Euro recovers from six week low, UK GDP growth revised upwards

- Go back to blog home

- Latest

The Euro rebounded from its six week low on Wednesday as concerns over political risks in Europe eased somewhat following the announcement that French centrist candidate, Francois Bayrou, would be pulling out of the race to become the country’s next President.

Earlier in the session, the Euro fell to its weakest position against the US Dollar since early January after a string of relatively hawkish rhetoric from a number of senior Federal Reserve policymakers. US ratesetter Patrick Harker suggested that the Central Bank could hike rates again next month, while Fed Governor Jerome Powell became the latest FOMC member to sound an optimistic note, claiming that the three hikes in 2017 remain a possibility.

Last night’s Federal Reserve meeting minutes were also fairly hawkish. While little new information was provided, the minutes were fairly positive on the outlook for the US economy with several Fed officials seeing a high risk of an unemployment overshoot. We think recent commentary from the Fed is broadly in line with our expectations for three interest rate hikes in the US this year, with March now a genuine possibility.

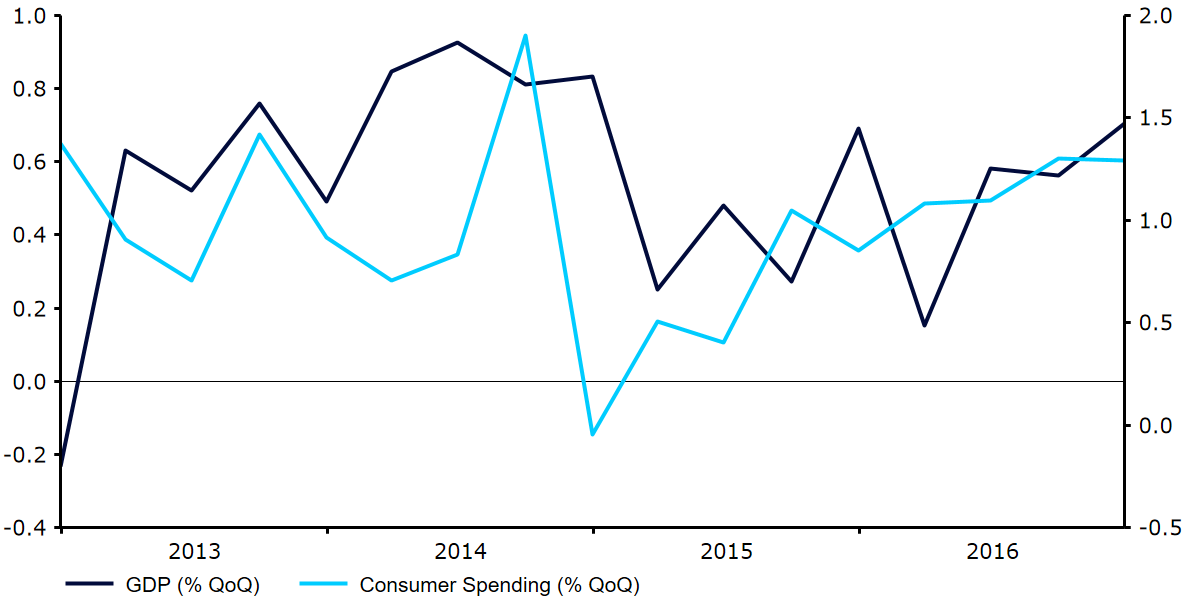

Meanwhile, Sterling ended the session lower against the greenback, largely off the back of growing Fed rate hike expectations. The Pound was little moved following the release of an updated set of GDP data for the fourth quarter which showed that the UK economy grew at its fastest pace since the final quarter of 2014 (Figure 1).

Figure 1: UK Annual GDP Growth Rate (2013 – 2016)

Major currencies in detail

GBP

Sterling declined 0.3% against the US Dollar, despite the release of yesterday’s impressive set of GDP figures.

Economic growth for the fourth quarter was unexpectedly revised upwards in the UK on Wednesday. The Economy expanded 0.7% in the final three months of 2016 compared to the original 0.6% estimate, primarily due to a larger than expected contribution from Britain’s manufacturing sector. This rebound in activity continues to show that the UK economy has, so far, weathered the uncertainty created following the Brexit vote remarkably well.

The CBI’s Distributive Trades survey is unlikely to shift the Pound today. Sterling remains fairly range bound as traders await fresh news on the Brexit front.

EUR

The Euro rose 0.4% during London trading on Wednesday following developments over in France.

Inflation in the Eurozone remained unrevised yesterday. Consumer prices in the Euro-area rose 1.8% in the year to January, its largest yearly increase in four years. Business confidence in Germany also grew in February, signalling a general improvement in economic conditions in Europe’s largest economy. The monthly business climate index rose to 111 from 109.8, while the current assessment index jumped to 118.4 from 116.9.

Growth figures for Germany released this morning also remained unrevised at 0.4% QoQ.

USD

A strong performance from the Euro helped send the US Dollar index 0.3% lower on Wednesday, despite last night’s relatively hawkish set of meeting minutes.

Housing data out of the US was broadly positive yesterday, continuing to point to growing confidence and improving economic conditions in the country’s economy. Existing home sales rose to their highest level in a decade in January, jumping 3.3% to a seasonally adjusted 5.69 million units.

Federal Reserve policymaker Dennis Lockhart will be the latest FOMC member to speak this week in Atlanta at 13:35 UK time. Initial jobless claims are also expected to remain around their four decade low.