ECB June Meeting Preview: Taper talk to be shelved

- Go back to blog home

- Latest

This Thursday’s European Central Bank meeting will be the main event risk in the FX market this week.

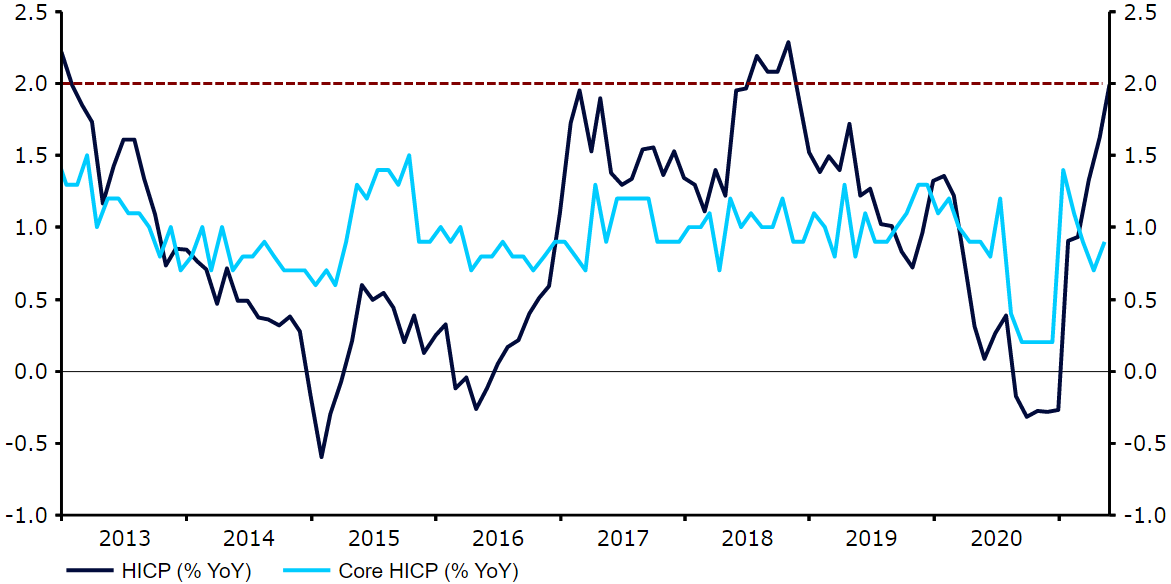

Figure 1: Euro Area Inflation Rate (2013 – 2021)

Source: Refintiv Datastream Date: 07/06/2021

With that in mind, we think that there is potential for a slightly less dovish set of communications from the Governing Council than the market is currently expecting, which could provide support for the euro. The bank will also release updated macroeconomic projections this week, and we expect modest upward revisions to its growth and inflation forecasts. The size of the latter will be of particular interest to the market considering that supply chain disruptions and elevated commodity prices are forcing prices higher globally.

The key to the market reaction will, however, likely be centred around the bank’s view on its asset purchasing programme, namely whether the ‘significantly’ higher rate of bond purchases announced earlier in the year is scaled back in view of the strengthening economy. We think the ECB is not quite ready to take that step. Similarly to recent FOMC communications, a number of ECB members have expressed their opinion that the pick-up in inflation will prove temporary. The uncertainty surrounding the ongoing health crisis, particularly the impact of the delta variant on contagion numbers, also presents a risk to the outlook and a reason to be cautious on policy normalisation.

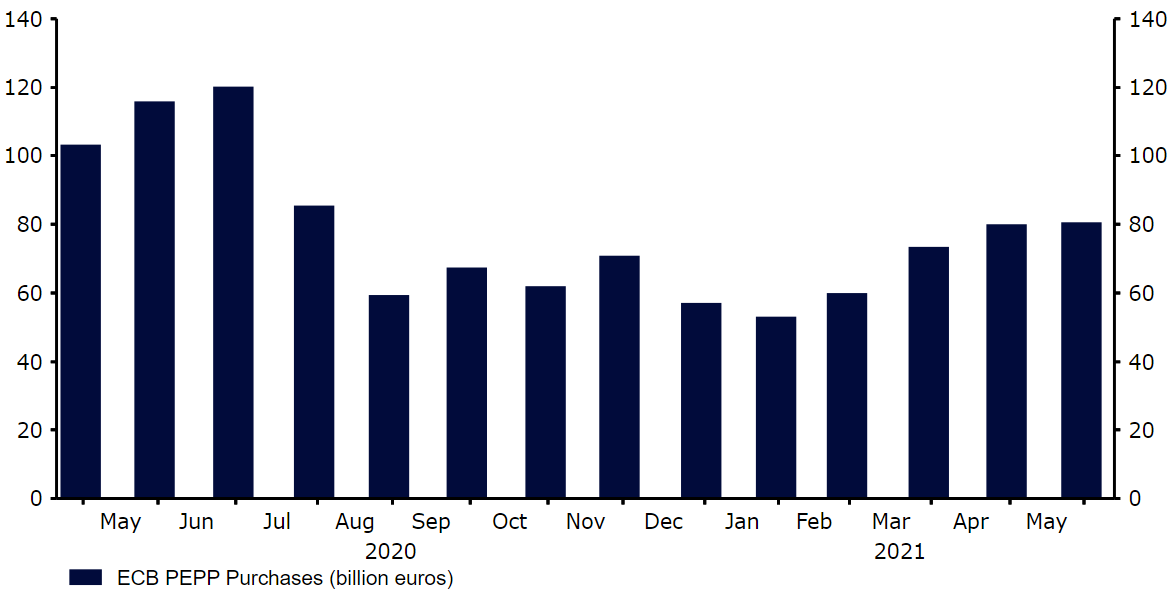

We think that the current pace of purchases under the PEPP (approximately 80 billion euros a month) will be maintained until September, at which stage we expect the pace of purchases to begin to be gradually lowered. Conversations surrounding the end date of the programme are also likely to be shelved until at least the September meeting, when policymakers will have a much clearer idea as to the state of the health crisis and, more specifically, its long-term implications for Euro Area inflation.

Figure 2: ECB PEPP Asset Purchases (2020 – 2021)

Source: Refintiv Datastream Date: 07/06/2021

Overall, we think that the ECB will strike a slightly less dovish than expected tone in its communications on Thursday, although we expect President Lagarde to refrain from indicating that a tapering in asset purchases is on the way. We certainly think that the staff forecasts will reflect this more optimistic outlook, which may provide some decent support for the euro towards the end of the week. A more dovish set of communications that suggest the current pace of purchases may be extended beyond September would, by contrast, likely trigger a sell-off in the common currency.

The ECB’s policy decision will be announced at 12:45 BST (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.