Euro tanks to two decade lows as market fears EUR/USD parity

( 3 min )

- Go back to blog home

- Latest

The main news headline in the FX market on Tuesday was undoubtedly the sharp sell-off in risk assets against the safe-haven US dollar, as heightened global recession concerns sparked a fresh flight to safety.

Summary:

- Most risk assets sell-off sharply against the safe-haven USD amid growing recession talk, thin liquidity.

- EUR/USD edges closer to parity, and a fresh two-decade low, as markets react to higher natural gas prices, rising Euro Area recession fears.

- GBP/USD down 1.5% to back below 1.20 level. High-risk majors (AUD, NZD, SEK) down between 1.5-2.0% during London session. NOK trades around 3% lower as Norway energy sector strikes begin.

- Brent crude oil prices collapse by almost 10% to $102 a barrel on growing recession fears.

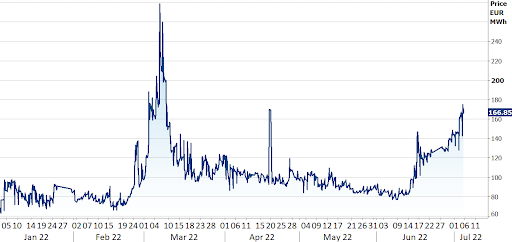

Perhaps the most noteworthy move was that of the euro, which fell to fresh two decade lows below the 1.03 level on the US dollar, sparking fresh calls that parity in the EUR/USD pair could soon be on the way for the first time since 2002. Talk of possible recessions have intensified in the bloc in recent weeks, as economic data begins to shows signs of a slowdown and the ongoing energy crisis in Europe takes a turn for the worse. Uncertainty over future gas supplies from Russia, and the commencement of worker strikes in Norway’s oil and gas sectors, triggered a fresh move higher in European Natural gas futures yesterday. Dutch TTF Gas futures for instance (Figure 1), are now up around 30% on this time last week.

Figure 1: Dutch TTF Natural Gas Futures [1 week] (YTD)

Source: Refinitiv Datastream Date: 05/07/2022

The sharp increase in natural gas prices, which investors believe could weigh heavily on Euro Area economic activity this year, was enough to send the euro crashing through a key support level around the 1.034 mark. This is likely to have exacerbated the extent of the move lower in the common currency, in our view, as have renewed concerns over the ECB’s ability to both simultaneously rein in inflation, and control the widening in European peripheral bond yield spreads. A speech from Bundesbank chief Joachim Nagel on Monday has failed to calm concerns about the latter.

Figure 2: EUR/USD (YTD)

Source: Refinitiv Datastream Date: 05/07/2022

We have been saying for a while that we think recession fears are slightly overdone, but markets are clearly yet to get the memo, and until they come around to this view, which we still contest they eventually will, the safe-haven US dollar is likely to remain well bid. While the euro was among the worst performers yesterday, it was far from an outlier. Among the majors, sterling fell back below the 1.20 level on the greenback, on a day that the Bank of England warned that the outlook for Britain and the world had ‘darkened’. Investors will be keeping close tabs on speeches from a handful of MPC members in the second half of the week for clues as to the magnitude of upcoming rate hikes. Meanwhile, the antipodean currencies (AUD and NZD) also fell sharply, in part due to the collapse in oil prices (down almost 10% for the day), while the Norwegian krone fell nearly 3% as worker strikes in the country’s energy sector begin.

The collapse in oil futures, and general risk-off mode induced by rising global recession concerns, was also bad news for emerging market currencies. European currencies largely underperformed on Tuesday, including the likes of the Polish zloty, Hungarian forint and Czech koruna, which were all down anywhere between around 2-3%. As we mentioned at the beginning of the week, volatility in markets is now being driven chiefly by recession fears, and until these fears begin to abate, higher risk currencies are likely to remain fragile at the expense of the safe-havens, particularly the US dollar.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk