ECB June Meeting Preview: Almost time for lift-off

( 3 min )

- Go back to blog home

- Latest

We expect a hawkish pivot from the European Central Bank at its meeting on Thursday, strongly suggesting that an aggressive pace of interest rate hikes will likely be required in the second half of 2022.

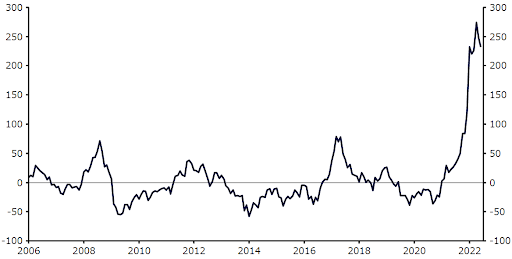

Figure 1: Euro Area Inflation Surprise Index [Citigroup] (2006 – 2022)

Source: Refinitiv Datastream Date: 07/06/2022

What could the ECB announce this week?

No change in rates is expected at this week’s meeting, indeed we see it as highly unlikely. This is not a reflection of macroeconomic conditions, but merely a consequence of sequencing, given the bank’s pledge to end net asset purchases before it begins raising interest rates. ECB President Christine Lagarde did, however, effectively confirm that hikes were on the way during her remarks in late May. Lagarde noted that she expected net asset purchases under the APP to end ‘very early in the third quarter’ and that the ECB would ‘likely be in a position to exit negative interest rates by the end of the third quarter’. We think this ensures that the ECB will announce the APP will formally end on 1st July, thus paving the way for a first hike in over a decade at the Governing Council’s 21st July meeting.

The only real question heading into this week’s meeting is not whether or not the Governing Council will raise interest rates in July, but by how much. Financial markets see at least a 25 basis point move as a certainty following Lagarde’s recent remarks, with two hikes of at least a quarter of a percentage point at both the July and September meetings a prerequisite to exit negative rates by the end of Q3. We’ve seen similarly hawkish comments from fellow ECB members, notably Chief Economist Philip Lane, who also effectively pre-committed to 25 bp moves in July and September. This is now seen as a bare minimum by investors heading into this week’s meeting.

There is a faction within the Governing Council that appears to be in support of more aggressive steps, including members Knot and Holzmann. Markets will be interested to see whether this is merely the view of a vocal few, or a shared opinion within the council.

We suspect that most will support a smaller rate increase to begin with, although we believe that policymakers will be open to discussing 50 bp hikes at upcoming meetings. Should the ECB indicate on Thursday that larger hikes are possible in H2, this would be seen as a clear bullish signal for the euro.

Another revision to the inflation outlook likely

Aside from its comments on interest rates, the bank’s updated macroeconomic projections will be closely monitored by investors and could shift the euro on Thursday. Indicators of Euro Area inflation have continued to surprise to the upside in recent months, so another upward revision to the ECB’s 2022 inflation projection is likely this week. The increase in core inflation to 3.8% in May indicates that price pressures are broadening, while higher commodity prices and a weaker euro since the last set of forecasts in March are also inflationary. We expect the average HICP inflation projection to be revised above 6% for 2022 (from 5.1%), with possible modest upward revisions in 2023 and 2024.

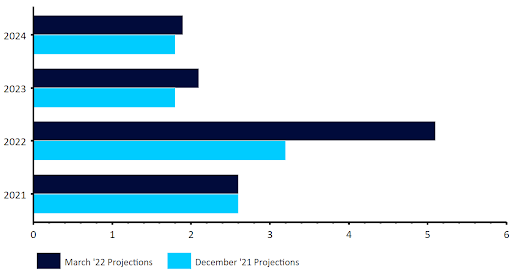

Figure 2: ECB HICP Inflation Projections [March 2022]

Source: Refinitiv Datastream Date: 07/06/2022

Downside risks to growth have also intensified, notably the sharp increase in domestic prices and disruption to Russian energy supply. We stress, however, that economic activity data has held up relatively well, suggesting that fears over a Euro Area recession later in the year are overstated. We expect this to be reflected in a slightly more modest downgrade to the growth outlook for 2022 and 2023 than many economists are currently pencilling in. That said, the ECB’s dismal track record in this area probably means that the projections will be mostly ignored by markets.

How could the common currency react?

We think that the ECB will keep all of its options on the table on Thursday, essentially punting the debate on the size of the July rate hike to the next meeting. At the time of writing, markets are fully pricing in a 25 basis point move in the deposit rate next month, with a roughly one-in-three chance of a 50 bp one. Should Lagarde keep open the possibility of the latter, then we could see support for the euro on Thursday afternoon as markets ramp up their expectations for hikes across the curve. By contrast, a more cautious approach on rates, that perhaps raises renewed concerns over the growth outlook and recession risks, would be seen as bearish for the common currency.

Ultimately, we think that there remains room for the ECB to exceed market expectations this year, which we think is a positive for the euro. That said, this gap has narrowed in recent weeks now that swaps are pricing in around 130 basis points of hikes by year-end (up from 50 in early-April).

The ECB’s policy decision will be announced at 12:45 BST (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.