ECB September Meeting Preview: bracing for a heated discussion

- Go back to blog home

- Latest

This Thursday’s European Central Bank meeting will be the main event risk in the FX market this week.

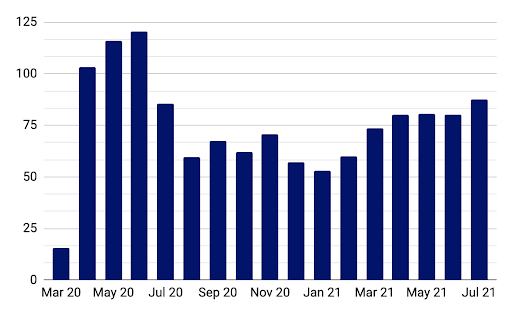

Figure 1: ECB PEPP Monthly Purchases [billion euros] (March ‘20 – July ‘21)

Source: European Central Bank Date: 07/09/2021

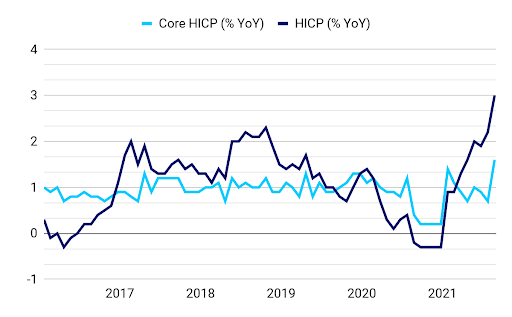

The arguments in favour of scaling back the PEPP from the currently elevated pace of approximately 80 bn euros per month (Figure 1) are that the economic situation in the bloc remains favourable, with most recent indicators continuing to point to a strong economic expansion so far in the third quarter. The PMIs of business activity are robust, with the composite index at 59.0 in August, shy of its 15-year peak from July. This has been coupled with higher inflation, with the headline rate of consumer price growth rising to a decade-high 3% last month, surprising to the upside. Core price growth, however, is more muted, at 1.6%, coming in only slightly higher than expected (Figure 2).

Figure 2: Euro Area Inflation Rate (2016 – 2021)

Source: Bloomberg Date: 07/09/2021

Price rises have been uneven, with countries such as Italy and France posting increases of approximately 2%, while Germany sees prints above 3% so far in the third quarter. CPI inflation soared to 3.9% in August reaching the highest level in 28 years. Part of the recent surge in both Germany as well as Eurozone has to do with low statistical base and temporary factors, such as expiration of German VAT cuts, albeit supply restrains and some improvements in the labour market also support price increases. At any rate, it seems clear that the phenomenon of widespread price pressures before the labor market fully heals from the pandemic is a global one.

Members of the ECB’s hawkish wing have recently become more active, worried about inflation. Jens Weidmann, Bundesbank president warned last week about the risk of higher inflation, while another Governing Council member Klaas Knot said he expects an agreement regarding the reduction in the asset purchases to take place at the September meeting. Another member, Robert Holzmann also struck a hawkish note, suggesting that the ECB should discuss the slowdown of purchases under the PEPP during this week’s meeting.

However, just as price increases, the improvements in the domestic labour markets are quite uneven, with primarily southern countries struggling with elevated levels of unemployment and labour market slack. This, alongside the risks stemming from Covid, could push policymakers to err on the side of caution, in fears that a tightening of monetary policy could prove premature. We expect that we’re not going to see changes to the PEPP programme just yet, with the bank more likely to opt for any alterations later in the year. However, there should be significant dissension in the Council for the first time in a while.

In addition to the news regarding the pace of purchases under PEPP, it would be important to see whether the bank will announce a change in the duration of the programme, which is set to continue until at least the end of March 2022. Furthermore, the bank will also release updated macroeconomic projections, and we expect modest upward revisions to its growth and inflation forecasts for 2021. Adjustments to the longer-term projections are likely to be minor if any. We don’t expect significant changes, particularly considering the cut-off date for the forecast was before the recent inflation surge and oil futures prices that tend to play a large role in revisions are relatively stable. Additionally, contrary to the Fed, the projections are produced by the central bank staff and are not a reflection of the policymakers’ views.

Considering that some of the hawkishness of the recent communications from the ECB members and higher inflation seems to have already filtered into the market prices the euro could be pressured lower if the ECB decides to stay put on policy and does not strike a hawkish note. At the same time, any immediate announcement of a PEPP reduction would most likely boost the common currency. A hawkish shift in the language could also be supportive.

The ECB’s policy decision will be announced at 11:45 GMT (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.