ECB February Meeting Preview: Will the ECB follow the Fed?

( 5 min )

- Go back to blog home

- Latest

Like many of its global peers, the European Central Bank faces stubbornly high inflation. In contrast to many of them, the central bank has, so far, taken only limited steps towards exiting its ultra-loose policy. Is a shift towards higher rates about to get quicker?

Figure 1: EUR/USD (2021 – 2022)

Source: Refinitiv Datastream Date: 31/01/2022

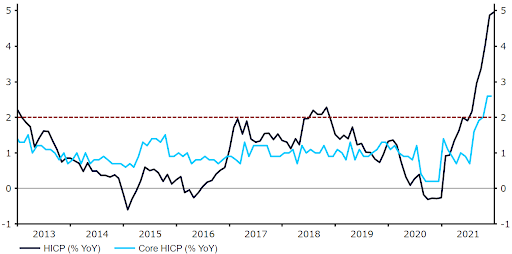

The Fed’s hawkish turn has added extra importance to this Thursday’s ECB meeting, as has the latest surprise to the upside in Eurozone inflation. Headline inflation increased to 5% in December, with core prices growing by 2.6%, both record highs.

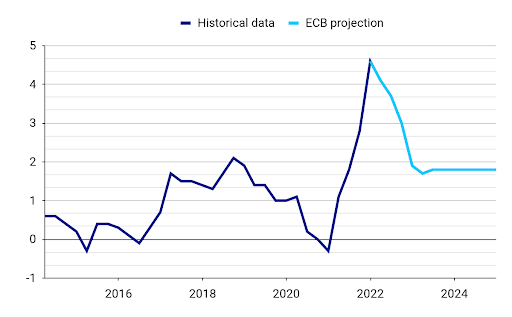

This inflation overshoot has caught the attention of policymakers, with a number of Governing Council members voicing some uneasiness over rising prices and, in particular, the ECB’s inflation forecast, which assumes price growth will decline markedly to 1.8% in 2023 and 2024.

Figure 2: Euro Area Inflation Rate (2013 – 2021)

Source: Refinitiv Datastream Date: 31/01/2022

While a number of members foresee inflation moderating before falling to target in the next two years, the hawkish voices among committee members appear to be getting louder. A representative of the hawkish wing of the ECB’s Governing Council, Robert Holzmann, recently suggested that the inflation outlook is highly uncertain and pointed to weakness of the ECB’s models. Vice President Luis de Guindos also said in mid-January that risks to inflation were ‘moderately tilted to the upside’ in the next twelve months, and that inflation may not be as transitory as believed some months prior.

Figure 3: ECB December HICP Inflation Forecast [annual percentage changes] (2014 – 2024)

Source: European Central Bank, Bloomberg Date: 31/01/2022

What’s next for the ECB?

Any important policy changes at this week’s meeting are unlikely. In December, the ECB announced a roadmap for asset purchases in 2022 that will see the Pandemic Emergency Purchase Programme end in March. There will also be a smooth transition to the ‘traditional’ APP, with a temporary increase in purchases (to €40 billion in Q2 then €30 billion in Q3) before returning back to €20 billion in October in order to avoid a cliff edge exit after purchases under PEPP conclude.

We’ll therefore focus on the tone of the ECB’s statement and President Lagarde’s press conference. So far, she has been one of the more dovish members of the committee, both indicating that inflation drivers should ease over the course of this year and dismissing a rate hike in 2022 as ‘very unlikely’. In her recent comments, she also touched on the difference between the Fed and the ECB, saying that the ECB has ‘every reason not to act as rapidly and as brutally that one can imagine the Fed would do’.

While we think that an easing of supply bottlenecks and a lower base effect may lead to a moderating in inflation in the next few quarters, this is unlikely to be as rapid as the European Central Bank outlined in December. Since then, prices in some sectors have normalised and there seem to be early signs of improving supply chains. That being said, many pieces of the inflation landscape have continued to show rising price pressures. This includes a sustained increase in commodity prices – the Bloomberg Commodity Index has jumped by 10%, oil prices are up 20%, and EU CO2 allowance futures have risen by 10% since mid-December. There are also a number of potential upside risks to inflation, with the latest ones being China’s zero-Covid strategy (due to risk of further supply-chain disruptions) and the Russia-Ukraine tensions (due to risk of increased energy and grain prices).

How could the euro react to this week’s meeting?

We think the reaction of the euro will depend largely on Lagarde’s tone with regard to policy normalisation and any signs of dissent. Considering the low market expectations for monetary policy tightening from the ECB, and recent euro weakness, any hawkish signal could provide a boost for the currency. On the other hand, sticking to last month’s script and a lack of hawkish noises might be viewed as a confirmation of very limited market expectations of policy action from the ECB and could push the common currency further lower.

The ECB’s policy decision will be announced at 12:45 GMT (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.