Euro suffers worst month against the Pound in 7 years

- Go back to blog home

- Latest

The Euro sank back below the 1.06 level against the US Dollar on Wednesday, while suffering from its worst monthly performance against Sterling since the financial crisis in 2009.

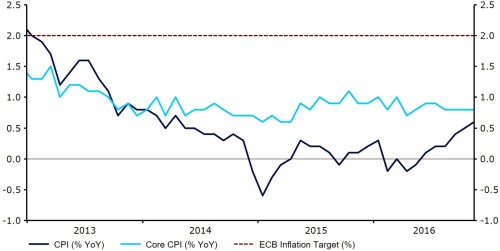

The single currency received little help from yesterday’s Eurozone inflation numbers, which came in right in line with expectations. Consumer prices grew to a 31 month high of 0.6% in the year to November, albeit remaining well below the European Central Bank’s 2% inflation target (Figure 1).

Figure 1: Eurozone Inflation Rate (2013 – 2016)

Sterling stuttered on Wednesday morning, suffering from a sharp decline against both the US Dollar and Euro during morning trading. Yesterday’s sharp sell-off was attributed to month-end rebalancing by large pension and investment funds, with the Bank of England’s Financial Stability report providing little market moving news.

The US Dollar went from strength to strength yesterday, hovering around a 14 year high against its trade-weighted basket of currencies and clocking its best month against the Japanese Yen in seven years. Private sector employment figures released yesterday boded well for tomorrow’s nonfarm payrolls report, while Federal Reserve member Robert Kaplan added to the growing list of policymakers in the US to throw their support behind an interest rate hike in the US next month.

Meanwhile, oil prices surged by around 7% for the day after yesterday’s OPEC meeting yielded an agreement on some details of a production cut. A decision to cut production has been severely hampered by a rivalry between Saudi Arabia and Iran, two of the world’s largest oil producers.

The monthly manufacturing PMIs in the Eurozone, US and UK are all set for release today. Markets will have one eye on Friday’s labour report in the US.

Major currencies in detail

GBP

Sterling had a very mixed session yesterday. The Pound slumped early in the session on apparent month end rebalancing, although recovered strongly as the day progressed to end London trading 0.3% higher against the US Dollar.

Investors digested the results of the Bank of England’s semi-annual bank stress test yesterday, which showed that some of the major commercial banks in the UK, most notably RBS, remained nowhere near capable of fending off another financial crisis.

The BoE warned financial stability in the UK faced a “challenging” outlook following Britain’s vote to leave the European Union. The Bank also cited other potential threats, including rapid credit growth in China and the health of the Eurozone’s banking system.

The UK’s manufacturing PMI is forecast to tick upwards slightly to 54.5 from 54.3 when released this morning.

EUR

Another underwhelming performance for the Euro saw the single currency fall 0.4% against the US Dollar as political uncertainty in Europe kept it under pressure.

German unemployment and retail sales yesterday were mostly overlooked by the market. Retail sales in Europe’s largest economy increased by 2.4% on a month previous in October, while unemployment remain unchanged at 6% following a 5,000 decline in absolute terms.

The manufacturing PMI and unemployment rate this morning will be worth looking out for. However, focus in the Eurozone remains firmly on political risks, namely the Italian referendum on Sunday.

USD

The US Dollar index climbed 0.5%, rallying against most major currencies, particularly the Yen.

Fed member Kaplan maintained the hawkish stance the market has become accustomed to in the past few months. Kaplan claimed he supported the removal of the country’s accommodative monetary policy stance and advocated further interest rate hikes in 2017.

Economic news was also impressive with the ADP employment change coming in above expectations at 216,000 compared to the 165,000 estimate. This solid number bodes well for tomorrow’s much more important nonfarm payrolls number, which is expected to come in around the 175K level. Personal spending also rose in October by an above forecast 0.6%.

The ISM’s manufacturing PMI will be the main economic release today as investors await tomorrow’s all-important nonfarm payrolls report.

Receive these market updates via email