European currencies rebound on hopes for a ceasefire in the Russia-Ukraine war

( 3 min )

- Go back to blog home

- Latest

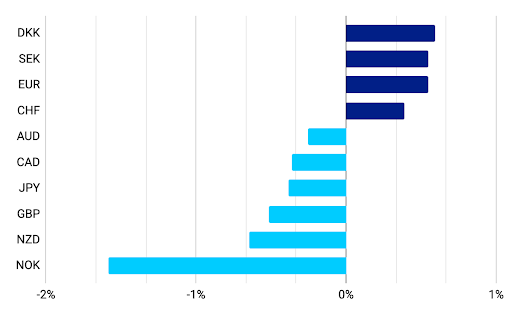

The Euro, together with the Swedish Krona and the Swiss franc led the G10 rankings last week.

This week, economic data is relatively light. The focus should be on central bank communications, as both the Federal Reserve (Wednesday) and the ECB (Thursday) will release the minutes of their respective March meetings. The Fed should validate the increasing tightening priced in by markets with a decided hawkish tone. The tone of the ECB minutes is more difficult to predict, but we expect to see a clear divide between the doves and the hawks, with the balance moving steadily in favour of the latter as relentless inflationary pressures become harder to explain away. This should be supportive of the common currency.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Bloomberg Date: 04/04/2022

GBP

The main news of the week out of the UK was a positive revision to the fourth-quarter economic growth numbers, but markets roundly ignored this backward-looking number. Instead, the perceived Bank of England dovishness continues to weigh on the pound, which lost ground last week against most of its peers. This week is also light in data, and the focus will be on Bank of England chief economist Pill’s speech on Thursday.

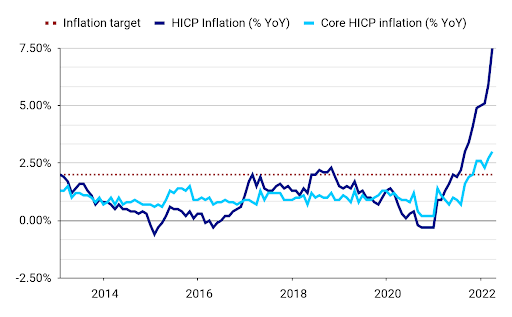

EUR

The March inflation report delivered another spectacular upward surprise at 7.5%, as the headline number blew away already high expectations, thanks mainly to the spikes in Spanish and German prices. The core index was more subdued at 3.0%, but the low weight assigned to housing prices in this index explains some of the quiescence. The lower oil price after Biden’s strategic reserve announcement certainly helps the Eurozone’s battered terms of trade, and that explains the euro’s rebound in recent days. However, a sustained upward trend in the common currency will have to wait for a more clear hawkish shift from the ECB and the prevalence of the hawks in its internal debate. We expect to see this over the coming weeks, starting with the release of the ECB March meeting minutes Thursday.

Figure 2: Eurozone Inflation [2013 – 2022]

Source: Bloomberg Date: 04/04/2022

USD

Another strong labor market report out of the US confirms that the economy is at full employment and labor shortages in many sectors are unlikely to be solved soon, which means inflationary pressures will continue to spread, in our view. All eyes now turn to the release of the minutes for the Federal Reserve March meeting, which is expected to include details on the reduction of the central bank’s enormous holding of Treasuries and mortgage bonds. The key figure will be the rate at which the Fed allows the bonds on its balance sheet to run off without reinvesting the proceeds. Anything above 80 billion dollars per month will be considered hawkish and may lead to a knee-jerk rally in the US dollar.

CHF

As risk sentiment improved last week the Swiss franc sold off somewhat against the euro but ended the week in the top half of the G10 currency dashboard, outperforming its safe-haven peers, the Japanese yen and the US dollar. Interestingly, today’s data showed that the SNB sight deposits increased by 5.7 bn CHF last week, most since May 2020. This suggests the bank may have intervened to stem the franc’s rally.

Figure 3: Change in SNB sight deposits [in mln CHF] (2017 – 2022)

Source: Bloomberg Date: 04/04/2022

Last week’s inflation reading showed headline inflation jumping to 2.4% in March. It did not rock the boat as it was in line with expectations, but it’s still worth noting that consumer price growth in Switzerland last month was the strongest since 2008. This week we’ll focus primarily on the news relating to the Russian invasion of Ukraine as they continue to have the greatest potential to influence the sentiment towards the currency in the near term.

AUD

The Australian dollar reached its highest level in almost five months last week at the start of the week but ended it slightly lower against the US dollar. The Reserve Bank of Australia is set to meet this Tuesday. While the RBA is not expected to change interest rates amid its pledge to remain patient on monetary policy, investors will be watching for any softening of that commitment. Markets also expect the first hike in June and a move to 1.75% by the end of the year to nearly match the Fed’s pace of monetary tightening.

Apart from the RBA meeting, no relevant data releases are expected in Australia this week. Therefore, the Australian dollar will likely continue reacting to shifts in commodity prices. Considering the difficult coronavirus situation in parts of China, news from the country could also impact AUD given the close economic relationship between the countries.

CAD

The Canadian dollar ended last week lower against the US dollar, pressured down by the decline in oil prices. Earlier, CAD reached the highest level since November 2021, on increased bets that the Bank of Canada will begin hiking its key interest rate in 50bps increments to tame inflation currently running at levels not seen since 1991.

The Canadian economy expanded 0.2% month-over-month in January, in line with market expectations. This was the eighth consecutive month of growth, a slight acceleration compared to an upwardly revised 0.1% increase in December.

Friday will see a release of the March labour market report expected to show further improvements. Throughout the week, the Canadian dollar will likely continue being driven by shifts in commodity prices.

CNY

The Chinese yuan ended the week little changed against the dollar as a large portion of the currency’s initial gains were erased late in the week following reports of a worsening coronavirus situation. On Sunday, the country reported north of 13,000 new coronavirus cases, the highest level since the peak of the outbreak. It also announced it found a new iteration of the virus which has evolved from an omicron strain in a city near Shanghai.

Moreover, economic data throughout the week continued to disappoint. Thursday’s official PMIs showed the composite index declining to 48.8 in March, its lowest level since February 2020. Both manufacturing and service sectors came out worse than expected and below level 50 separating expansion and contraction, but the decline in services was particularly sharp, with the index declining to 48.4 from 51.6 a month earlier. On Friday, Caixin Manufacturing PMI did not buck this trend, dropping to 48.1 from 50.4 in February, far below expectations. We’re waiting for Caixin services and composite prints, out Wednesday, but so far the data points to the broad-based weakness of China’s economy brought on about by the new wave of the virus. Considering the prospects for April look gloomy as well we are likely to see more policy easing to cushion the blow.

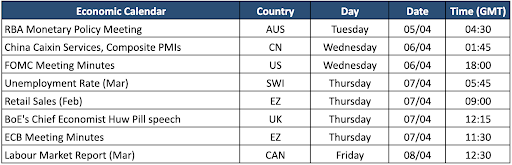

Economic Calendar (04/04/2022 – 08/04/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports