Federal Reserve optimism and German election results cap Euro gains

- Go back to blog home

- Latest

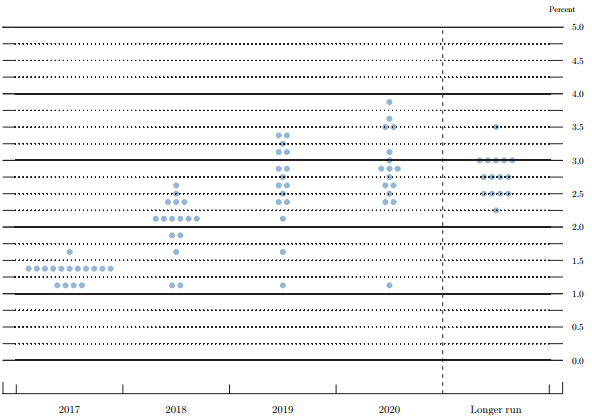

The Federal Reserve gave the market it’s clearer indication yet on Wednesday evening that it intends to hike interest rates again at its December meeting.

Figure 1: FOMC September ‘Dot Plot’

This week should be a relatively quiet one until Friday. We then get the advance inflation report for the Eurozone for the month of September. The core number, excluding volatile food and energy components, needs to start heading higher soon or the ECB forecasts will be increasingly unlikely to be met.

Major currencies in detail

GBP

With no major economic or policy releases scheduled, attention in Sterling trading should shift back to the pace and tone of Brexit negotiations. Clarity on this front will not come for many weeks. There was very little in the way of meaningful takeaways from Prime Minister Theresa May’s heavily anticipated Brexit speech on Friday afternoon.

After its scorching recent rally, we think it’s likely that the Pound will take a breather against the Dollar, and wait for the next round of business activity and inflation data from the UK before making further gains against the Euro.

EUR

The strength of the PMI business activity indicators for September confirms the positive cyclical outlook for the Eurozone economy and explains the quick recovery of the common currency from its post-FOMC meeting losses.

However, the news from the German election on Sunday night was on balance negative for the Euro. While Chancellor Merkel looks set to maintain power, the rise of the extreme right and the decision of the social-democrats to move to the opposition will force her to rely on a complicated coalition with Greens and Liberals. The resulting uncertainty is not a positive for European integration and the Euro gave up some ground on Sunday night during Asian hours trading as a result.

USD

The Federal Reserve meeting last Wednesday fully validated our view that there is a dramatic disconnection between market expectations for rates and those of the Fed itself. The hawkish tone in the FOMC communications nudged markets to revise upward these expectations, but the gap remains very large.

This week’s most important release will be the August PCE inflation indicator on Friday afternoon. The noise from the impact of the recent hurricanes could make for some volatile trading late on Friday.