Dollar soars on bad US inflation number as rates spike

( 5 min )

- Go back to blog home

- Latest

The Federal Reserve received an unpleasant surprise last week, in the form of a hotter-than-expected inflation number that showed no hint that price pressures are abating.

This week is all about central bank meetings. The Federal Reserve on Wednesday dominates the schedule, but Sweden (Tuesday) and Japan, the UK, Switzerland and Norway (Thursday) will also see their central banks meet. All except the Bank of Japan are expected to raise rates significantly and deliver hawkish messages. The Fed and the Bank of England are both expected to deliver large hikes, while remaining hawkish and reiterating to markets that they are focused exclusively on bringing inflation under control. We are probably at the point where any central bank failure to deliver on a hawkish message would crater its currency.

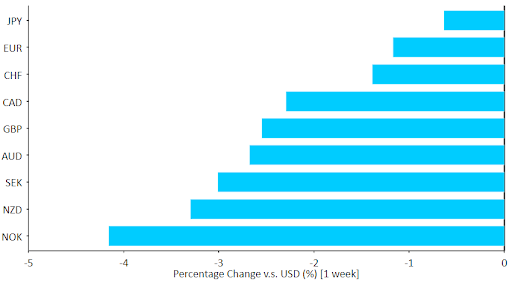

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 20/09/2022

GBP

Sterling had another difficult week, hammered not only by the general dollar rally but also by a very weak UK retail sales report, which showed that the inflation spike is resulting in a lower volume of actual goods sold. The inevitable response to high inflation and a still very tight labour market is continued Bank of England interest rate hikes.

We think that the decision between a 50bp and 75bp rate hike will be a close call among BoE members at this Thursday’s meeting, delayed by a week due to the passing of Her Majesty the Queen, although most economists are erring towards the former. Traders will be paying very keen attention to the MPC’s communications after the decision, particularly comments on how high rates could go in 2023. The flash PMIs of business activity for September out on Friday will round up a very busy week for sterling.

EUR

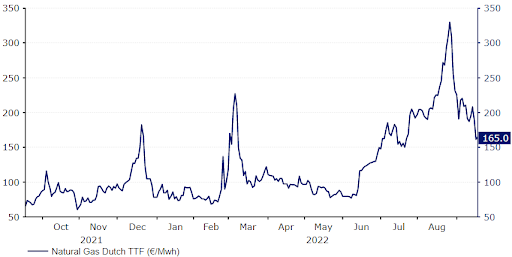

Last week was a slow one for macroeconomic news out of the Eurozone, but natural gas and electricity prices signalled a potential easing of the energy crunch in Europe, which all buyed the euro, at least in relative terms. Indeed, the euro has actually outperformed all of its major peers in the past month, including the US dollar.

Figure 2: EU Natural Gas Prices (2021 – 2022)

Source: Refinitiv Datastream Date: 20/09/2022

The Federal Reserve meeting will probably drive euro trading this week, at least until Friday, when we get the all-important PMIs of business activity. Expectations are pretty low, so the hurdle for a positive surprise here isn’t high. ECB speakers on the Bundesbank Open Day will probably stick closely to the hawkish tone adopted recently by the institution, keeping upward pressure on rates and perhaps the currency as well.

USD

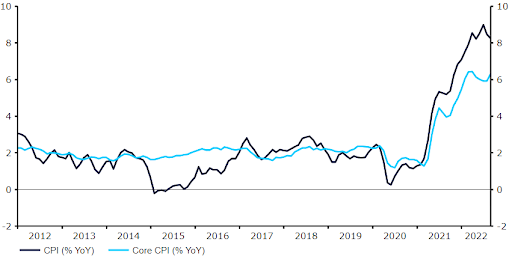

An unambiguously bad inflation report will certainly keep the pressure on the Federal Reserve for another massive 75bp rate hike this week, and markets are pricing in a 20% chance of a nearly unprecedented 100 bp move. Previous hints at an easing of core inflation pressures were erased, and this key index seems to be stabilising around a sky high 6% level.

Figure 3: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 20/09/2022

Expectations for peak Federal Fund rate are now around 4.5%. The rally in the dollar was fully to be expected, though we note that expectations on Wednesday’s meeting are so high that even a slight disappointment could result in a significant dollar sell-off. As always, the Federal Reserve’s updated ‘dot plot’ will be highly important for markets, particularly the Fed’s view on the level of the terminal rate.

CHF

Following its recent out-performance, the Swiss franc has handed over its crown to the US dollar, albeit the currency still managed to post gains against most of its major peers last week. On Thursday, the currency reached its strongest position against the euro since 2015.

Attention this week should focus squarely on monetary policy. It sets up to be a historic one, as the Swiss National Bank is widely expected to end the era of negative interest rates with a jumbo hike on Thursday. In June, the central bank stunned markets by hiking rates by 50 bps. We expect a 75 basis point increase this week to 0.5%. While investors are in agreement, neither a larger nor a smaller hike can be ruled out given the bank’s penchant for surprises. Of the two, we do, however, think that an upside surprise is more likely.

Aside from the size of the move itself, we’ll focus on the bank’s communications, particularly regarding the franc. We think it’s likely that the bank will reiterate its message from June, confirming that it is unopposed to franc strength. The inflation forecast could see an upward revision, albeit probably not to the extent witnessed in June.

AUD

A broadly strong US dollar pushed the Australian dollar below the 0.67 level on the USD last week, its lowest level in two years. The minutes of the latest Reserve Bank of Australia meeting, published today, have also not helped AUD. At its September meeting, the bank raised interest rates by 50 basis points to 2.35% as, in the words of the bank, it was needed to help bring inflation back to the 2-3% target range and create a more sustainable balance of demand and supply in the economy. However, as the latest minutes showed, there could be a slowdown in rate hikes as rates approach more normal values. Members said that the size and timing of future interest rate increases will continue to depend on incoming data.

We think that risk sentiment and the Fed’s interest rate decision will be the main drivers of the Australian dollar this week. The business activity PMIs, to be released on Friday, will also be closely watched by market participants.

CAD

In line with most currencies, the Canadian dollar depreciated against the broadly stronger US dollar last week and is now trading near its lowest level in almost two years. A drop in Brent crude oil prices to back below $90 a barrel has hardly helped the currency, though we have at least seen a modest retracement in the commodity.

The focus this week will be on the publication of the August inflation data on Tuesday. The data is expected to show a slight decline from the previous month, but to remain at very high levels. This will be of great importance as it will influence market expectations about the size of the Bank of Canada’s rate hike at its next meeting in October. Markets are now fully pricing a 50 basis points rate hike in October and a 25bp one in December. Aside from that, July retail sales will be released on Friday.

CNY

For the first time in two years, the USD/CNY pair rose above the psychological 7.0 level last week that, considering the stability of the CFETS RMB index, can be largely attributed to broad US dollar strength. A weaker yuan has gained the focus of authorities. The People’s Bank of China has set stronger yuan fixings of late, and does not look on course to lower rates further, at least in the near future. The 1-year MLF rate was kept stable last week, with the 1- and 5-year loan prime rates also left unchanged this week. Comments from the country’s FX regulator, and an official close to the central bank, also appeared to calm nerves regarding the recent sell-off.

On the whole, economic data out last week was better-than-expected. Industrial production, fixed asset investment, and retail sales surprised to the upside, with unemployment falling unexpectedly. China lifted the lockdown in Chengdu on Monday, but the Covid situation continues to cast a shadow on the country’s economic prospects. The economic calendar for China is not particularly rich this week. We’ll focus largely on any signals from authorities regarding the currency, ongoing COVID-19 developments and outside news.

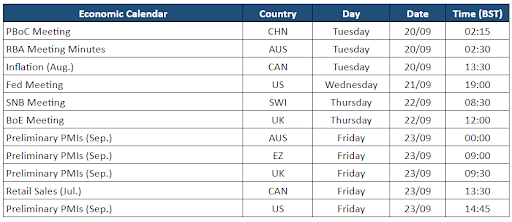

Economic Calendar (19/09/2022 – 23/09/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports