ECB September Meeting Preview: Will Lagarde talk down the euro?

( 4 min )

- Go back to blog home

- Latest

This month’s European Central Bank (ECB) meeting will be more important than the market believed a week or so ago.

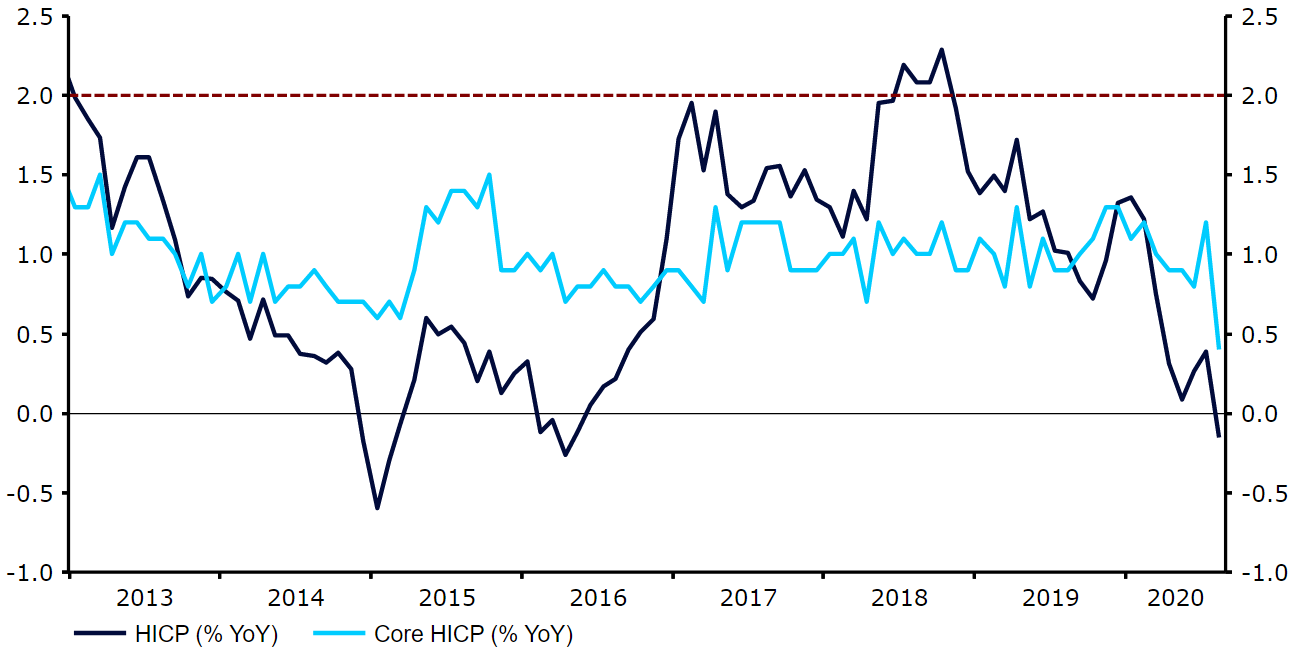

Recent improvements in soft indicators of economic activity will provide the ECB with some encouragement, although the unexpected decline in retail sales in July will be a cause for concern. The main topic of conversation will, however, likely be centred around the sharp decline witnessed in Euro Area inflation. Data released last week showed that consumer price growth in the bloc slumped into negative territory in the year to August for the first time since 2016 (-0.2% versus the 0.2% expected). This is considerably short of the bank’s most recent projections unveiled in June. More critically, core inflation, which strips out the volatile priced components of food and energy, arguably fared even worse. This measure slowed to a record low 0.4% year-on-year last month, well below the 1.2% recorded in July.

Figure 1: Euro Area Inflation Rate (2013 – 2020)

Source: Refinitiv Datastream Date: 07/09/2020

Unlike some of its major counterparts, the sole mandate of the ECB is to lift inflation in the bloc to close to, but just below its 2% target. The complete lack of inflationary pressure in the bloc will therefore be a significant worry for the central bank and may well dominate discussions among the committee this week.

We outline below the keys to the bank’s communications this Thursday:

Updated economic projections. We are unlikely to see too much attention given to the bank’s updated GDP forecasts, which will probably remain more-or-less unrevised. Given last week’s CPI miss, a significant downward revision to the inflation forecasts does, however, seem likely. The Governing Council may even voice an opinion that risks to future inflation are skewed to the downside following the recent sharp rally in the euro (up more than 5% versus the dollar since the June meeting), which tends to have the effect of pushing down prices. The prospect of rising unemployment and falling wage growth once job retention schemes are ended also present a downside risk to the inflation outlook.

Hints at additional stimulus in the near future. Given the downside risks to inflation, we think that there is a possibility that the ECB opens the door to an increase in the PEPP later in the year at either of the next couple of Governing Council meetings. The ECB’s chief economist Philip Lane already suggested last week that policymakers stand ready to do more if needed. While we don’t think that there is any immediate need for action this month, the bank may choose to use this week’s meeting as an opportunity to lay the groundwork for an increase in the programme later in the year, possibly December.

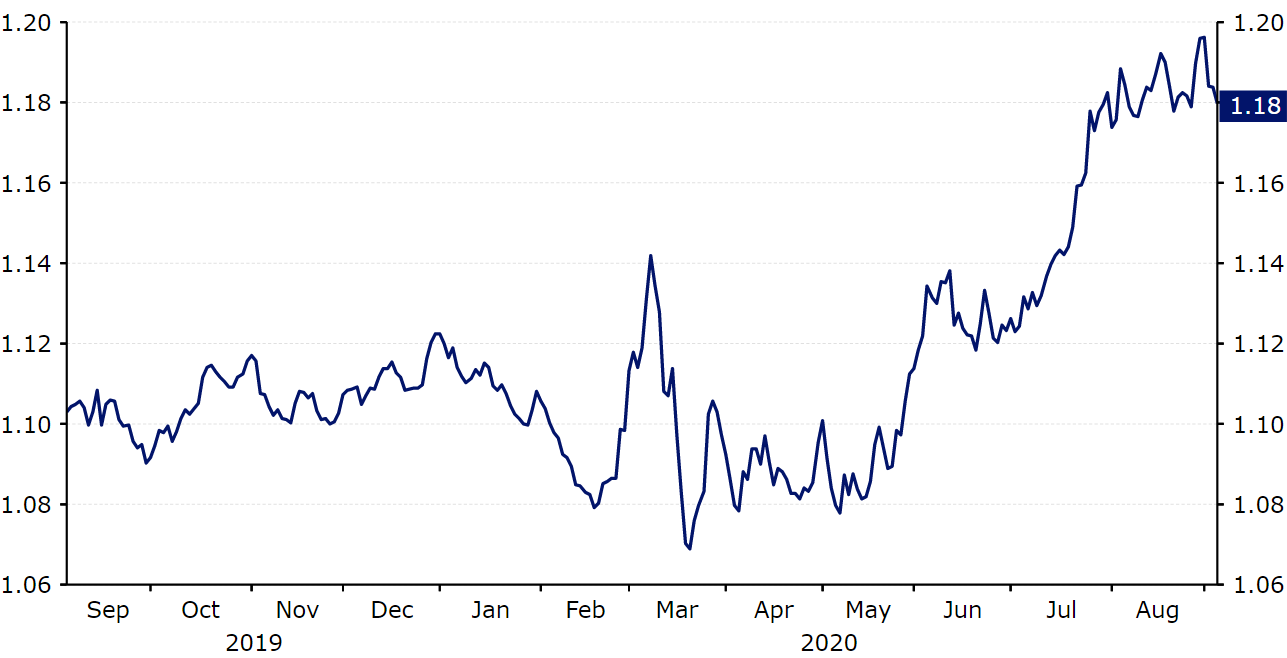

Comments on the strength of the euro. The euro has rallied to its highest position versus the dollar since May 2018 in the past few days, having now appreciated by 9% since mid-May. This is an unwanted development for the bank given the impact this has on both suppressing inflation and worsening export competitiveness. Last week’s remarks from Lane that the value of the currency matters suggests that the issue of euro strength will likely be on the ECB’s agenda at this month’s meeting. There is a chance that this could be followed by some form of verbal intervention during President Lagarde’s press conference intended to curtail the currency’s recent rally.

Figure 2: EUR/USD (September ‘19 – September ‘20)

Source: Refinitiv Datastream Date: 03/09/2020

Overall, we expect the ECB’s communications to take on a more dovish tilt on Thursday, particularly following last week’s dismal inflation data. Should the bank raise concerns over a protracted period of deflation, while hinting that an increase in the PEPP could be in the offing later in the year, then we think the euro would come under selling pressure on Thursday. Any comments from Lagarde regarding the recent strength of the euro, or increased fears regarding a second wave of virus infection, would also trigger investors to ditch the common currency, in our view.

The ECB’s policy decision will be announced at 12:45 BST (13:45 CET) this Thursday, with the press conference to follow 45 minutes later.