Dollar tumbles as business optimism buoys markets worldwide

- Go back to blog home

- Latest

Currencies were no exception, and the dollar sold-off against every major peer except the usual safe-haven suspects, the yen and the Swiss franc. Emerging market currencies that had sold-off the most during the crises led the gains, like the Brazilian real and the Mexican peso. Ominously, the Turkish lira failed to join the party and ended the week flat against the dollar and down against the euro.

Late last week, a new risk factor emerged as US-China tensions took a turn for the worse, as the Trump administration upped its rhetoric against the new National Security bill for its Hong Kong territory. The US Memorial Day holiday yesterday and the absence of any specific retaliatory measures from the US so far means that risk assets and emerging market currencies start the week well supported. The most important data point, in our view, will be flash May inflation data out of the Eurozone on Friday, which will shed light on the relative damage wreaked on the supply vs. the demand side of the Eurozone economy.

GBP

April data showed a record jump in unemployment claims, but the data was not sufficiently bad to fulfill the worst expectations. Retail sales also fell by a record amount in April, over 22%. The poor data, combined with the Bank of England’s refusal to rule out the possibility of negative interest rates in the future, capped the rally in sterling.

With most indices of economic activity showing a rebound since late-April equal to about half of the losses sustained, we think that short-term downside for the pound is limited from these depressed levels. The continued sharp easing in new daily deaths caused by the virus, which is not getting the attention we think it deserves given the Dominic Cummins scandal, and the potential for a further easing in lockdown measures this week, both provide additional reason for optimism.

EUR

The Franco-German proposal of a €500 billion programme to finance the recovery from the pandemic, in addition to the measures already taken by the ECB, has provided good support for the euro.

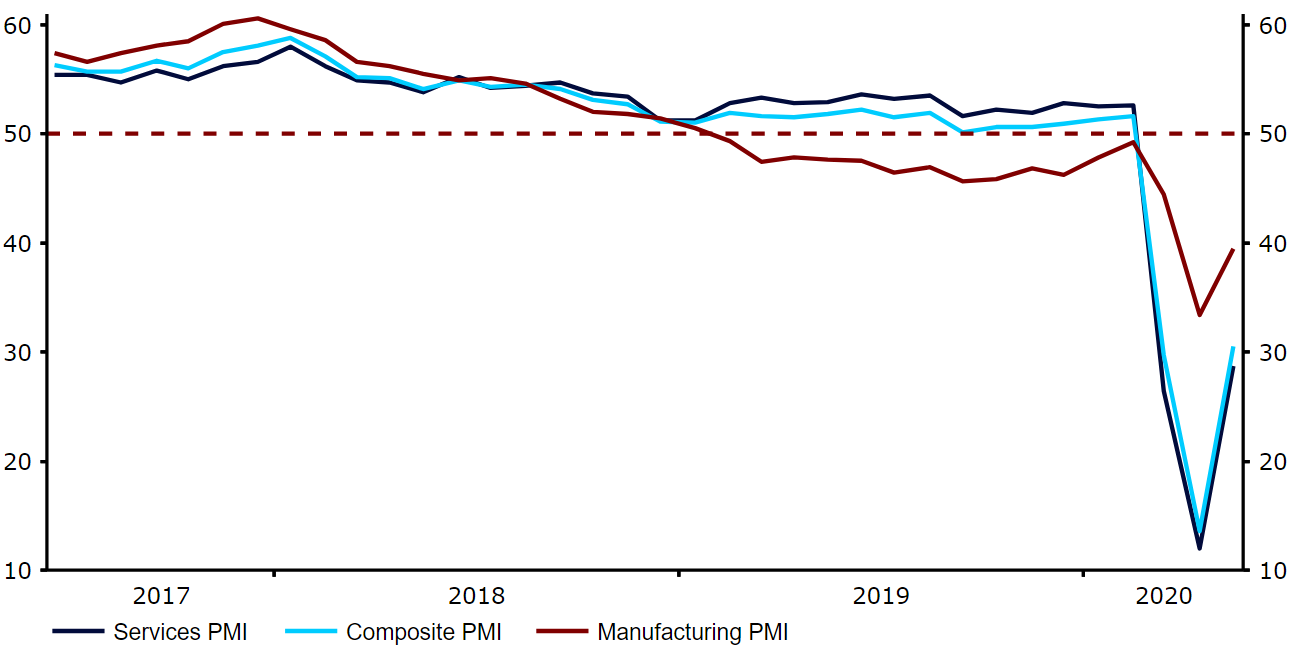

It’s still very early, but the significant rebound in Eurozone PMI indicators of business activity (to a still dismally low level) is a positive early read on the impact of the various state support programmes and the lifting of the harshest lockdown measures.The German IFO index of business expectations, in particular, came out considerably higher-than-expected. This measure was one of the first in signaling a bottom in the 2008 recession.

Figure 1: Euro Area PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 26/05/2020

USD

The US labour market has yet to hit a bottom. Both the new and continuing weekly jobless claims numbers increased once again above expectations, and are consistent with an unemployment rate of roughly 20%. Congress ensured that jobless benefits will remain quite generous over the short term, which should protect aggregate demand. However, the damage to businesses will be substantial.

The key data point this week will again be the jobless data. Economists are forecasting a relative stabilisation in the continuing number, as the job churn becomes more bidirectional and some businesses start to rehire laid off workers. We continue to expect the dollar to suffer over the medium term, due to the poorer response to the crisis in the US and the higher likelihood of medium-term damage to the labour market vs Europe.