Dollar soars as inflation fears slam markets

( 5 min )

- Go back to blog home

- Latest

Risk assets worldwide endured a very difficult week.

The Federal Reserve meeting next week will be the event to watch in currency markets. In the wake of Friday’s nasty inflation numbers in the US, markets are pricing in a 25% chance of a 75bp increase. The Bank of England meeting will also be a nail biter, with markets evenly split between expectations for 25 and 50 basis point hikes. Everywhere central banks are gearing up for the war on inflation, and the speed at which rates rise in different regions will be the main driver of currency moves in the near and medium term.

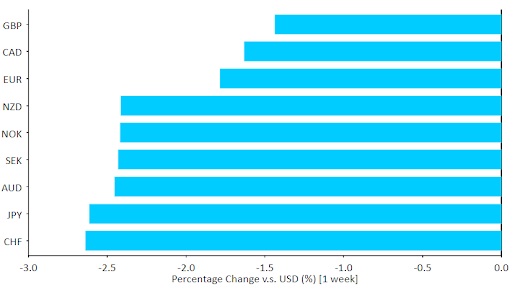

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 13/06/2022

GBP

Sterling traded quite well last week. It fell against the dollar, but rose against every other G10 currency, in a sign that the market may already be very short the pound and, at current levels, a lot of bad news is already priced in. An unusually large positive revision to the PMIs of business activity for May also helped, suggesting that the Bank of England negativity on the UK economy may be overdone.

This Thursday we expect a 25 basis point interest rate hike, but there should be enough hawkish dissent among Monetary Policy Committee members, calling for a 50 basis point hike instead, to provide support for the pound.

EUR

The May ECB meeting last week proved that its hawkish pivot is gathering momentum. It announced that purchases of sovereign bonds will end 1st July and, most critically, it took the highly unusual step of pre-committing to a 25bp hike in July and a 50bp one in September. In addition to high inflation, the ECB now has to worry about peripheral spreads, which blew out significantly last week. However, in historical terms peripheral yields remain fairly low, and the central bank signalled that for now at least the inflation battle takes priority.

This week there is no market moving news on tap out of the Eurozone, so the focus will remain across the Atlantic on the Federal Reserve June meeting.

USD

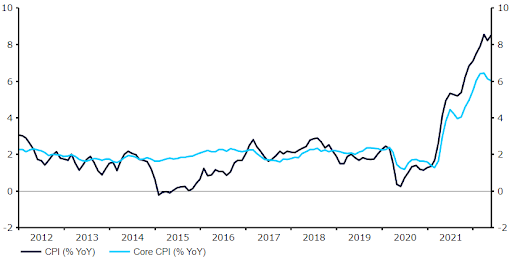

Friday’s inflation data out of the US was unambiguously bad news for the Federal Reserve. The headline was another multi-decade high of 8.6%, dashing expectations that inflation had peaked a few months back. Core inflation also printed higher than expected, and price pressures are both accelerating and widespread. Particularly worrisome is the acceleration in housing inflation, which tends to be one of the most persistent components of the index.

Figure 2: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 13/06/2022

The market’s knee-jerk reaction was, perhaps understandably, to sell everything and buy the US dollar. It is now up to the Federal Reserve to validate the market’s very high expectations. Even a 50 bp hike and a hawkish press conference may not be enough to sustain the dollar rally.

CHF

While sentiment towards risk assets was far from favourable last week, the franc sold off against the common currency and was one of the worst performers in the G10. We attribute this weakness primarily to rising expectations for aggressive monetary policy tightening from the ECB, and a sharp rise in yields on both sides of the Atlantic.

All eyes this week will be on the Swiss National Bank, which meets on Thursday. The vast majority of economists, ourselves included, don’t foresee an immediate change in interest rates. That said, there’s been some shift in decisionmakers’ tone and approach to FX interventions (judging by recent changes to sight deposits), which technically could precede a change in rates. We do, however, think that an unexpected rate hike at this point, before the ECB, would not be seen as a correct course of action, particularly given policymakers believe the surge in prices to be temporary.

The key question now is how persistent price pressures will be. We’ll focus on both the language of the central bank, as well as the inflation forecast. A significant change in the latter to indicate inflation staying above 2% for much longer than previously estimated, may elicit action in some capacity in the second half of the year.

AUD

The Australian dollar, like all major currencies, depreciated against the US dollar last week. The hawkish surprise from the Reserve Bank of Australia, which raised rates by 50 basis points, as we had anticipated, was not enough to support AUD.

The RBA raised rates to 0.85% in response to soaring price pressure that the country is experiencing. This is the second rate hike since May designed to address the ‘significant increase’ in inflation, as justified by the RBA in its statement last Tuesday. However, despite the surprise, the announcement was not entirely hawkish. In the rate statement, it stressed that while ‘inflation is expected to rise further’, currently standing at 4.8%, ‘it will then decline toward the 2 to 3 percent range next year.’ RBA governor Lowe noted that ‘as global supply-side issues are resolved and commodity prices stabilise, inflation is expected to moderate, today’s interest rate hike will help with the return of inflation to target over time’.

The May unemployment rate will be released on Friday. Aside from that, AUD will be driven by events elsewhere.

CAD

As was the case with all other major currencies, the Canadian dollar depreciated against its US counterpart last week. In a week with relatively little major news for the Canadian economy, the general strength of the USD, due to the upward surprise in US inflation, was the main driver in currency markets.

Despite a rather quiet week in terms of relevant macroeconomic releases in Canada, we did receive the monthly labour report on Friday, which provided some good news. A net 39.8k jobs were added in the country last month, above the 30k priced in by markets. The Canadian unemployment rate also fell to 5.1% in May, the lowest level since 1976, from 5.2% a month earlier. The data confirms that the Canadian labour market is performing rather well, and should allow the Bank of Canada to continue with its aggressive tightening cycle in the coming months.

With no relevant macroeconomic data releases due this week, CAD will likely be driven by events elsewhere.

CNY

The USD/CNY rally witnessed last week accelerated on Monday. As evidenced by last week’s uptick in the trade-weighted RMB CFETS index, a large part of this can be attributed to dollar strength, although news from China has also turned negative. After a surge in cases in both key cities, China partly reintroduced restrictions in Shanghai and delayed an easing of some curbs in Beijing, demonstrating that the zero-Covid policy is very much alive, despite the effect it has on the economy. We should see a good approximation of the extent of this effect this week, with key hard economic data for May out on Wednesday.

Since the covid situation remains the key near-term risk to the outlook for the Chinese currency, we’ll focus primarily on the developments on that front in the coming days. We’ll also keep an eye on Wednesday’s decision regarding the 1-year Medium-Term Lending Facility. A change this week would be a surprise, but a surge in cases and a stabilisation of inflation leads to a renewed question about possible further monetary policy easing in China.

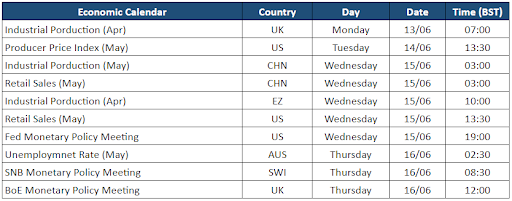

Economic Calendar (13/06/2022 – 17/06/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports