Euro rallies as October PMIs avoid complete collapse

( 3 min )

- Go back to blog home

- Latest

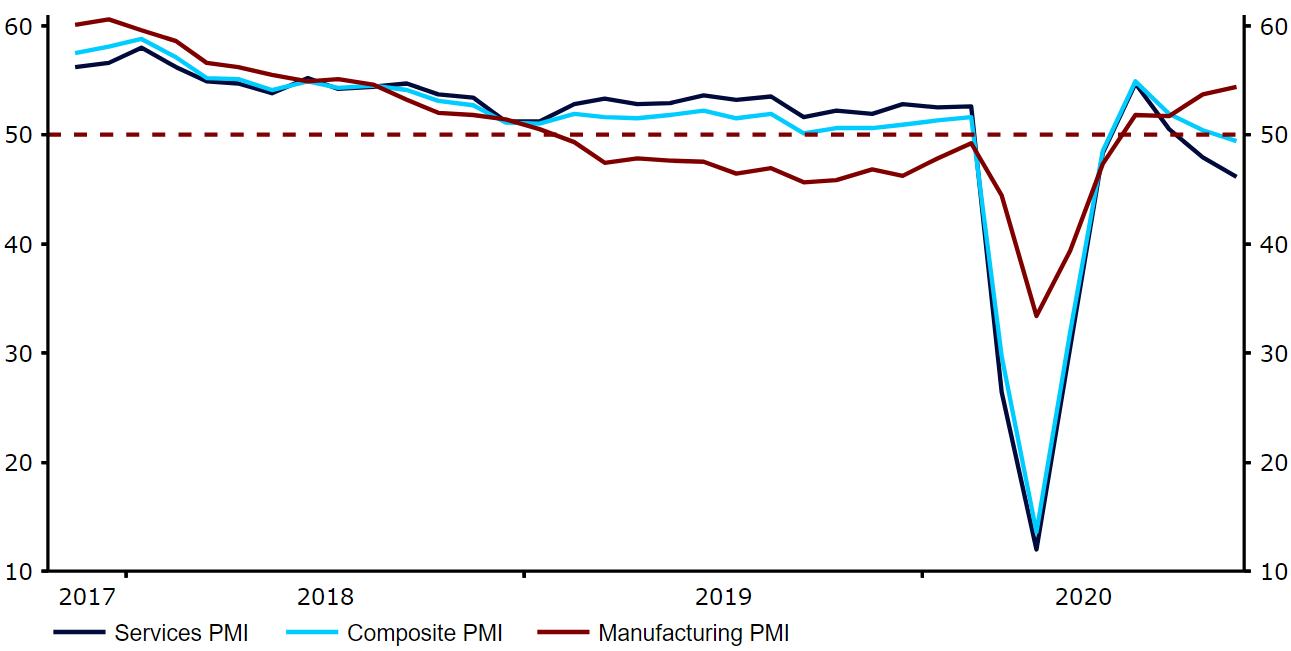

The euro jumped back above the 1.18 level versus the US dollar this morning, helped by a slightly better-than-expected composite PMI for October.

So far, investors have been largely unphased by the violent increase in virus cases in Europe. This data beat may well calm nerves further and perhaps dampen expectations for an imminent increase in stimulus from the European Central Bank, which is undoubtedly a euro positive.

Figure 1: Euro Area PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 23/10/2020

Biden and Trump clash in final TV election debate

Last night’s final TV debate between Biden and Trump was a much more civilised affair than the first one, in no small part due to the host’s ability to mute microphones. The two candidates clashed over COVID, immigration and the recent story surrounding Joe Biden’s son Hunter and his alleged ownership of a laptop that is being investigated by the FBI for connections to money laundering.

While we have seen a minor narrowing in the polls in the past few days, perhaps connected to the Hunter Biden news, the deficit remains around a commanding 8 points or so. We’ve certainly not seen a dramatic collapse in the lead such as that witnessed in the days leading up to the 2016 election following the Clinton email scandal.

Pound set for weekly gains as Brexit talks resume

Sterling edged lower versus the dollar on Thursday, although still remains up for the week amid optimism surrounding Brexit. Talks between the UK and EU have restarted, a week after Boris Johnson warned over a ‘no deal’ and stated that talks would not resume unless the EU changed its stance. The current resilience shown in the pound indicates to us that the market is fairly confident that a deal will be done before mid-November, thus avoiding a messy ‘no deal’ scenario.

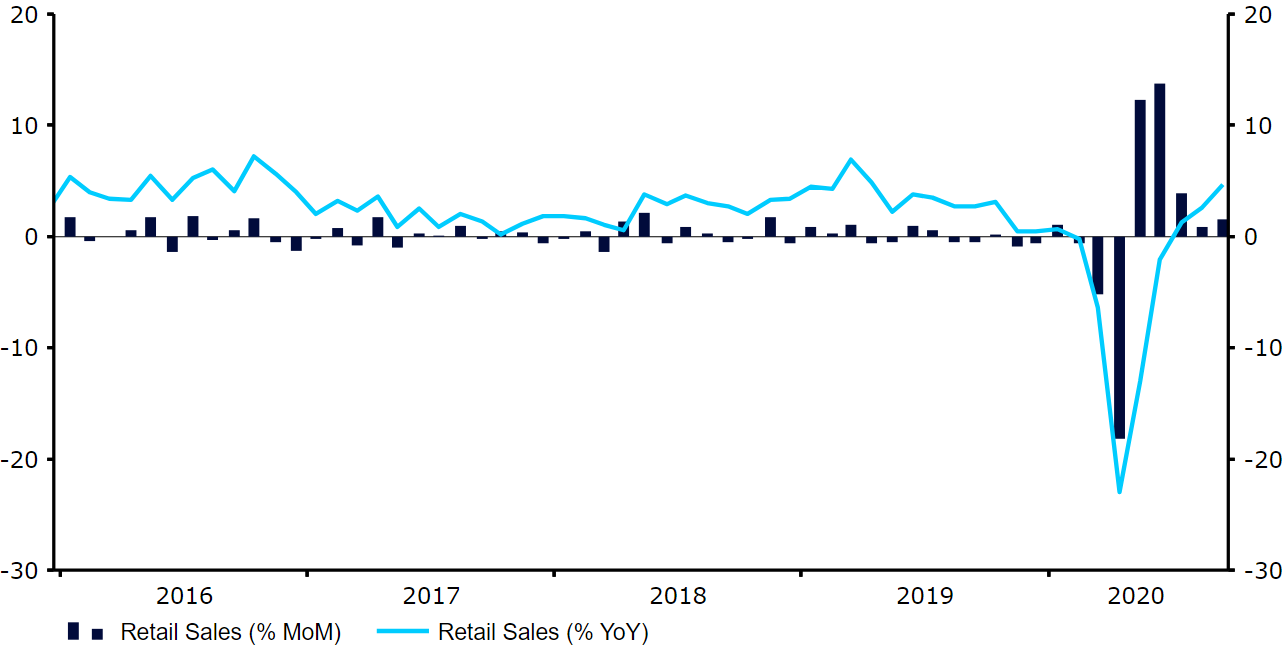

Meanwhile, this morning’s UK retail sales provided sterling with a bit of a boost. Sales remained robust in September, jumping by 1.5% month-on-month and 4.7% year-on-year, both better than forecast. The real test will probably come in the October data, which will cover the period of tighter COVID restrictions.

Figure 2: UK Retail Sales (2016 – 2020)

Source: Refinitiv Datastream Date: 23/10/2020