Emerging market currencies show resilience in wake of US inflation shocker

( 5 min )

- Go back to blog home

- Latest

Volatility has made a triumphant return to markets so far in 2022, as macroeconomic and geopolitical shocks continue to buffet markets.

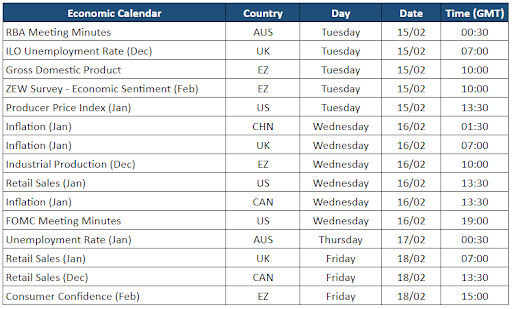

It seems that the latest inflation shock has forced some sort of tipping point at the Federal Reserve. James Bullard, a FOMC voting member, stated that he now favours hikes in interest rates even outside the scheduled meetings, something that has not happened since 1979. For the foreseeable future, markets will focus almost exclusively on two factors: inflation numbers, and central bank policy. As to the former, this week sees US producer inflation (Tuesday) and UK CPI (Wednesday). As for the latter, five Federal Reserve officials, as well as ECB President Lagarde and Chief Economist Lane are all scheduled to speak. Further, the minutes for the last Fed meeting will be released Wednesday, though it should be noted that these come with a three week lag.

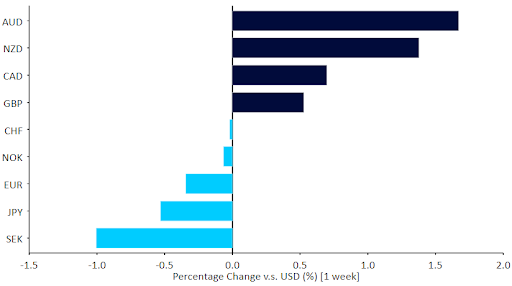

Figure 1: G10 FX Performance Tracker (1 week)

Source: Refinitiv Datastream Date: 14/02/2022

GBP

The main news out of the UK is that GDP growth appears to be resilient, growing at 6.5% YoY in the last quarter of 2021, which seems to leave the hawks in the Bank of England an open lane. The news from the US must surely further strengthen their hand, as the need to get a grip on inflationary pressures becomes the priority for policymakers worldwide.

Partygate continues to have no discernible impact on markets, which will be fully focused this week on the CPI inflation report out of the UK. Forecasts are for the same or slightly higher readings as last month, but the recent track record of positive surprises in inflation readings worldwide are sure to keep traders on edge.

EUR

ECB President Lagarde´s continued efforts to push back against market expectations for ECB hikes mostly failed until the flare up of tensions in Ukraine sent rates back down late Friday. As it stands, markets are now expecting 50 bp of hikes in 2022 but a terminal rate of just 0.7% , which strikes us as totally inadequate given the strength of inflationary pressures.

This week there is little in the way of market moving news. Focus will be on the leaders of the dovish faction within the ECB, Lagarde and Chief Economist Lane, who are both set to speak in public. Any sign that either of them is owing to the inflationary reality would be a positive for the common currency.

USD

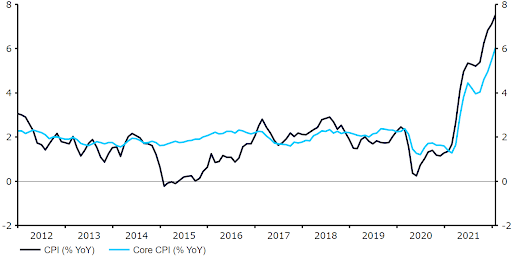

The January inflation report was yet another shocker. Inflation rose to another 40 year high of 7.5%. Even more worrisome, price increases are becoming widespread. Of particular concern is the spread of pricing pressure to housing, a particularly sticky component that is not expected to ease any time soon. US yields rose sharply in the following days, only to give up some of those gains on news that the US thinks a Russian invasion of Ukraine may be imminent.

Figure 2: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 14/02/2022

We expect producer prices to pull back slightly next week. More importantly, there are multiple Federal Reserve officials speeches on tap. We expect these to reaffirm mounting concern with inflation and suggest to markets that rates could go up every meeting and by more than 25 basis points unless inflation numbers start coming down soo.

CHF

Last week would have been a calm one for the franc had it not been for the worrying news late-Friday about a real risk of a Russian invasion of Ukraine that may take place as soon as this week. This has triggered a bout of risk aversion, causing the Swiss currency to rally alongside its fellow safe-haven assets.

The franc has extended its gains so far this morning, and is now trading back below the 1.05 versus the euro and its strongest position in around ten days. While the pair has already fallen by approximately 1.5% from its recent highs, we have little doubt that the pair would drop further should the perceived risk of an escalation in the tensions increase, or if there is indeed an incursion.

AUD

The Australian dollar ended last week trading around 0.715 to the US dollar, after hitting a 3-week high of 0.725 earlier in the week, as risk sentiment improved. AUD lost some of its gains as bets increased for faster Fed tightening, although still finished atop of the G10 performance tracker. Meanwhile, RBA governor Philip Lowe said it was plausible interest rates could rise later this year, but there were risks in moving too early and the bank wanted to see a couple more quarterly inflation reports before deciding. The prospect of higher interest rates, and concerns surrounding the rising cost of living, partly weighed on the February consumer sentiment index, which declined to 100.8 last week.

On Tuesday, the RBA meeting minutes will be published, followed by the publication of the January unemployment rate on Thursday.

CAD

The Canadian dollar lost ground against its US dollar last week, trading at around the 1.27 level, as the US January inflation report surprised to the upside. The shutdown of a crucial US-Canada trade route amid protests against Ottawa’s pandemic measures also partly weighed on CAD last week, as investors fret over the impact on automakers’ operations. An increase in oil prices, one of Canada’s major exports did, however, limit the fall of the Canadian dollar.

On Wednesday, January inflation will be published, followed by the publication of December retail sales on Friday. Economists are eyeing an unchanged reading in the annual rate of inflation, although in line with the recent global trend, we think that a surprise to the upside here is likely.

CNY

The yuan remained remarkably stable last week, ending little changed against the US dollar. The next few days in China will belong to inflation and the central bank, mirroring the last few weeks in the G3. On Wednesday, both producer and consumer inflation are expected to show slower annual price growth in the first month of 2022. On Tuesday the bank is expected to roll over maturing loans and set its 1-year medium-term lending facility (MLF) rate. Next Monday the bank will set its 1-year and 5-year loan prime rates. No changes in rates are foreseen by the consensus, but a minority of economists expect the PBOC to make small downward adjustments (5-10 bp).

While China still has room to ease policy, and may do so later this year, we think there’s little benefit in cutting rates further at this stage, particularly considering there has been limited economic data to base decisions upon. The statistical office will release key economic numbers for the first two months of the year only in mid-March, as the January release is bundled together with the February data due to Lunar holiday distortions.

Economic Calendar (14/02/2022 - 18/02/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports