Euro under pressure amid ongoing virus concerns

( 2 min )

- Go back to blog home

- Latest

The euro was back under pressure on Wednesday, spending all of London trading below the 1.18 level versus the US dollar.

President of the European Central Bank Christine Lagarde spoke during an ECB Forum on central banking yesterday, giving another clear hint that policymakers would be increasing stimulus measures in order to protect the Euro Area economy. She noted that ‘while all options are on the table, the PEPP and TLTROs have proven their effectiveness in the current environment and can be dynamically adjusted to react to how the pandemic evolves’. While the euro moved modestly lower following her comments, this merely reinforces what the market is already largely pricing in – a sizable increase in the ECB’s emergency bond buying programme is almost certain to be forthcoming at the bank’s December meeting.

UK economy posts record expansion in third quarter

Sterling faltered following its recent rally yesterday, sliding back below the 1.32 level versus the broadly stronger US dollar.

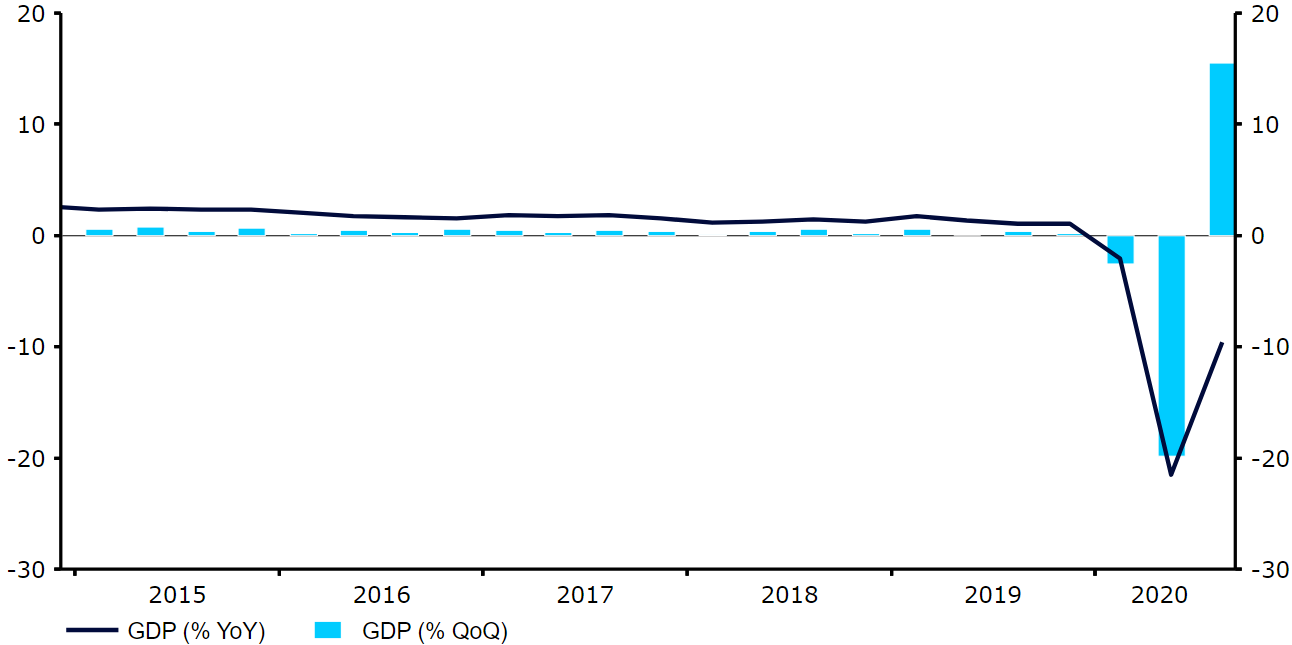

The UK economy bounced back more-or-less in line with expectations in the third quarter of the year according to data from ONS this morning, expanding by a record 15.5% in the three months to September following its record contraction in Q2. The more timely data on industrial and manufacturing production both missed their mark, and we’ve seen a little bit of a move lower in the pound so far today as a result. Sterling was already under pressure yesterday, retreating from its highest level in two months versus the dollar amid ongoing jitters surrounding the Brexit process. According to reports from Reuters, the mid-November deadline for a deal was likely to be missed, with talks to instead continue into next week. While the market appears confident that a deal will be done, the longer the process drags on, the greater the element of doubt.

Figure 1: UK GDP Growth Rate (2015 – 2020)

Source: Refinitiv Datastream Date: 12/11/2020

US dollar rallies against peers as market optimism sours

Meanwhile, the US dollar continues to be driven largely by sentiment towards the pandemic and news of a potential vaccine. With optimism towards the latter waning slightly, we’ve seen a move higher in the greenback versus most of its major peers in the past 24 hours or so.

Investors have been largely unflustered by ongoing political headlines. President-elect Biden has begun making transition plans for the White House, despite Trump’s refusal to accept defeat and his ongoing legal challenge against the result of the election. Trump is targeting the states of Arizona, Georgia, Michigan, Nevada, Pennsylvania and Wisconsin for recounts. There may be some lingering concerns among investors should his legal challenge gain any degree of traction. We do, however, expect this to ultimately fail, with any correction in risk sentiment linked to the election likely to be relatively minor from here.