Dollar slides as Powell fails to commit

( 3 min )

- Go back to blog home

- Latest

This week’s FOMC announcement was largely as expected, though the lack of a firm commitment to additional larger rate increases did send the US dollar lower against its major counterparts on Wednesday.

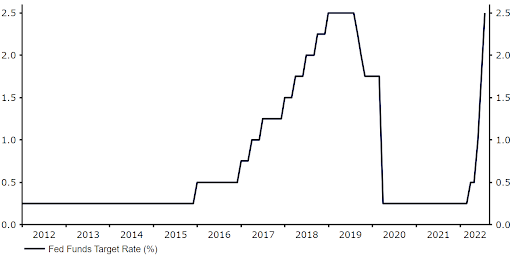

Figure 1: US Federal Funds Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 27/07/2022

The Fed’s statement was very much as expected. As we had anticipated, there was a slight downgrade to the language on the US economy, with the Fed saying that indicators of spending and production had ‘softened’. This comes hot off the heels of last Friday’s highly disappointing PMI figures from S&P, which collapsed below the level of 50 and into contractionary territory for the first time in two years. The bank also mentioned the recent surge in food and energy prices, though it continued to strike an optimistic note on the US labour market, which remains a bright spot.

Chair Powell’s comments on the economy during his press conference were noticeably more dovish than in June. He said that consumer spending had slowed ‘significantly’, while indicating that the outlook for the US economy was highly uncertain in the next 6-12 months. He expressed the Fed’s view that a period of below potential growth was needed in order to create some slack in the economy, and that the path for a soft landing had clearly narrowed. Powell largely reiterated the bank’s stance on inflation, saying that it was ‘much too high’, and that there remains upward pressure on price growth, despite an easing in some commodity prices.

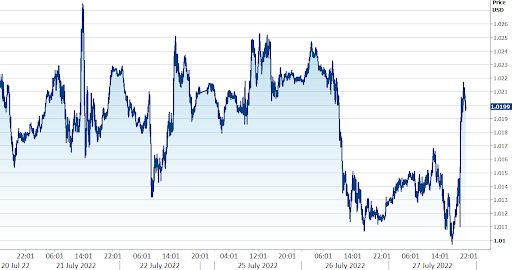

While Powell left the door open to another ‘unusually large’ rate increase (i.e 75 basis points or more) at the next meeting, it is clear that the Fed is in a data-dependent mode, and is steering clear of pre-committing to the size of future rate increases. In Powell’s own words, the magnitude of additional rate hikes will depend on both incoming data and the outlook for the economy. Investors viewed this lack of a strong commitment to additional 75 basis point hikes as a US dollar negative, which can partly explain the weakness in the greenback following the announcement. Despite briefly selling off, EUR/USD rallied by around one percent during the press conference to back above the 1.02 level yesterday evening.

Figure 2: EUR/USD (1 week)

Source: Refinitiv Date: 27/07/2022

As things stand, markets see a non-negligible possibility of another 75 basis point rate increase at the next meeting in September (around a one-in-five chance at the time of writing). Following Wednesday’s announcement, a return to a 50 basis point rate hike seems by far the safer bet for now, particularly given signs of a worsening in US activity data – Thursday’s Q2 GDP numbers could even show that the US economy has already tipped into a technical recession.

In our view, signs of a stabilisation in inflation in the interim would warrant a return to a 50 basis point move (or even a 25 bp one) at the next meeting, and a possible end to the hiking cycle by year-end. This could present a bit of a downside risk to the US dollar as other major central banks, notably the European Central Bank, catch up with the Fed’s highly aggressive pace of policy normalisation.