Soft inflation data sinks Euro against US Dollar, Pound

- Go back to blog home

- Latest

Our view that market expectations for ECB interest rate hikes were unjustified received some validation last Friday.

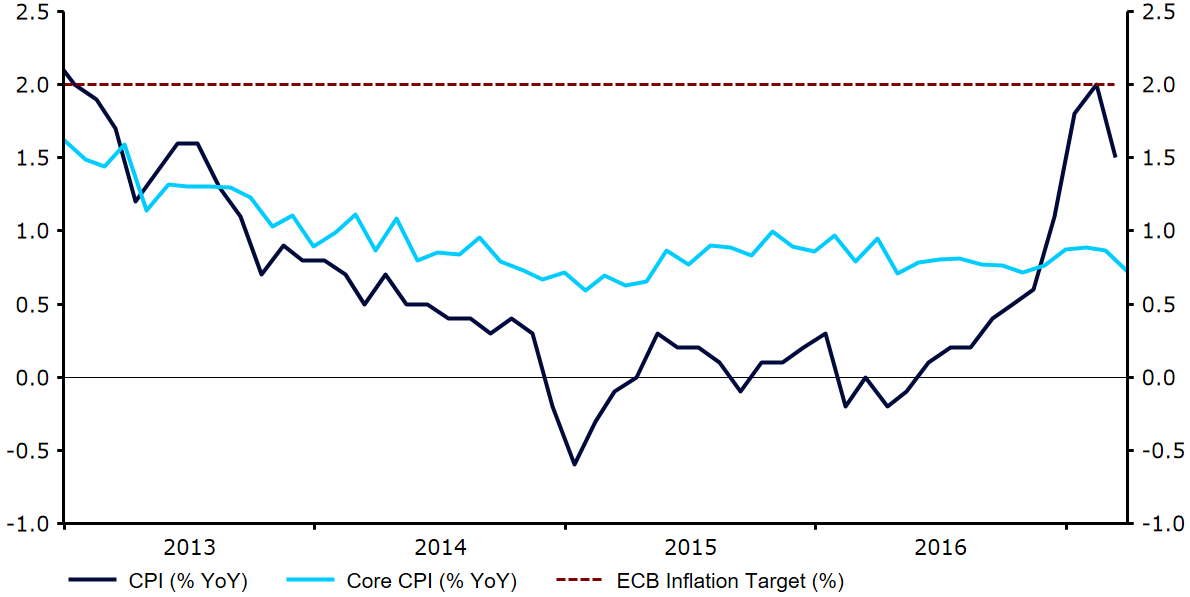

Figure 1: Eurozone Inflation Rate (2013 – 2017)

The big mover last week was the South African Rand, which collapsed by about 6% on the news that President Zuma had fired his well-regarded Finance minister Gordhan in a move that may signal loosening of monetary and fiscal policy in South Africa.

After a fairly sparse couple of weeks, key macroeconomic releases should drive markets next week. The Tankan confidence index in Japan, Eurozone retail sales, Chinese PMI, and of course, the all important US payroll report out on Friday. Again, the latter report will be closely scrutinised for any signs that a tightening labour market is finally driving wage increases as the Federal Reserve hopes.

Major currencies in detail

GBP

The formal triggering of Article 50 last week actually resulted in a fairly decent relief rally in Sterling. The bullish mood was helped along by the relatively mollifying tone of the latest communications from Prime Minister May’s Government.

This week we turn our attention to the PMI business sentiment indices for the month of March to get a read of the likely evolution of investment spending in the first stages of the Brexit process.

EUR

Expectations for ECB hikes were pushed considerably into the future after last week. The combination of a discrete ECB effort to dampen these expectations and weak inflation data for March was a clear Euro negative.

Headline inflation dropped from 2% to 1.5%. More importantly, the more stable core indicator pulled back from 0.9% all the way to 0.7%, again calling into question the optimistic expectations of the ECB’s own forecasts. Unless we get an unlikely sharp bounce back in core inflation in the next two months, we are likely to see a downward revision at the June ECB meeting which is sure to keep downward pressure on the Euro throughout 2017.

USD

Early in the week, pessimism over the prospects for further Trump Administration initiatives in fiscal policy after its health care debacle weighed on the Dollar. However, positive economic surprises and a steady drumbeat of hawkish Federal Reserve comments were enough to bring forward rate hike expectations and support the greenback.

The contrast with the dovish anonymous ECB commentary once again highlighted the huge gap in monetary policy across the Atlantic and brought the US Dollar back up towards the middle of its recent range.