Euro slumps to 19 month low after bumper US durable goods orders

- Go back to blog home

- Latest

The Euro and Japanese Yen fell sharply on Wednesday, with almost every other currency in the world losing ground against the US Dollar. Investors continued to pile into the currency on growing expectations for an interest rate hike by the Federal Reserve next month.

Chances of a second interest rate hike by the Fed since the financial crisis now looks like a nailed on certainty. The minutes from the Fed’s November meeting released last night did little to change our view that a December hike is highly likely. Policymakers in the US concluded that the labour market was improving, while growth had picked up from its modest pace in the first half of the year. “Almost all” of the FOMC members continued to think that risks to the outlook were roughly balanced.

The US Dollar was little changed after the release of the minutes, with the Dollar index subsequently trading around its strongest position in more than 13 years. The Euro depreciated by nearly one percent at one stage to its lowest level since April 2015.

Earlier in the day, Chancellor Philip Hammond released his first Autumn Budget statement and the first since the Brexit vote. Hammond announced only relatively modest cuts to growth forecasts, while delivering a fairly upbeat assessment of the UK economy. Investors took heart from the announcement with the Pound just about the only currency in the world to end the London session higher against the Dollar.

Major currencies in detail

GBP

Sterling rose 0.3% against the US Dollar yesterday, while soaring to its strongest position against the Euro since early September.

Notable highlights from Hammond’s speech included a £3.7 billion increase in new spending on housing projects, an increase in the National Living Wage and a minor reduction in benefits for new workers.

Hammond also released the latest growth forecasts from OBR, which showed only a minor downgrade following Britain’s vote to leave the EU. Growth is now expected to slow to 1.4% in 2017, down from an earlier estimate of 2.2%, and 1.7% in 2018 compared to March’s 2.1% forecast.

With no economic data releases in the UK today, investors will now have one eye on Friday’s GDP numbers.

EUR

The relentless sell-off in the single currency continued yesterday, with the Euro falling sharply by 0.7% to its weakest position in 19 months against the Dollar.

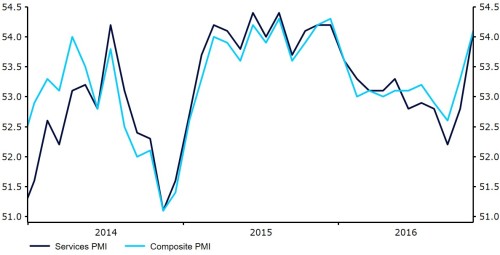

With an uncertain political backdrop dominating trading in Europe at present, investors completed overlooked yesterday morning’s impressive manufacturing and services PMIs from Markit. The manufacturing PMI jumped to 54.1 from 53.5, while the services index also increased sharply to 54.1 from 52.8 (Figure 1), its highest level of positive growth since December last year.

Figure 1: Eurozone Purchasing Managers’ Indexes [PMIs] (2014 – 2016)

The inability of the Euro to eke out any sort of gains whatsoever from these very encouraging numbers pays testament to overall bearish outlook for the currency following the US election.

German GDP and business confidence data this morning will be the main economic releases in the Eurozone today.

USD

The US Dollar index increased 0.6% to its strongest position in almost 14 years on Wednesday, buoyed by the impressive set of durable goods data.

The sharp jump in orders last month was driven by a near doubling in orders for aircrafts, although most other categories received an increase in demand. Including transportation, orders increased 1%, its largest rise in three months.

Meanwhile the latest manufacturing data also surprised to the upside. The PMI from Markit rose to 53.9 from 53.4. Housing sales jumped 0.6%, while initial jobless claims remained at a very healthy 251,000 last week in an overall very bullish day of economic data in the US.

With the US off for the Thanksgiving holiday today, there will be no economic releases across the pond.

Receive these market updates via email