Will the ECB boost its pandemic response programme this week?

- Go back to blog home

- Latest

The COVID-19 pandemic is continuing to cause devastation to the global economy and force central banks and governments around the world to unveil massive and unprecedented stimulus measures.

Under normal circumstances the bank would, at this juncture, stand pat on policy and await the impact of its recent stimulus measures on macroeconomic data. We are, however, in unprecedented times, and the announcement of further easing measures at the ECB’s Governing Council meeting this coming Thursday is now very much a possibility, in our view. At the very least, we expect the ECB to provide forward guidance that would indicate its readiness and willingness to do more if needed at upcoming meetings, particularly regarding an expansion of the PEPP.

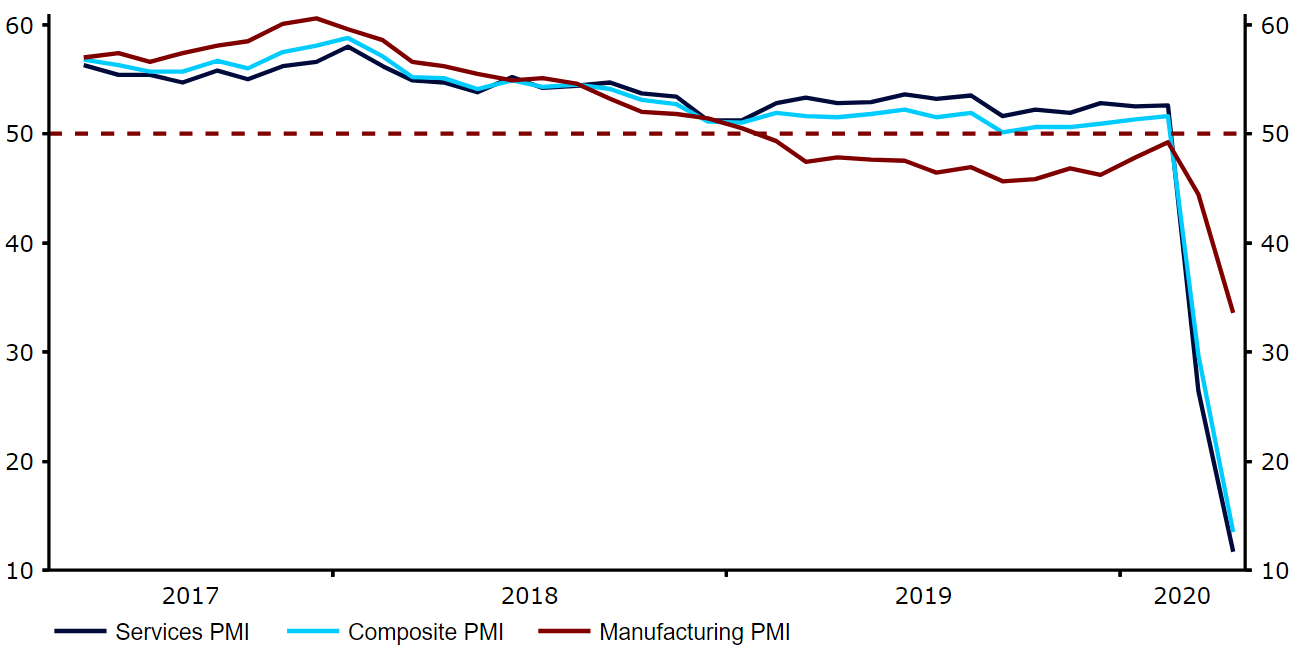

The latest contagion numbers out of Europe have been encouraging, suggesting that the worst of the virus may now be over. It is clear, however, that the pace of an unwinding in the containment measures will be gradual and their economic impact severe. Since the bank’s previous meeting in March, we have begun to see evidence of this fallout in the latest Euro Area macroeconomic data. The business activity PMIs, in particular, have collapsed, with the composite index dropping to a fresh record low 13.5 in April (Figure 1).

Figure 1: Euro Area PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 28/04/2020

Employment in both the manufacturing and services sectors has declined rapidly, although there are at least some signs that the bloc’s labour market is holding up better than in the US. We think this is due to the much stronger job retention schemes currently in place in the common bloc than across the Atlantic. Regardless, the pending recession in the bloc this year looks set to be a very severe one, with President Lagarde herself warned earlier this month that the Euro Area economy could contract by as much as 15% this year. We think that the ECB will acknowledge the severity of the downturn by striking a very dovish tone during its accompanying communications.

Ebury’s expectations

While there is certainly a possibility that the ECB refrains from altering policy until a later date, we think that there is room for the bank to increase its stimulus measures as soon as this Thursday’s meeting. We think that the bank will announce an increase in its Pandemic Emergency Purchase Programme up to a size where it can absorb all the expected issuance from peripheral sovereigns through at least the end of 2020. While the current envelope of €750 billion is undoubtedly sizable, this still only equates to around 6% of the Euro Area’s GDP, suggesting that there is scope for it to be increased. Interest rates do, on the other hand, look likely to remain unchanged at current levels for the foreseeable future given the bank’s seeming reluctance to cut during the height of the market panic last month.

We think that there are three broad scenarios for how EUR/USD could react to this week’s meeting. Should the ECB both fail to act now and refrain from pledging future action, then the euro would likely sell-off sharply. This would appear counterintuitive under normal circumstances, although we believe that investor concerns regarding a less stimulated economy battered by the current crisis would supersede any fears regarding an increase in the money supply.

The second possibility would be for the ECB to hold policy steady for the time being, but make a firm pledge to do more in the summer. The reaction in the currency markets would likely depend on whether Lagarde can convince the market that more easing is genuinely on the cards, although we think that the overall knee-jerk move would be to send EUR/USD lower.

The last option, and our base case scenario, would be for the bank to act now by increasing its PEPP on Thursday. The euro would likely rally under this scenario, particularly given the market currently appears torn over whether immediate action is necessarily on the way. This would drive the point home to markets that there is sufficient firepower within European authorities to ensure the bloc makes a full recovery from the crisis once the worst is over and a sense of normalcy is resumed.