ECB October Meeting Preview: Will Lagarde voice concern over rising inflation?

( 5 min. )

- Go back to blog home

- Latest

While we don’t expect any major fireworks from the European Central Bank at this Thursday’s meeting, the bank’s communications will be key to the near-term evolution of the euro.

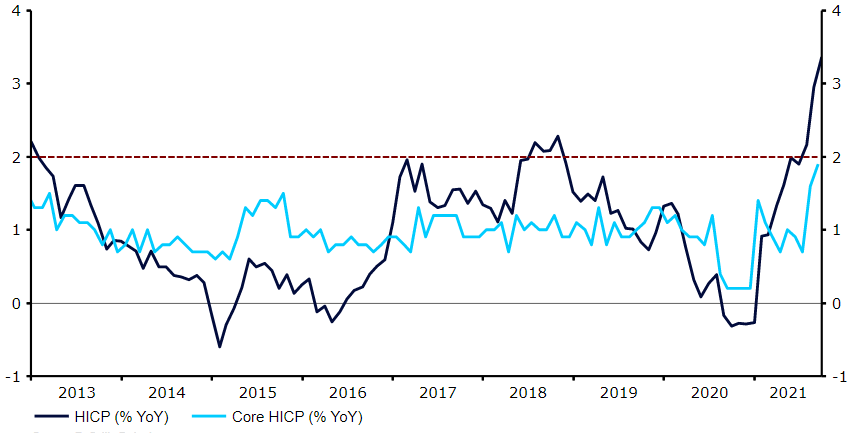

But what will investors be looking out for at this week’s meeting? With no updated macroeconomic projections due on Thursday, we think that a decision on the bank’s emergency asset purchase programme (PEPP) will be delayed until December, and expect Lagarde to sidestep questions on the matter during her accompanying press conference. Instead, market participants are likely to be more interested in the ECB’s view on Euro Area inflation and, more specifically, its implication for interest rates. Inflation in the Eurozone has continued to overshoot the ECB’s staff projections in the past few months. Headline price growth jumped to a 13-year high 3.4% in September, well above the 2.2% pencilled in for 2021, while the core rate is now just shy of target for the first time since 2008 (Figure 1). We think that there is a limit as to how long rate setters can argue that this spike in prices is temporary, and the hawks within the council will contest that this jump in prices cannot be ignored for much longer.

Figure 1: Euro Area Inflation Rate (2011 – 2021)

Source: Refinitiv Datastream Date: 26/10/2021

The other focal point of the meeting is likely to centre around the ECB’s view on market pricing for interest rates. Speaking earlier in the month, chief economist Lane argued that ‘markets may not have fully absorbed rate forward guidance’, indicating his view that investors are perhaps somewhat overestimating the chances of hikes in 2022. According to futures pricing, the market is currently fully pricing in a 10 basis point rate increase by the end of 2022, and a total of around 40 basis points of hikes by the end of 2023. This appears to be a bit of a disconnect between the ECB’s recent dovish rhetoric, which has continued to emphasise the need for an accommodation policy for some time yet. Lagarde may, therefore, use this week’s meeting as an opportunity to push back against market pricing for hikes, although this would likely be communicated in as delicate a manner as possible.

How could the euro react to this week’s meeting?

We think that risks to the euro going into the meeting may be slightly skewed to the upside. Markets appear to be bracing for a very dovish message from the ECB this week, and the bar for a hawkish surprise may, therefore, be a relatively low one. We think that even a neutral tone from President Lagarde could be enough to trigger a euro rally. We would expect a particularly sharp move higher in the common currency should the bank view higher inflation as more persistent, and open the door to an aggressive unwinding in the PEPP, to commence in either December or early-2022.

On the other hand, should Lagarde stick to her guns and again downplay the impact of rising inflation, while pushing back on market pricing for hikes, we would expect a sell-off in the euro against most currencies. In this event, we would likely revisit our euro forecasts, and may be forced to once again revise lower our EUR/USD projections.

The ECB’s policy decision will be announced at 12:45 BST (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.