ECB September Meeting Reaction: PEPP ‘recalibration’ leaves markets underwhelmed

( 5 min. read )

- Go back to blog home

- Latest

PEPP ‘recalibration’ leaves markets underwhelmed

The statement after the monetary policy meeting was little changed from July except for a small modification in the text regarding the PEPP programme. It states that “the Governing Council judges that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the previous two quarters”. It confirmed the expectations of a number of market participants anticipating the ECB will decide to slow down the pace of purchases under PEPP, particularly after a series of hawkish messages from some ECB members in recent days and August inflation in the bloc surprising to the upside. At the same time, it was a little surprising to us as we anticipated the ECB will prefer to wait longer before making changes to the programme.

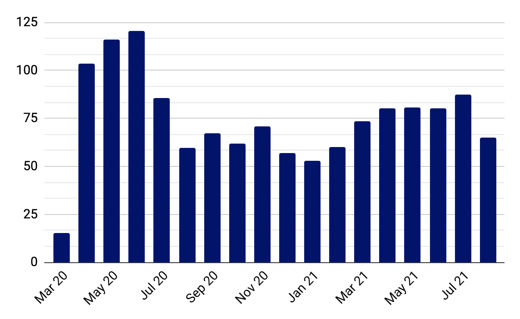

That being said, this slowdown in purchases is minor and should not affect the financing conditions to a significant extent. Particularly as the ECB started purchasing fewer assets under PEPP even before the announcement. The most recent data indicates the bank bought 65 bn euros worth of assets in August, down from approximately 80 bn euros in previous months (Figure 1).

There were no other changes regarding the PEPP programme as the total envelope of purchases was left unchanged at 1,850 bn euros and the programme is set to continue until at least the end of March 2022.

Figure 1: ECB PEPP Monthly Purchases [billion euros] (March ‘20 – August ‘21)

Source: European Central Bank Date: 09/09/2021

President’s Lagarde tone during the press conference can be described as mixed. Risks to the outlook were described as ‘broadly balanced’, same as in June and July. Lagarde pointed to improvements in the Eurozone economy, employment situation, and vaccination process, while at the same time noting risks, particularly the delta spread across the globe. Regarding the slowdown in PEPP purchases, Lagarde stated that it’s a ‘recalibration’ instead of tapering, suggesting that the Governing Council will decide on the future of the programme in December.

Growth and inflation projections for this year were upgraded somewhat higher, as anticipated. The Euro Area economy is now expected to expand by 5% in 2021 versus the 4.6% anticipated in June. Growth in 2022 is forecasted to be slightly lower, at 4.6%, down from 4.7%. The growth forecast for 2023 was unchanged at 2.1%.

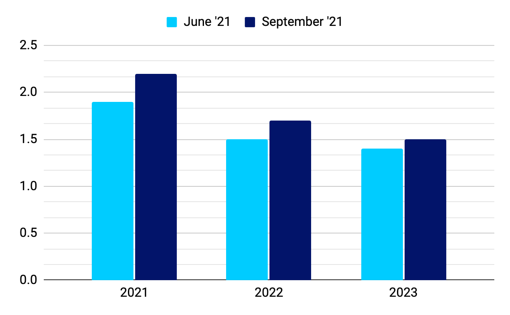

The inflation forecast was revised higher for the entire forecast horizon, but the changes were mostly minor. Prices are expected to grow by 2.2% in 2021, 1.7% in 2022, and 1.5% in 2023, up from 1.9%, 1.5% and 1.4% respectively estimated in June (Figure 2). Although the ECB anticipates that also the underlying inflation will be slightly higher than estimated earlier it is expected to remain below the ECB target for the entire forecast horizon. Even after the upward revisions, new projections don’t suggest that the Governing Council should be concerned with inflationary pressures.

Figure 2: ECB Inflation Projections (HICP, %) [September]

Source: European Central Bank Date: 09/09/2021

As far as the FX reaction is concerned, we’ve not seen too much volatility in the euro on the back of today’s announcement. After an initial uptick following the announcement regarding PEPP, the EUR/USD pair has declined during Lagarde’s press conference. Changes to the ECB forecasts were largely in line with expectations, while Lagarde’s tone was mixed. Nevertheless, judging by the market reaction, the press conference seems to have been read as moderately dovish. The attention now turns to the December meeting, as Lagarde clearly suggested that major monetary policy announcements should be expected at that time.

Written by:

Enrique Díaz-Alvarez, Matthew Ryan, Roman Ziruk & Itsaso Apezteguia

9 September 2021