ECB December Meeting Reaction: PEPP expanded, ECB to monitor FX rate

( 3 min )

- Go back to blog home

- Latest

The European Central Bank rolled out more monetary stimulus on Thursday as it aims to protect the Euro Area economy from the downside risks posed by the ongoing COVID-19 pandemic.

The immediate reaction in EUR/USD was very limited. We note that the scale of the PEPP increase was more-or-less entirely priced in by the market prior to the meeting. Investors were more interested in President Lagarde’s comments on the state of the economy and the bank’s updated macroeconomic projections. Policymakers now expect the bloc’s economy to contract in Q4, although interestingly the 2020 GDP forecast was revised up to -7.3% from the -8% seen in September. The economy is expected to return to growth in 2021, although the projected pace of expansion was revised down to 3.9% from the previous 5% forecast, with stronger growth to follow in 2022 (Figure 1). Price pressures also remain ‘subdued’, with inflation ‘disappointingly low’ according to Lagarde. Headline inflation is now expected to remain negative until early-2021, before increasing thereafter.

Figure 1: ECB GDP Projections [December 2020]

Source: Refinitiv Datastream Date: 10/12/2020

Lagarde’s comments on the euro exchange rate are, however, the most noteworthy to come out of this afternoon’s press conference, in our view. According to Lagarde, the ECB will ‘continue to monitor it [the euro exchange rate] very carefully going forward’. She also stated that an appreciation in the common currency plays an important role in placing downward pressure on prices. This is a slight shift in tone from the September meeting, in which officials were said to be in agreement that there was no need to overreact to the euro’s recent gains. Since the beginning of the year, the currency has rallied by approximately 7% in trade-weighted terms, a development that has the unwanted side-effect of both suppressing growth and inflation.

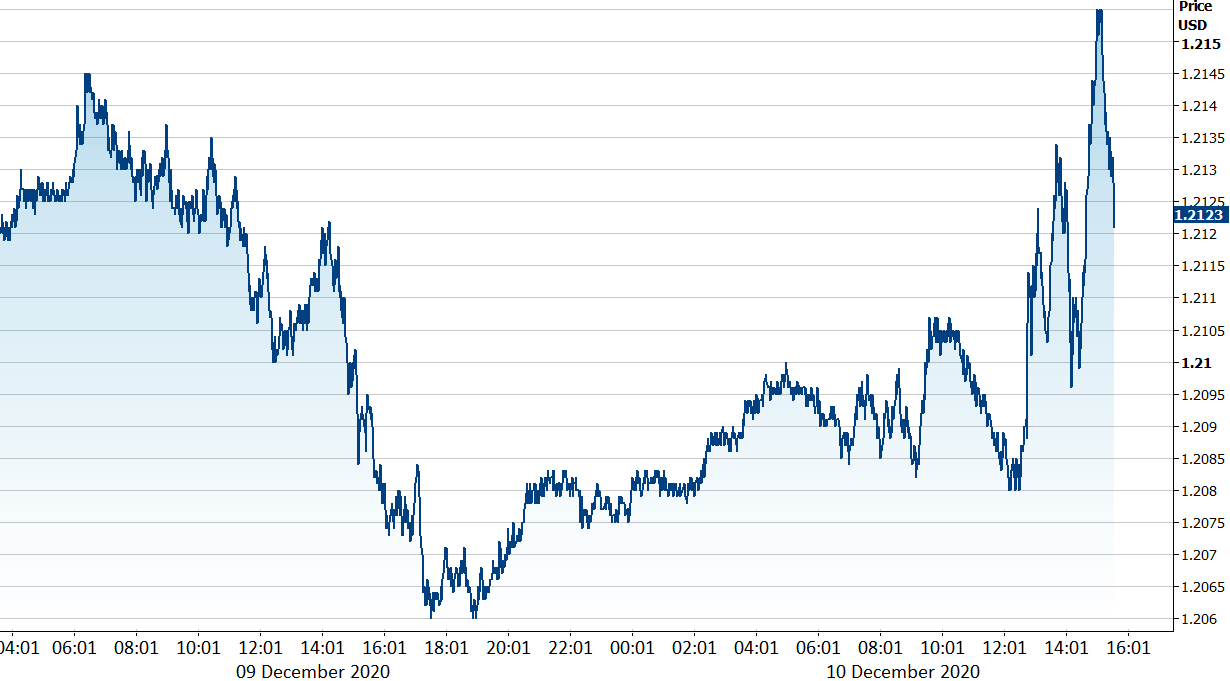

While our long-term view is a bullish one, we think that the ECB’s aversion to a stronger euro, combined with a possible sharp contraction in Euro Area activity in Q4, may trigger a minor short-term retracement in EUR/USD. Investors were, however, comforted by the absence of a more forceful talking down of the currency’s value and the market’s reaction in the aftermath of the press conference was to send EUR/USD marginally higher (Figure 2).

Figure 2: EUR/USD (09/12/20 – 10/12/20)

Source: Refinitiv Datastream Date: 10/12/2020

We remain optimistic about the Euro Area economy in 2021 and think that the large fiscal and monetary stimulus packages currently in place should allow it to rebound strongly once the latest round of virus restrictions are unwound. The resurgence of the virus, and the still significant downside risk that the pandemic poses to the global economy will, however, ensure that ECB policy will remain highly accommodative next year. Lagarde’s dovish rhetoric during today’s press conference supports this view.