European business activity picks up as lockdowns eased

( 3 min read )

- Go back to blog home

- Latest

The euro continued to remain well bid against its major peers on Thursday morning amid a solid rebound in European PMI data and a dovish set of FOMC minutes.

“a second wave of the coronavirus outbreak, with another round of strict restrictions on social interactions and business operations, was assumed to begin around year-end, inducing a decrease in real GDP, a jump in the unemployment rate, and renewed downward pressure on inflation next year”.

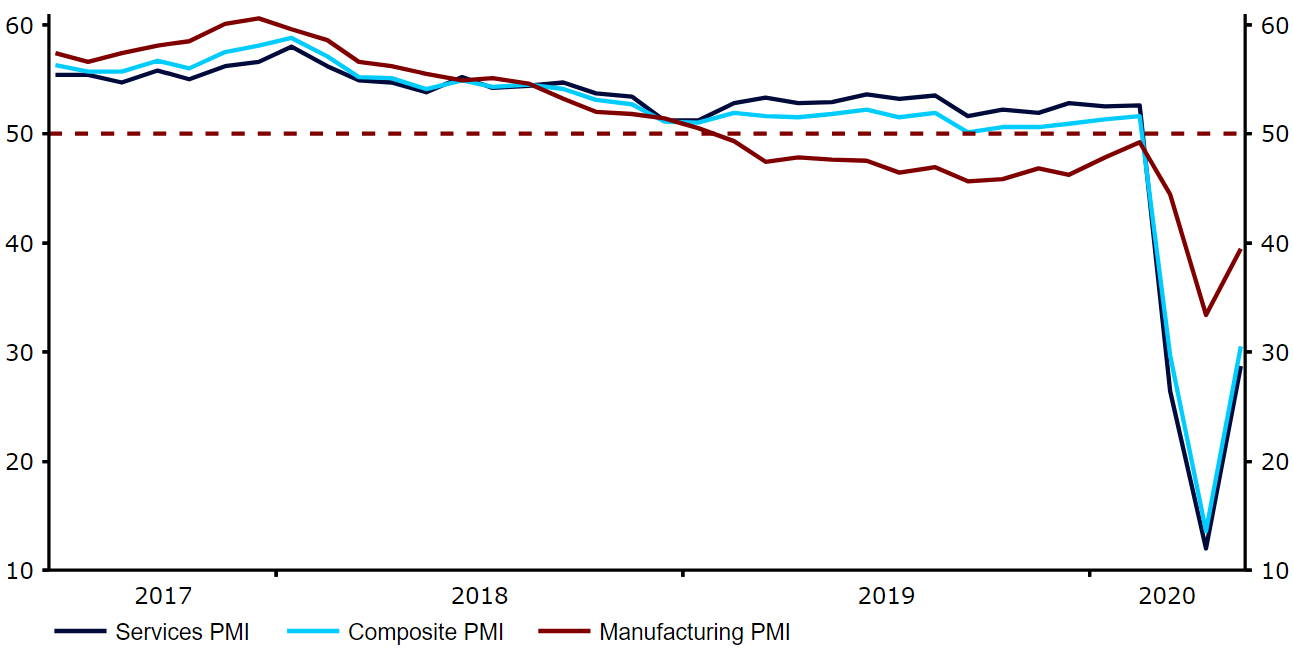

By contrast, this morning’s Euro Area PMI data provided reason to be slightly more optimistic regarding the outlook for Europe. As we thought it might, the data rebounded more-than-expected, particularly the services index, which leapt back up to 28.7 in May from April’s record low 12.0. This helped lift the composite index, a weighted average of both the services and manufacturing sectors, to a more respectable 30.5 from April’s 13.6.

Figure 1: Euro Area PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 21/05/2020

The aforementioned rebound clearly reflects the gradual easing of lockdown measures in Europe, with a range of industries across the continent now beginning to resume at least partial operations. While the move higher in the euro off the back of the data was limited, we believe we are seeing the beginning of a more sustained move higher in the common currency. With new cases and deaths caused by the virus easing at a much slower rate in the US than in Europe, it seems likely that the lifting of lockdown measures and a return to normalcy will occur at a much more gradual pace in the States than in the Euro Area. Should this begin to be reflected in upcoming macroeconomic prints, then the aforementioned more sustained move higher in EUR/USD may start to begin in earnest.

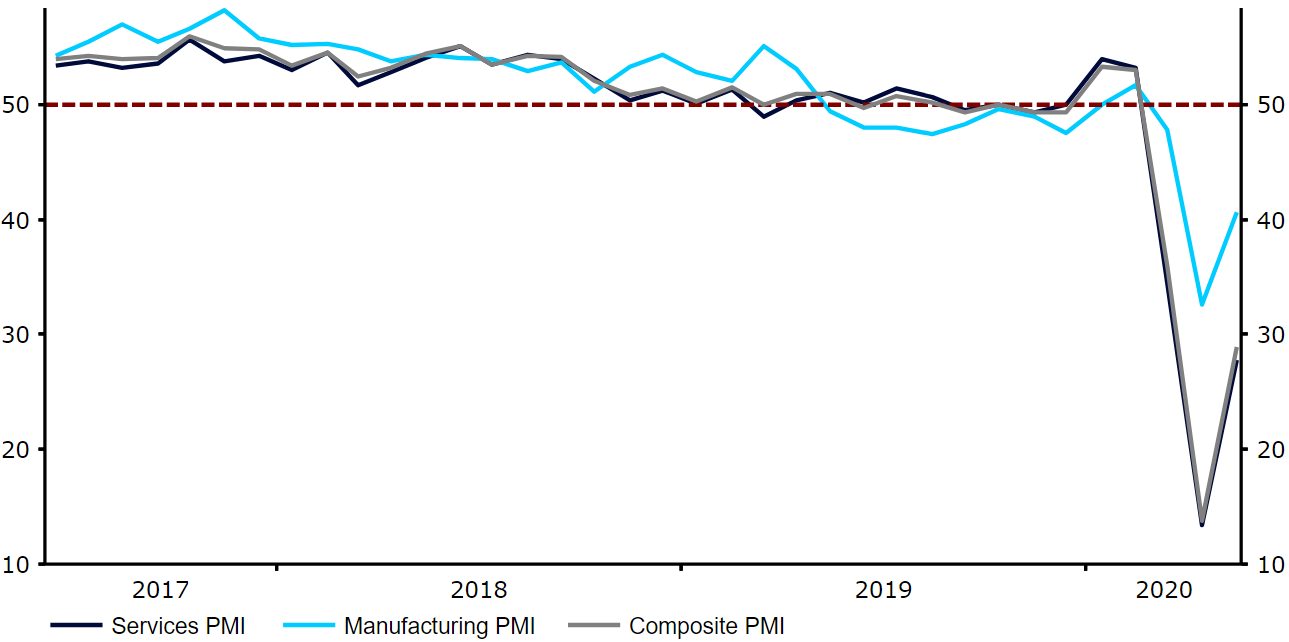

UK PMIs rebound, April retail sales eyed

This morning’s UK PMI data similarly beat expectations. The services index jumped back up to 27.8 in May from April’s record low 13.4, while the manufacturing index also rose to 40.6 versus last month’s 32.6 reading (Figure 2).

Figure 2: UK PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 21/05/2020

The fact that the data came in remarkably similar to that in the Euro Area is an encouraging sign, given that the UK has run on a lag to most of its European counterparts in both imposing and gradually unwinding lockdown measures. Investors will now turn their attention to tomorrow’s retail sales data for April, which is expected to show a record contraction in activity. Sterling has underperformed its peers this month and is in need of a bit of a boost – an upside surprise here could provide just the lift that the currency is looking for.