ECB March Meeting Preview: Geopolitics to delay policy normalisation?

( 3 min )

- Go back to blog home

- Latest

As if there wasn’t already enough uncertainty heading into Thursday’s European Central Bank meeting, Russia’s full-scale invasion of Ukraine in late-February has added yet another layer.

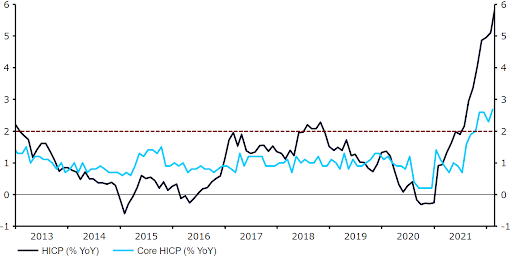

The ECB has plenty of reasons to strike a cautious tone this week. With no sense as to how long the fighting in Ukraine will last, policymakers can be forgiven for waiting to see how the crisis plays out before committing to any meaningful policy changes. On the other hand, inflation in the Euro Area continues to increase aggressively. The new move higher in commodity prices and the further disruption to supply-chains induced by the crisis means that risks to price growth remain firmly skewed to the upside. Data out last week showed that headline HICP inflation once again beat expectations in February, jumping to a record high 5.8%, well above the 5.4% consensus.

Even excluding the volatile components, prices grew at an annual rate of 2.7%, a sizable increase on the January number (2.3%).

Figure 1: Euro Area Inflation Rate (2013 – 2022)

Figure 1: Euro Area Inflation Rate (2013 - 2022)

rior to the latest geopolitical developments, we had expected the ECB to announce a hawkish recalibration of its asset purchase programme this week that would pave the way for a first interest rate hike in June. We have since tempered these expectations, particularly in light of some dovish comments from ECB members since the start of the invasion. Governing Council member Fabio Panetta noted ‘it would be unwise to pre-commit on future policy steps until the fallout from the current crisis becomes clearer’. Even some of the more hawkish members, including Austrian National Bank Governor Robert Holzmann, have indicated a cautious approach may be on the way. Holzmann said last week that while the bank is clearly moving towards policy normalisation, that process ‘may now be somewhat delayed’.

Will the ECB announce any policy changes this week?

So what can we expect from the ECB this week? We think that there will be heated discussion and significant division among policymakers as to how to proceed in light of the uncertainty created by the Russia-Ukraine conflict. That makes this Thursday’s meeting one of the hardest to call in recent memory.

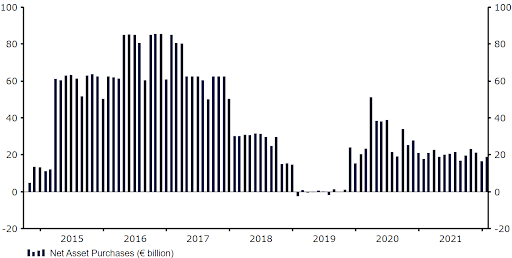

Without news of a ceasefire, it’s difficult to see how the ECB announces an aggressive recalibration of the APP just yet. We think that the bank likely has two main choices on how to proceed. It can either announce that it is speeding up the pace of APP withdrawal, albeit at a more gradual speed than anticipated immediately prior to the invasion. In December, the bank announced that it would be temporarily boosting net asset purchases under the APP in order to smooth the transition away from the pandemic asset purchase programme (PEPP), which ends this month. Net asset purchases under the programme are set to be increased from €20 billion to €40 billion in Q2, before being gradually lowered back to €20 billion in October. Under a possible new schedule, we could perhaps see an announcement that the APP will be wound down to zero by October, with further recalibrations to be left to upcoming meetings.

Figure 2: ECB Net Asset Purchases [APP] (2014 – 2022)

Source: Refinitiv Datastream Date: 08/03/2022

An alternative, and perhaps the more likely scenario given recent comments from Governing Council members, would be for the bank to simply stand pat and delay its decision entirely until at least the next meeting in April. Depending on the tone of President Lagarde’s accompanying rhetoric, we think that the former would probably be perceived as bullish for the common currency, whereas the latter would likely trigger another bout of euro weakness. These projections are, however, simply conjecture at this stage, and a lot can change depending on newsflow in the coming days.

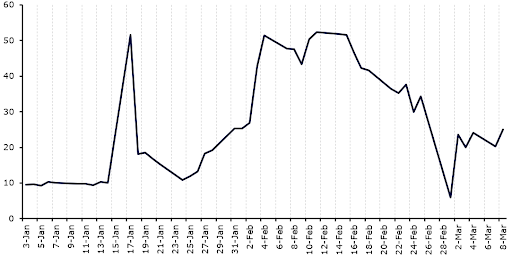

We do, however, still think that much tighter policy will be required not too far down the road. We don’t think that the ECB can ignore the increase in inflation for much longer, and believe that the initial retracing in market pricing for rate hikes in response to the crisis was a bit of an overreaction. At one stage, markets were pricing in just 10 basis points of hikes through to the end of 2022 (down from around 50), although this has since increased back up to approximately 25 basis points (Figure 3). We continue to think that this is an underestimation. We now expect a first rate hike in September, with another to follow in December. 25 basis point hikes are also very much a possibility, in our view – a departure from the 10 basis point increments that have been common-place during the sub-zero policy rate era. As mentioned in our report in the immediate aftermath of the invasion, we see the crisis in Ukraine as having dovish implications in the immediate-term, and hawkish in the medium-run. Once the uncertainty of the conflict has passed, we think that the ECB will need to change gears rather swiftly to try to bring inflation under control.

Figure 3: Basis Points of ECB Rate Hikes Priced In [by E-2022] (2022)

Source: Refinitiv Datastream Date: 08/03/2022

The bank’s updated macroeconomic projections, which the ECB has confirmed will take into account the implications of Russia’s invasion of Ukraine, will also be closely watched by market participants this week. We expect a downward revision to near-term growth to be accompanied by a rather sharp upward revision to the 2022 inflation forecast. It will be interesting to see how markets react in such a scenario. We suspect that the inflation projections will garner greater attention, with a particularly sharp upward revision to this year’s and/or future numbers likely to be perceived as bullish for the euro. A marked downward revision to growth would, however, be bearish for the common currency, particularly should the ECB sound concerned about the terms of trade (ToT) shock induced by the crisis.

We expect this week’s European Central Bank meeting to be the most important since the start of the COVID-19 pandemic in March 2020, and volatility in the euro is likely to be heightened surrounding the release of the bank’s statement and Lagarde’s press conference.

The ECB’s policy decision will be announced at 12:45 GMT (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.