Euro slides by one percent after dovish ECB surprise

- Go back to blog home

- Latest

The Euro sank by around one percent against the US Dollar on Thursday, putting it on course for its worst weekly performance in a year, after the ECB delivered a very dovish surprise following its latest monetary policy meeting.

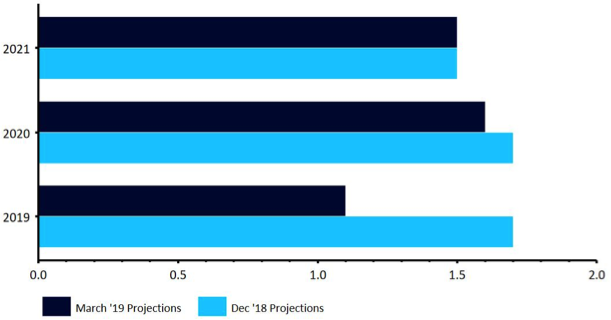

Figure 1: ECB Growth Projections [March 2019]

Draghi also struck a dovish tone with regards to the possibility of Euro-area inflation returning back to the bank’s target any time soon. Policymakers now think that inflation will take longer to converge to target than previously anticipated, reivising lower their price growth forecasts to just 1.2% for 2019 from December’s 1.6% projection. Policymakers intimated that interest rates would stay lower for longer, stating that rates would remain at current level ‘at least through the end of 2019’, compared to ‘through the summer of 2019’ from the previous statement.

Moreover, the ECB also surprised markets by announcing that it intends to launch a new round of TLTRO (Targeted Long Term Refinancing Operations), intended to lift activity and boost confidence in the bloc’s economy. While precise details of the programme, which involves the ECB issuing long-term loans to European banks, were not not announced during the press conference, the measures will begin in September 2019 and run until March 2021, each with maturity of two years.

We are now more confident than ever that the ECB will hold its policy steady throughout 2019 and now quite possibly deep into 2020. The key to ECB policy remains the level of core inflation and, until we see meaningful signs of an uptrend in this measure, we think that tighter policy from the European Central Bank remains a long way off.

Sterling falls on Brexit nerves, US payrolls report eyed

Elsewhere in the FX market, a sharp decline in Chinese equity markets caused investors to flock to the safe-haven Japanese Yen, which strengthened by around half a percent during Asian trading. Sterling also fell back below the 1.31 mark for the first time in two weeks as investors ramped up bets that Theresa May’s withdrawal bill would be shot down in next week’s parliament vote.

The general consensus is for May’s vote to be rejected when held on Tuesday, albeit not quite as heavily than in January – an approximate 100 vote margin of defeat has been mooted. Should this be the case, MPs will now vote on whether to leave without a deal in place on Wednesday, and whether to extend Article 50 on Thursday.

With this week’s ECB meeting now out of the way, markets turn their attention firmly to this afternoon’s nonfarm payrolls report. Another solid month of job creation around the 180k level is expected. As always, we look for signs that multi-decade low unemployment is feeding its way through to higher wages.