Euro breaks to new highs against dollar on EU recovery optimism

( 3 min )

- Go back to blog home

- Latest

The main theme in currency markets continues to be general US dollar weakness.

We maintain the view that concerns over governance and state capacity in the US, highlighted by the poor response to the COVID pandemic, are at least partly to blame. Either way, the euro rose to its highest levels vs. the dollar since September 2018. As this is written, it is rallying sharply again during early morning Asian trading.

This week is packed with news on both the economic and policy front. The Federal Reserve meeting on Wednesday and the rhetoric emanating therefrom will be key for the US dollar. Friday will be a packed data day from the Eurozone, as second quarter GDP data and flash July inflation are released simultaneously. The former, in particular, will provide the first comprehensive gauge of the damage wrought by the pandemic on the economy of the Eurozone.

GBP

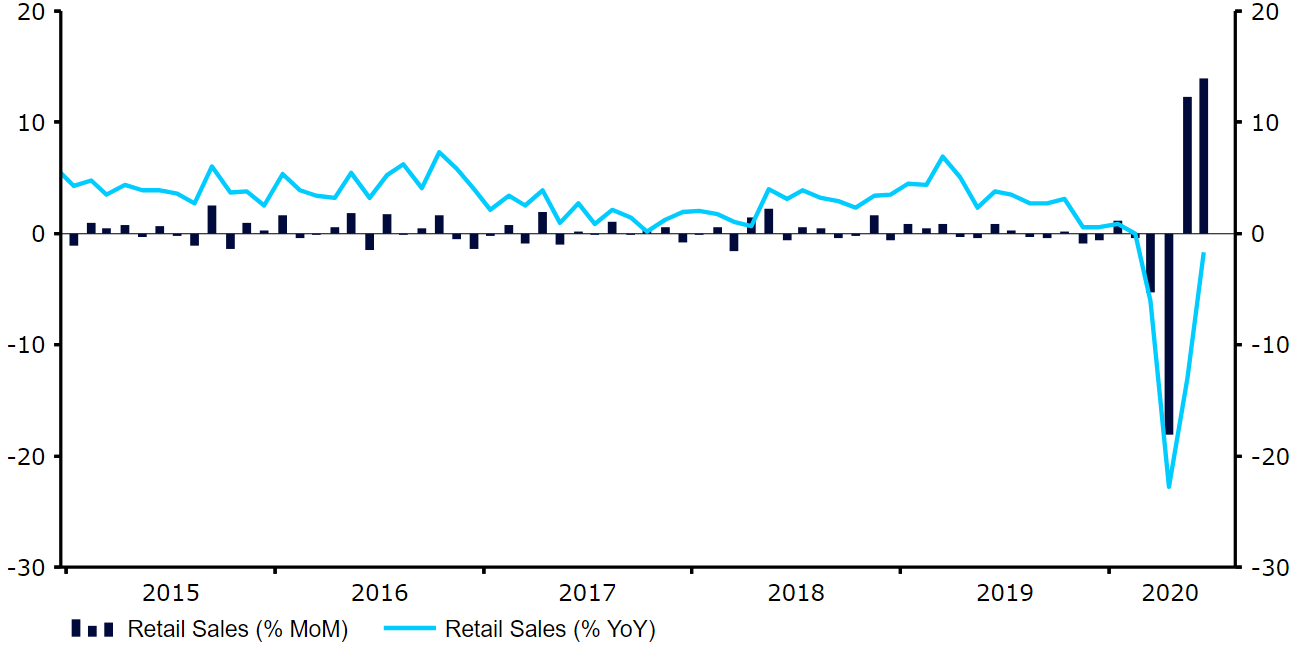

Macroeconomic news that we had out of the UK last week was broadly encouraging. Most notable was Friday’s retail sales figures, which posted a significantly sharper-than-expected rebound in June (Figure 1), lifting sales back up to where they were prior to the lockdown. In spite of good economic news, the absence of signs of progress in the Brexit negotiations with the EU prevented the pound from keeping up with the euro’s rally, though it did manage to post significant gains against the US dollar.

Figure 1: UK Retail Sales (2015 – 2020)

Source: Refinitiv Datastream Date: 27/07/2020

This week, the UK calendar for macroeconomic data looks pretty thin, in contrast with those across the Channel or the Atlantic. Therefore, we expect sterling to largely track the euro’s move against the US dollar.

EUR

As in the UK, the PMIs of business activity blew away expectations, led by a much stronger-than-expected rebound in services. The resulting optimism only added to the euphoria over the approval of the EU economic recovery package, which marks a fundamental shift on the EU approach to this crisis as compared to the previous one. Markets thoroughly approved of both developments, sending the euro higher against all non-European major currencies worldwide.

This week’s second quarter GDP numbers are expected to show a brutal double-digit contraction from the previous quarter. Given the furious pace of the recent euro rally and the increasingly stretched long positioning of speculative investors on the common currency, these numbers may provide an excuse for profit taking and a pause in the euro’s climb.

USD

As US COVID numbers continue to diverge sharply from those in Europe, the US dollar is suffering. The short term issue is the likelihood that the Eurozone economy will rebound faster. Here, consumers and business’ perception that the pandemic is under control is key, and the Eurozone seems to have the advantage so far.

Longer-term, changing perceptions on US institutional quality and state capacity may dent the dollar’s role as a reserve currency. 62% of world reserves are held in dollars, while only 20% are in euros. Any convergence in the numbers would provide a steady headwind against the greenback. In the short-term, the dollar has fallen very fast and speculators are now significantly short the currency. We would not be surprised to see a short-term bounce back.

🔊 Get updated in 20 min on the latest financial market news with our podcast FX Talk