduled speeches from ECB President Lagarde. For now, the relentless dollar rally appears to have peaked, and the path of least resistance for the greenback may be down in the short-term.

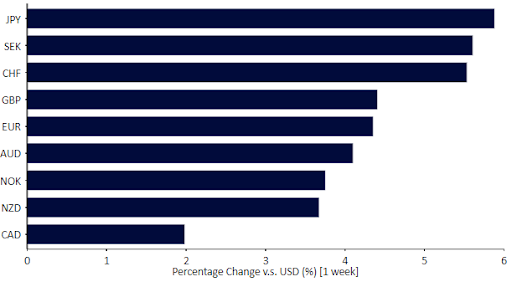

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 14/11/2022

GBP

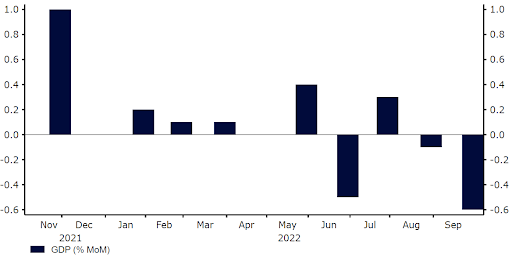

Last week’s third-quarter GDP report had mixed news. It was better than expected, but still negative. This means the UK may be in a technical recession already, albeit so far the numbers are consistent with a short, shallow one.

Figure 2: UK GDP Growth Rate [MoM] (2013 – 2022)

Source: Refinitiv Datastream Date: 14/11/2022

This week will be an intense one for data out of the UK. The employment report on Tuesday will be followed by the inflation data on Wednesday. The former is expected to show strong payrolls growth for October. The latter, steady core inflation well above 6%. Technical recession or not, we do not think that the Bank of England can afford to stop tightening any time soon given this backdrop, and expect a higher terminal rate than markets do. The unveiling of the UK government’s fiscal plan on Thursday could also garner some attention.

EUR

No news of any importance out of the Eurozone last week left the euro to trade mostly off events taking place elsewhere, notably the US inflation report. That said, we did get a handful of ECB member speeches, which mostly struck a hawkish tone, suggesting that there will be no let up in rate hikes just yet.

Further news suggesting that China may ease COVID restrictions, which would stoke appetite for European exports there, also buoyed the common currency to a near 4% rise against the dollar. We still see market pricing for European terminal rates way too low and out of touch with economic reality and the relentless rise in inflation. Lagarde has two opportunities to jawbone these rates higher, one of Wednesday and another Friday. There will be little else to move markets in the Eurozone this week.

USD

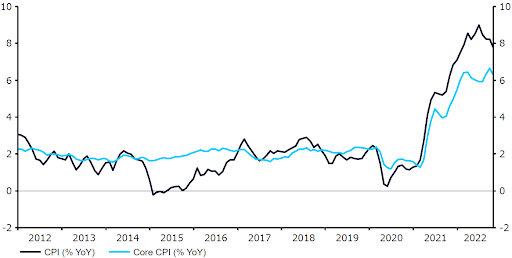

One swallow does not a summer make, but the October inflation report was good news and was justly celebrated by markets as such. Goods prices came in lower than expected and drove both the core and headline numbers down from the previous month. The headline number has now been falling for some months, and while the more important core index is not yet falling, neither is it rising.

Figure 3: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 14/11/2022

This week will be light in terms of data out of the US, but we will be getting a surfeit of Fed speeches, no fewer than seven in all. Markets will eagerly read them for hints on the impact of last week’s inflation report on Fed expectations for the December hike and the terminal Fed Funds rate.

JPY

We’ve seen a quite remarkable reversal of fortune for the yen in the past few weeks. The yen was the best performer in the G10 last week, ending it around 6% higher on the dollar – the largest one-week move in the USD/JPY pair since 1998. While most of the rally was driven by broad weakness in the US dollar, the already suppressed valuation of the yen provided room for an outperformance. A possible dovish pivot from the Federal Reserve is also disproportionately bullish for JPY, given that the Bank of Japan is the only central bank in the G10 not to be engaging in a tightening cycle of its own.

Attention this week may turn to macroeconomic news, with a number of data releases on tap. We will be paying close attention to the Q3 GDP print (Monday), trade data (Wednesday) and inflation report (Thursday).

CHF

The Swiss franc was one of the best-performing G10 currencies last week, rallying on Friday after hawkish remarks from SNB chairman Thomas Jordan. Jordan stated that the bank is ready to take ‘all measures necessary’ to achieve price stability. Moreover he said that current monetary policy settings are ‘not sufficiently restrictive’ in order to bring inflation back towards the central bank’s target. He also confirmed that the bank remained able to sell its FX reserves as part of its policy efforts.

Jordan’s hawkish rhetoric all but guarantees another interest rate hike in December, although the size of the move is more of an open question. At present, we’re leaning towards another 50 basis point hike. In the coming days, we’ll continue to focus on additional communications from the SNB, with a handful of speeches from officials scheduled this week.

AUD

Signs of an easing in the Chinese government’s stance towards ‘zero-covid’ provided an element of assistance for the Australian dollar last week, though the extent of the move higher in the AUD/USD pair was still driven almost entirely by the soft US inflation print. As one of the higher-risk currencies in the G10, AUD should have been near the top of the performance tracker, though the recent dovish shift from the Reserve Bank of Australia means that the currency would receive less support from a narrowing in US rate differentials. Deputy governor Bullock reaffirmed this stance last week, noting that the bank was nearing the point where it could pause the hike cycle.

We don’t necessarily expect this week’s RBA meeting minutes (Tuesday) to rock the boat, as expectations for anything other than 25bp hikes going forward are very low. The October labour report on Thursday may prove more of a market mover. Economists expect a solid rebound in job creation following the weak September data (+15k consensus), which would likely support the case for additional modest tightening in RBA monetary policy.

NZD

The New Zealand dollar underperformed its antipodean G10 counterpart last week, which we can only really ascribe to the recent strong rally in the kiwi that left it trading at a near seven-month high on the Aussie dollar. There wasn’t too much domestic news to report last week, though the latest manufacturing PMI did raise a few alarm bells over the state of the New Zealand economy. The October index fell below the critical level of 50, separating expansion from contraction, for the first time since August 2021.

Q3 producer price inflation data will be released on Thursday in another otherwise quiet week. The key for the New Zealand dollar in the coming days will continue to be market expectations for the next RBNZ meeting on 23rd November. Investors remain torn between a 50bp and 75bp rate hike, and will be looking for news in the interim that may support either argument.

CAD

CAD continues to trade in much closer lockstep with the US dollar than any other currency in the G10, outperforming during periods of USD strength, and underperforming when the greenback deprecates. This was very much evident last week as, aside from the USD, the Canadian dollar ended at the bottom of the pack among the major currencies. Remarks from Bank of Canada governor Macklem were largely ignored on Thursday. Macklem said that more rate hikes were on the way, while warning that a recession and an increase in layoffs may be a price to pay for bringing down inflation.

This week will be all about Wednesday’s inflation report. Economists are pencilling in an easing the headline number to 6.9% (from 7%), but an increase in core inflation to 6.3% (from 6%). An acceleration in the latter could bring another 50bp hike into view at the December BoC meeting, which would be bullish for CAD. At the time of writing, markets only see around a one-in-four possibility of such a move.

SEK

As one of the higher-risk currencies in the G10, the improvement in investor appetite for risk, due to the relaxation of some of the restrictions to curb covid in China and expectations of a more dovish Federal Reserve, benefited the Swedish krona disproportionally last week. As a consequence, SEK rose by around 1.5% against the euro and 5% against the dollar.

The focus this week will return to inflation, with the October CPI and CPIF reports set to be released on Tuesday. While the former is expected to continue on its upward trend, the latter (the Riksbank’s preferred measure of inflation), is projected to ease from September’s thirty-year high. Any surprises to the upside in either, notably the CPIF report, could heap additional pressure on the Riksbank to continue raising interest rates aggressively, just ahead of its November meeting next week.

NOK

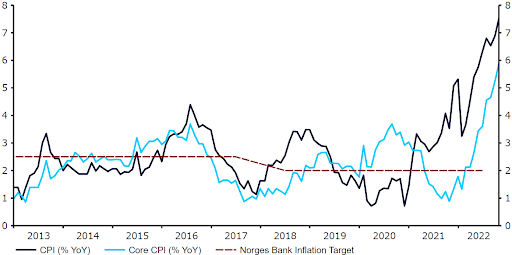

The Norwegian krone ended last week almost unchanged against the euro, but in line with other risk assets, it appreciated strongly against the dollar. Inflation data continues to be one of the main drivers in FX markets. Norway’s October inflation data was released last week, and unlike in the US, it again surprised to the upside. Headline inflation rose sharply to 7.5% in October, from 6.9% in September, and above market expectation (7.1%) – its highest rate in 35 years. The core inflation rate, arguably of even greater importance, also broke to a new record high 5.9%.

Figure 4: Norway Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 14/11/2022

The lack of a peak in domestic price pressures will provide a big headache for policymakers at Norges Bank, which may now have to raise rates higher and deeper into next year than currently expected, which could support the krone. Third quarter GDP data will be released on Friday. We will be paying special attention to this print, as Norges bank’s dovish pivot was due to risks to growth.

CNY

The Chinese yuan has managed to rally against the US dollar in the past few days, rising to its strongest position since September. US inflation news has certainly helped, as the expected gap between US and Chinese monetary policy has narrowed. An easing of some of the country’s covid restrictions on Friday, including a shortening of quarantine periods and a reduction in contract-tracing efforts, have further supported the yuan.

The above changes mark a significant shift in China’s approach towards the pandemic, and have raised hopes that the economy will have more breathing room as the country continues its efforts to combat the virus. That said, these steps are small ones, and authorities have emphasised that zero-Covid remains in place. Infections in China are on the rise and Beijing and a number of other key cities have seen record numbers of new cases in the past few days. In addition to covid, we’ll focus on headlines from the Biden-Xi meeting in Bali today and hard data releases, out on Tuesday. The PBoC will also set the MLF rate that day, albeit no change in rates is expected, even with inflation surprising to the downside last week (2.1% in October).

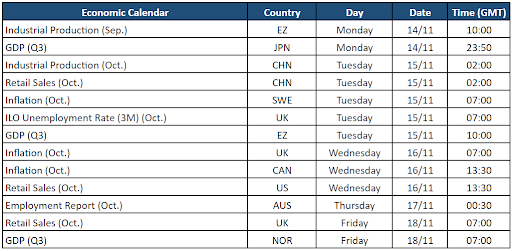

Economic Calendar (14/11/2022 – 18/11/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports