European currencies plummet on recession fears

( 5 min )

- Go back to blog home

- Latest

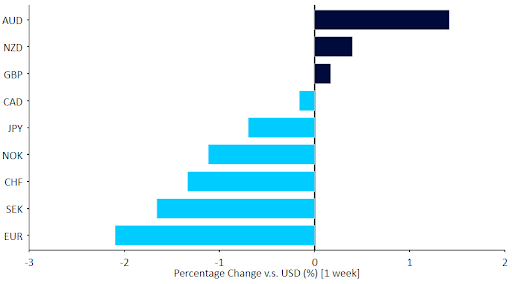

Increasing concerns about the fragility of natural gas supplies to Europe, combined with good economic news from the US labour market, means that recession fears are now more sharply focused in Europe.

We now go into Inflation Week in the US. The CPI report has become the most critical data point worldwide. The headline number out on Wednesday is expected to show yet another multi-decade high, but the core data may pull back somewhat. Aside from that, it will be a news-light week, and the always unpredictable headlines regarding the energy situation in Europe may have an oversized impact on markets.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 11/07/2022

GBP

The resignation of Boris Johnson was the spotlight in an otherwise data-light week, but sterling actually managed to rise on the news against all other European currencies and nearly keep up with the relentless dollar rally in spite of it. The avoidance of an ugly and potentially drawn out removal from office gave the pound a modest leg up, although uncertainty remains over the identity and timing of Johnson’s replacement. Regardless, we expect little to no major changes in policy, so the impact on the pound is likely to be minor.

The June PMIs of business activity were revised higher, which provided a positive backdrop for the pound. Focus will be back on the economy this week, with May data out on construction, industrial production and the trade balance.

EUR

Broad dollar strength and jitters about natural gas supply to Central Europe conspired last week to push the euro to a two-decade low. The breaking of recent support levels exacerbated the move, as did heightened calls for parity in the EUR/USD pair, which looks increasingly more likely by the day.

Figure 2: EUR/USD (May ‘22 – July ‘22)

Source: Refinitiv Date: 11/07/2022

Valuation is as cheap as ever, and positioning is even more stretched this week, but the fear of a disruption in natural gas supplies that would cause stoppages in Central Europe makes the common currency a hot potato no one wants to hold, at least for now. There is no market moving news on tap this week out of the Eurozone, so the CPI report in the US will be key. Investors may also have one eye on next week’s European Central Bank meeting.

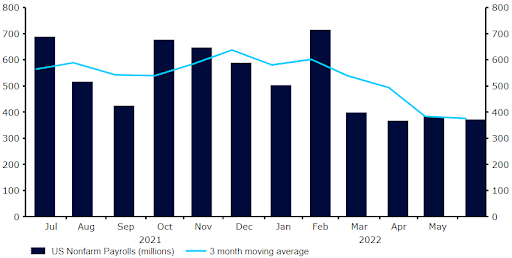

USD

Yet another strong labour market report out of the US validates our view that a recession there is not in sight. Jobs continue to be created at a much faster pace than the growth in the labour force, unemployment remains well below 4% and the number of job openings dwarfs that of job seekers – hardly the stuff of which recessions are made.

Figure 3: US Nonfarm Payrolls (2021 – 2022)

Source: Refinitiv Datastream Date: 11/07/2022

Markets are again pricing it a high likelihood of a 75 bp hike from the Fed at the July meeting. However, the key hurdle remains the inflation report this week. More important than the headline number, in our view, will be the more meaningful core index. There have been hints of stabilisation there in other reports, such as the PCE. A downward surprise could lead markets to revert back to pricing a 50bp hike and, given stretched positioning, cause a countertrend sell off in the greenback.

CHF

Following a few weeks of outperformance, the Swiss franc ended last week near the bottom of the pack in the G10. With market worries concentrated in Europe, the franc (a safe haven, but still European currency) was not the first choice among investors last week. That said, the currency edged higher against a broadly weaker euro, and the EUR/CHF rate dropped below the 0.99 level on Wednesday.

With not much data on tap this week, we’ll focus primarily on outside news. Keeping in mind the market’s recession fears, and the SNB’s laid back approach to a degree of currency strength, we wouldn’t be surprised to see the franc remaining well-bid in the near term.

AUD

The Australian dollar was the best performing currency in the G10 last week, and even posted modest gains against the safe-haven US dollar. We saw a classic ‘buy the rumour, sell the fact’ reaction to last week’s Reserve Bank of Australia meeting. Interest rates were raised by 50 basis points, as we had anticipated, marking the third straight hike and the fastest pace of policy tightening since the mid-1990s. While AUD rallied in the day prior to the meeting, it sold-off following the announcement, as the RBA’s accompanying rhetoric was perceived as dovish. Governor Lowe said that the board expected additional tightening, although the bank said that medium-term inflation expectations were well anchored, with inflation set to return to the target range at some point next year. Markets viewed this as in line with a possible slowdown in the pace of hikes at subsequent meetings, and swaps now only see a 50/50 chance of another half a percentage point hike at the next policy meeting in August.

Thursday’s monthly Australian labour report will be the main focus for markets this week. An easing in net job creation is expected, although economists are bracing for a fresh record low unemployment number.

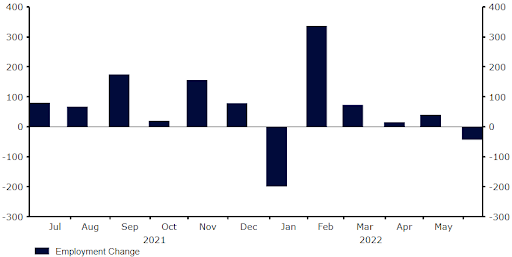

CAD

CAD outperformed most European currencies last week, although still ending the week lower against the US dollar, as a sharp move lower in global oil prices weighed on commodity-dependent currencies worldwide. Heightened recession concerns triggered a rough 10% sell-off in Brent crude oil prices last Tuesday, sending the commodity to back below $100 a barrel at one stage. The Canadian dollar was, however, able to hold its own during the remainder of the week, and was largely unchanged following Friday’s mixed labour report for June, which showed a sharp contraction in jobs (-43.2k), but a move lower in unemployment (4.9% from 5.1%).

Figure 4: Canada Net Employment Change (2021 – 2022)

Source: Refinitiv Datastream Date: 04/07/2022

Attention this week will all be on Wednesday’s Bank of Canada meeting. Following the sizable upside surprise in the May inflation report, we think that the BoC will follow in the Federal Reserve’s footsteps in raising rates by 75 basis points this week. Markets are, however, almost entirely pricing this in, so the reaction in CAD will likely be far more dependent on the bank’s communications on future rate increases. Any indication that an additional 75bp move could be on the way in September would be bullish for CAD, while the lack of one would be seen as a pretty significant disappointment, and could trigger a fairly sharp sell-off in the currency.

CNY

While the USD/CNY rate ended the week almost unchanged, the Chinese yuan was the second-best performing emerging market currency last week, after the Brazilian real. The Asia–Pacific currencies fared the best on the whole, as the gap between market sentiment towards economies there and in other regions (particularly in Europe) widened. One reason for that has been improving economic data from China. Similar to other PMI prints, the services PMI from Caixin was much better than expected. The index surged to 54.5, its strongest expansion in almost a year and the first since February. Assuming an easing in pandemic concerns, we are likely to see more of these positive headlines going forward. It might be a big ‘if’, however. Just last week, China announced new lockdown measures in Xi’an, a northern city of 13 million. Infections have also increased in Shanghai.

This week is jam-packed with data from the mainland. Second-quarter GDP growth on Friday will catch the most attention. Due to Covid-related disturbance, it’s expected to show the first contraction on a quarterly basis since Q1 2020. In addition, the PBoC will set the MLF rate. Any immediate change would be a big surprise considering improving economic numbers, notably on inflation, which edged closer to target and surprising to the upside in June (2.5%).

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports