Sterling extends gains after above target inflation data

- Go back to blog home

- Latest

The Pound soared by almost one percent against the US Dollar to its highest level in three weeks on Tuesday on growing expectations that the Bank of England could hike interest rates in the UK before the end of the year.

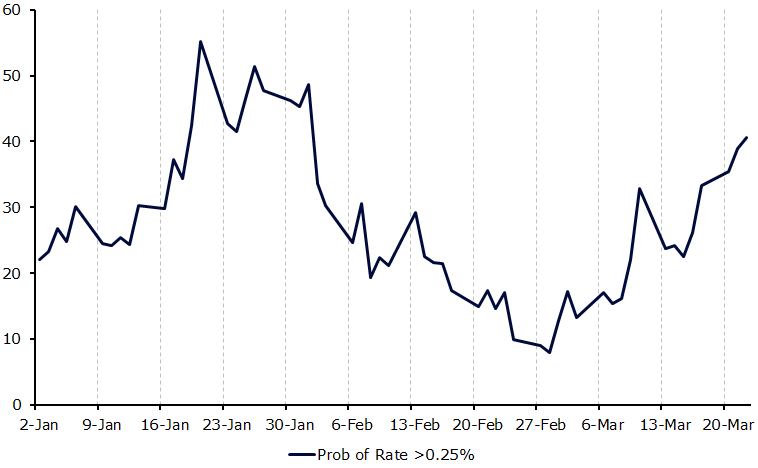

Expectations that the BoE would raise interest rates this year have grown steadily in the past few weeks. While Governor Mark Carney and other members of the MPC have claimed they would overlook a Sterling-induced increase in prices, we think it will become increasingly hard to ignore should inflationary pressures continue to mount in the coming months. Market pricing for a 2017 hike has risen to 40% from below 20% before last week’s MPC meeting (Figure 1), where Kristin Forbes unexpectedly voted for an immediate rate increase.

Figure 1: Implied Probability of BoE Interest Rate Hike in 2017 (Jan ‘ 17 – Mar ‘17)

Meanwhile, the Euro surged back above 1.08 to the Dollar to its highest level since the beginning of February. The single currency was well supported following Monday night’s French Presidential Election debate, with Emmanuel Macron emerging from the debate with the highest approval ratings. While the dimming possibility of a victory for anti-EU Marine Le Pen has supported the Euro, market remains wary of the opinion polls, which could cap gains for the common currency in the lead up to the election.

The economic calendar today is fairly barren. The Reserve Bank of New Zealand will be announcing its interest rate tonight, although is almost certain to keep its policy unchanged.

Major currencies in detail

GBP

Sterling rose 0.9% against the US Dollar on Tuesday off the back the impressive inflation data for February.

Bank of England Governor Mark Carney spoke yesterday morning following the release of February’s inflation figures. Carney warned not to overreact to a single data point, reinforcing our view that the central bank is unlikely to alter its monetary policy until it sees a sustained increase in consumer prices, possibly before year end.

Retail prices also exceeded expectations yesterday, increasing to 3.2% from 2.6%. The BoE’s new measure of inflation which includes housing costs and council tax, known as CPIH, came in in line with the headline number at 2.3%.

With no economic data releases in the UK today, Sterling will largely be driven by events elsewhere. Attention among traders will turn to Thursday’s retail sales data for an indication of how consumer spending is holding up amid the uncertainty of the impending Brexit negotiations.

EUR

Dampening expectations for a Marine Le Pen election victory helped sent the Euro 0.5% higher against the US Dollar on Tuesday.

Economic news was essentially non-existent in the Eurozone on Tuesday, with attention firmly on political developments. Following the TV debate, odds of a Marine Le Pen victory dipped back below 30% according to online prediction website PredictIt.

Current account data in the Eurozone this morning is unlikely to rock the boat. Friday’s PMI’s will be the next main economic data release on the horizon.

USD

The US Dollar index fell to its lowest level in six weeks yesterday, extending its losses following last week’s less hawkish than expected Federal Reserve communications.

Federal Reserve member William Dudley disappointed investors by failing to comment on monetary policy during his appearance yesterday. Chicago Fed President Charles Evans was fairly hawkish on Monday evening, claiming that there was “some chance” of four interest rate hikes in the US this year, although only if the economy was “a lot stronger”.

Existing home sales this afternoon will be the only major economic data release in an otherwise quiet day in the US today.