Easing UK inflation data helps extend sterling rally

- Go back to blog home

- Latest

Summary:

- GBP rises to one-month high on US dollar, as strong labour data and signs of a downtrend in UK inflation allay recession fears.

- Chinese economy unexpectedly posts flat growth in Q4, despite strict zero-covid policies.

- US dollar outperforms, as Bank of Japan market jitters heighten yen volatility.

- Bank of Japan unexpectedly keeps YCC policy unchanged, sending yen sharply lower.

Sterling rose to a one-month high on the US dollar, the euro struggled, while volatility in the Japanese yen surged to multi-year highs during an eventful trading session in the FX market on Tuesday.

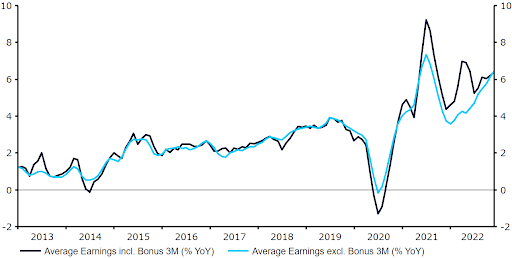

The dollar was actually broadly stronger against most currencies yesterday, though the pound was a rare exception, as a robust UK labour report raised expectations for Bank of England policy tightening. Data released from the ONS on Tuesday morning showed that average earnings growth rose by 6.4% in the three months to November (both including and excluding bonuses). These prints were both higher than expected and the fastest pace of since records began in 2001 once excluding the pandemic period, which admittedly distorted the data.

Meanwhile, this morning’s inflation data further supported the argument that the pending downturn in UK economic activity won’t be as bad as necessarily feared. Headline inflation eased for the second month, falling to 10.5% in December (10.6% consensus), while the core number remained unchanged at 6.3% (6.5% expected). So far, the Bank of England has delivered thoroughly mixed messages at its latest policy meetings, though with prices remaining elevated, and the labour market holding up well, markets are still pencilling in 100bps of hikes through mid-year. Indeed, BoE governor Bailey has warned this week that labour shortages posed a risk to inflation, given the upward pressure this places on wages.

Figure 1: UK Average Earnings Growth (2013 – 2022)

Source: Refinitiv Datastream Date: 17/01/2023

As mentioned, the euro struggled yesterday, as did most other currencies against the US dollar. There was no real clear catalyst for the move, though market jitters ahead of this morning’s Bank of Japan policy meeting may partly have been to blame. News out on Tuesday was actually largely encouraging for global growth, as a dump of Chinese activity data, all beat expectations. This included the all-important Q4 GDP numbers, which showed that Asia’s largest economy unexpectedly posted flat growth in the three months to December despite the government’ strict zero-covid measures, above the -0.8% consensus.

In the end, the Bank of Japan surprised economists’ expectations, keeping its policy unchanged, while pushing back against bets that it may soon tighten policy – there were some in the market that had braced for the BoJ to ditch its yield-curve control policy, but that was kept as is. Expectations for tighter policy has driven much of the rally in the yen in recent weeks, so the USD/JPY pair was understandably up over 2% at one stage overnight. Euro Area inflation and US retail sales data will be released today in what looks likely to be another eventful day in financial markets.