Euro soars to fresh highs as Trump concerns weigh on Dollar

- Go back to blog home

- Latest

The Euro touched a fresh six month high against the US Dollar on Tuesday with the single currency soaring above the 1.11 level for the first time since the US Presidential Election in November last year.

Sterling’s post-inflation bounce proved short lived yesterday morning, with the currency slumping to a five week low against the Euro. With the Bank of England appearing in no rush to hike interest rates following its monetary policy meeting last week, investors viewed the spike in inflation as negative for the currency, given its potential adverse impact on UK consumer spending.

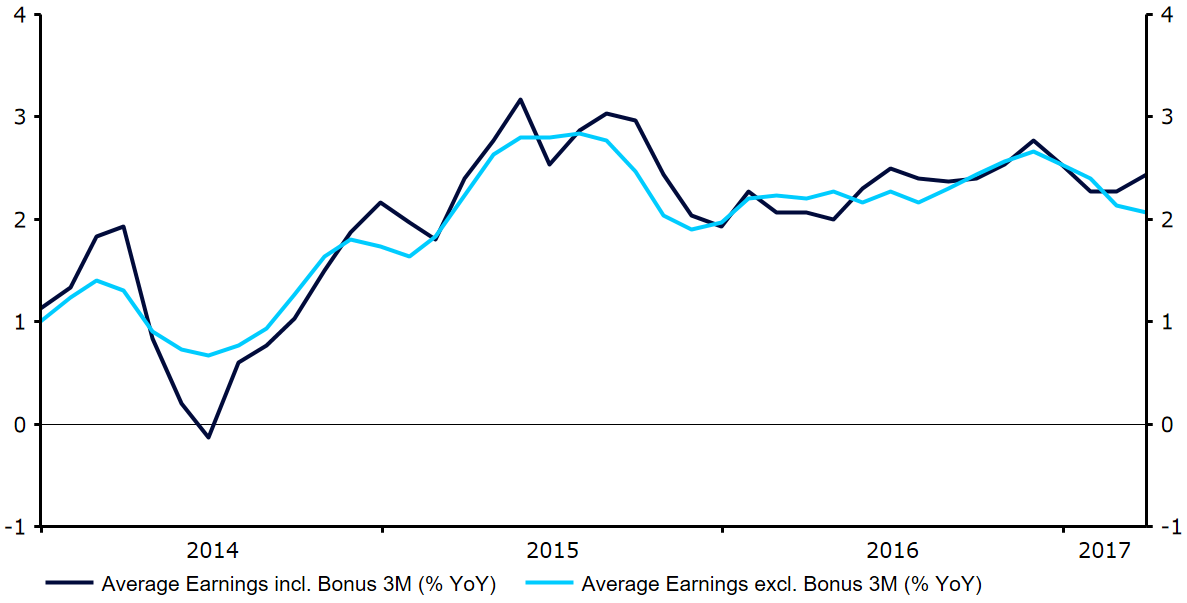

This morning’s labour data was mixed. Earnings growth excluding bonus slipped to 2.1% in the three months to March from 2.2% (Figure 1), meaning real wages has now fallen even further in negative territory. However, unemployment was very encouraging, declining to its lowest level since 1975 at 4.6%. Revised Eurozone inflation numbers could also receive some attention at 10:00 UK time.

Figure 1: UK Average Earnings Growth (2014 – 2017)

Major currencies in detail

GBP

Sterling continues to stall just shy of the 1.30 level against the US Dollar, with investors concerned regarding the impact of rising inflation on central bank policy. Following the recent Sterling-induced bounce in inflation, real earnings growth is now negative at -0.5%, which is likely to put a fairly sizable squeeze on UK households in the coming months.

This morning’s labour report was the main announcement in the UK today. Sterling was little moved following the announcement with a decline in earnings growth offset by the better-than-expected unemployment number.

EUR

Euro-area GDP data yesterday morning remained unrevised for the first quarter. The Eurozone economy grew by 0.5% in the quarter, comfortably outpacing that of the US. Yesterday’s ZEW economic sentiment survey was also fairly encouraging, providing further signs that the Euro-area economy is currently in very good shape. The monthly confidence index rose to a near two year high 35.1 this month from 26.3 recorded in April.

Today’s CPI data will be the main economic data release in the Eurozone today. The ECB’s non-monetary policy meeting is generally not a market mover.

USD

The US Dollar index slumped by over half a percent to its lowest level since November on Tuesday. A slew of disappointing economic news and political turmoil out of Washington continued to dampen sentiment towards the Dollar yesterday.

Housing starts slowed in April, falling to just 1.172 million units from north of 1.2 million. However, the highly volatile measure of industrial production provided a welcome positive surprise. Industrial output increased by 1% in the month to April, its largest monthly bounce since the beginning of 2014.

With no economic data releases whatsoever in the US today, the Dollar could spend much of today range bound. Speeches from FOMC members Mester and Bullard could shift the Dollar later in the week.