ECB February Meeting Preview: Hawks to keep the upper hand

- Go back to blog home

- Latest

Recent hawkish noises from Governing Council members suggest that the European Central Bank will once again deliver another large rate hike on Thursday, as it attempts to bring down still sky-high Euro Area inflation.

President Lagarde did not water down the hawkish rhetoric during her press conference, stressing that the above stance was one of the key messages from the ECB’s announcement. She said that it was ‘obvious’ that additional 50bp rate hikes were on the way, and that these should be expected for a ‘period of time’. Moreover, she indicated that market pricing for rates was too low at the time, and that policymakers are ‘in for a long game’.

Hawkish noises continue

ECB members have stuck to their guns since the last meeting. Holzmann and Knot, representatives of the committee’s hawkish wing, indicated that they expect at least two 50bp rate increases in the coming months, while Nagel (president of the Bundesbank) has stated that the ECB has already committed to sharp hikes at the next two meetings. There has been some pushback from the dovish wing, although it has not been particularly forceful. Perhaps the most dovish member of the council, Panetta, warned against pre-committing beyond February, though fellow dove Makhlouf said he would not be surprised if the bank continued to raise rates beyond the first quarter.

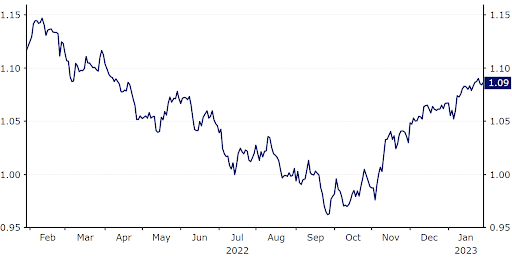

In her recent comments from Davos, ECB President Lagarde reiterated the message from the December press conference, confirming that the bank will ‘stay the course’. Following a correction in pricing for further hikes, she also said that markets would be advised to ‘revise their position’ that a slowdown in hikes will soon be on the cards. Aside from confirming to markets that a 50bp hike in February is effectively a certainty, and that another one in March is highly likely, the barrage of hawkish comments appear to have given the euro a leg up in the past few weeks.

Figure 1: EUR/USD (2022 – 2023)

Source: Refinitiv Datastream Date: 31/01/2023

Euro Area data showing resilience

After surprising to the downside in November, headline inflation declined more than expected in December, coming in at 9.2%. This moderation has come off the back of lower energy costs and government intervention. Core inflation, a more sticky and arguably more meaningful measure of underlying price pressures, ticked up to 5.2% and, as of yet, has shown no signs of easing. Until we see a sustained and clear downtrend in this key measure, it’s difficult to see the ECB pivoting away from its hawkish stance – the bank simply cannot afford the luxury that the Fed has right now.

Figure 2: Euro Area Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 31/01/2023

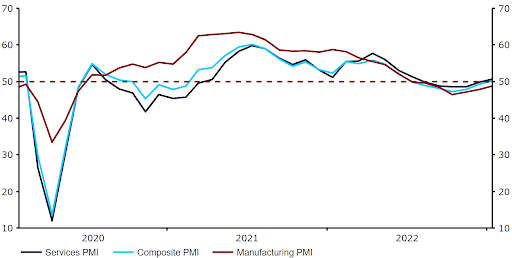

Moreover, recent readings have suggested that the Eurozone’s economy is proving more resilient than previously believed, which should warrant additional rate hikes and suggests that the economy can withstand further tightening. The business activity PMI data surprised to the upside in January, with the composite index rising back above the key level of 50 (50.2) – the first expansion since last June. In addition to the recent drop in natural gas prices, which have fallen by around 80% since August, this provides backing to our view that a recession in the Eurozone in 2023 will be avoided. This will likely be raised by policymakers at this week’s meeting, and we think that the bank may actually use it as one of the main arguments for retaining its hawkish stance.

Other survey-based indicators have also seen some improvements. Germany’s ZEW economic sentiment index is back in positive territory for the first time since February 2022 (when the war in Ukraine began). Moreover, the Citi Economic Surprise Index for the Eurozone has jumped to its highest level since July 2021, further emphasising that economists have been far too gloomy with regards to the Eurozone’s economic outlook, a view that we have expressed for some time. Since late-November this index has also diverged from the corresponding US index.

China’s reopening should further support global growth. At the same time, it may make it more difficult for the ECB to bring down rates of inflation. President Lagarde appears to share this view based on her recent comments in Davos, where she stated that ‘there will be constraints, there will be more inflationary pressure coming out of that added demand’.

Figure 3: Eurozone PMIs (2020 – 2023)

Source: Refinitiv Datastream Date: 31/01/2023

How could the euro react to this week’s announcement?

At the time of writing, another 50bp hike is fully priced in by swap markets, so we believe that the rate decision itself is unlikely to cause significant market volatility. We think that the reaction in the euro will instead be largely dependent on the tone of the ECB’s accompanying communications.

Should the bank hint that another 50bp hike is likely on the way in March, and that further tightening should be expected in the coming months, the common currency could extend its recent rally against most currencies. On the other hand, were the ECB to give any reason to doubt its newfound hawkish stance, then the euro would likely give up some of its recent gains. Given the latest economic data out of the common bloc, particularly on core inflation and business activity, we think that the former is more likely. We also believe that President Lagarde may again directly push back against market expectations for a slowdown in the pace of tightening, which could provide further support for the common currency on Thursday.

The ECB’s policy decision will be announced at 13:15 GMT (14:15 CET) this Thursday, with the press conference to follow 30 minutes later.