Euro retraces gains as investors use calm to profit take

( 2 min read )

- Go back to blog home

- Latest

The typically quiet August trading was in full swing in the FX markets on Monday, with most major currency pairs stuck within a relatively narrow range, particularly by recent standards.

It is also worth noting that we have begun to see a mild improvement in the latest US virus numbers, which may be behind at least some of the currency’s recovery. New daily cases have dropped back below the 50k level from almost 80k at one stage. Ongoing uncertainty surrounding US-China trade relations has also acted in the dollar’s favour in the past few trading sessions, given that this tends to fuel safe-haven flows into the greenback. Negotiations between the two countries are set to resume later this week, with tensions running high after the tit-for-tat imposition of sanctions on senior officials from both countries.

UK unemployment benefit claims creep up in July

Sterling has edged higher so far this week, although has also been relatively range bound, trading just below the 1.31 mark versus the US dollar.

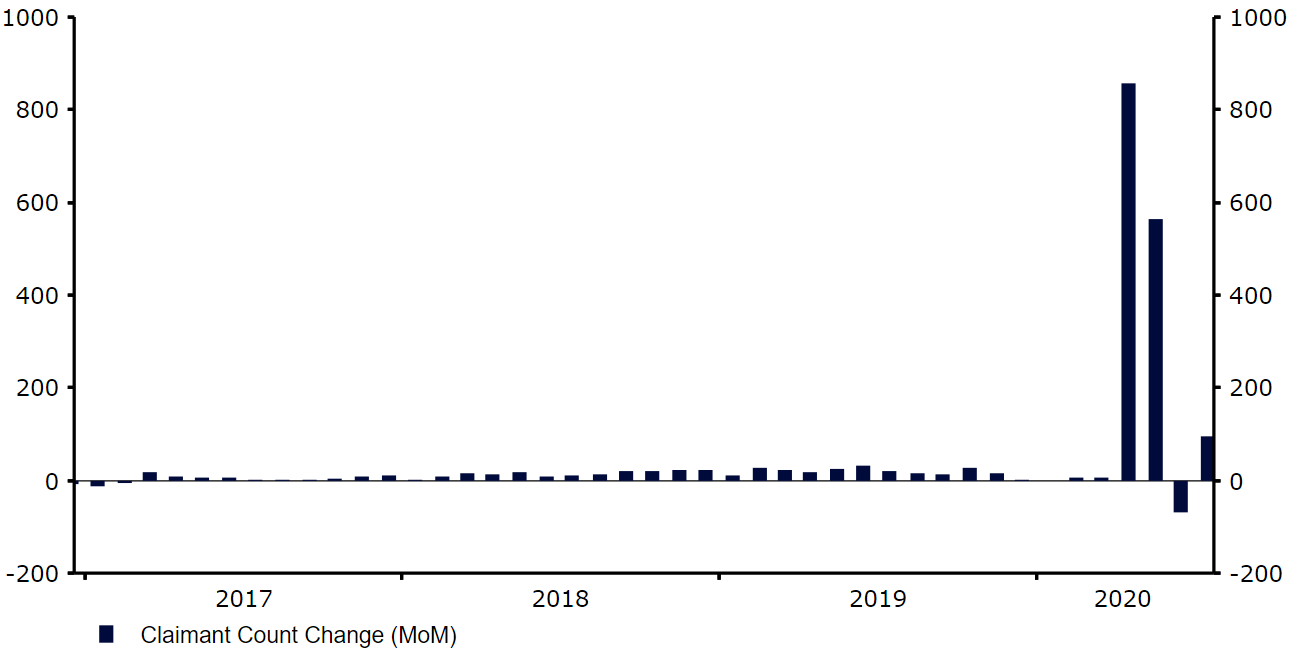

This morning’s UK labour report came in worse-than-expected, although the reaction in the currency markets was almost non-existent. The rate of unemployment unexpectedly remained unchanged at 3.9% in the three months to June after economists had eyed a 0.3 p.p increase. July’s claimant count number, which provides a more timely measure of labour market performance, did, however, come in higher than predicted. The number of those claiming unemployment benefits rose by 94.4k last month, an increase of 3.6%, (+10k expected). The lack of a more meaningful move in sterling to the news may perhaps be due to the slight irrelevance investors are placing on the data due to the government’s furlough scheme, which is acting to artificially deflate these unemployment numbers.

Figure 1: UK Claimant Count Change (2017 – 2020)

Source: Refinitiv Datastream Date: 11/08/2020

The next main focal point for investors will be tomorrow morning’s UK second quarter GDP data, which is almost certain to show the largest contraction on record.