What to expect from this week’s European Central Bank meeting

- Go back to blog home

- Latest

This Thursday’s meeting of the European Central Bank in Riga, Latvia, is shaping up to be key, with increasing speculation that policymakers could begin discussions on when to end the bank’s quantitative easing programme.

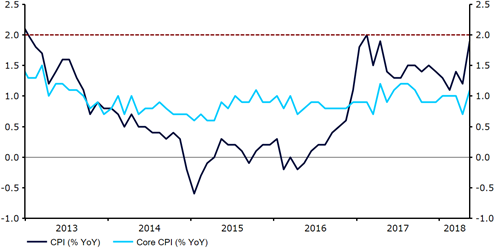

The recent speculation that a policy announcement could be imminent has come off the back of the much-better-than-expected inflation figures for May, which bucked the trend of recent disappointing economic news out of the Euro-area. Headline inflation jumped to 1.9% from the 1.2% recorded a month previous, its highest level in a little over a year (Figure 1). The core measure of consumer prices, one of the most important economic data releases the ECB considers when deciding on policy, also improved, although still remains stuck at just 1.1%. This is still well below the central bank’s ‘close to, but below 2%’ target.

Figure 1: Eurozone Inflation Rate (2013 – 2018)

We think that there is more uncertainty than usual around this week’s meeting. While the improvement in inflation dynamics could well spark a discussion on a possible QE exit, it far from guarantees that any exit strategy will be announced during Mario Draghi’s press conference. It is also not clear to us what reaction the Council will have as to the political and market turmoil caused by the new Italian populist government, as well as the general slowdown in economic data out of the Euro-area.

The formation of the coalition government in Italy has allayed concerns that the country may be heading towards a snap election in the autumn. Investors do, however, remain concerned over Prime Minister Giuseppe Conte’s plans to cut taxes and ramp up government spending, given the country’s already precarious fiscal position. Italy’s debt-to-GDP ratio has been above 130% for the past few years, among the highest in the world. Financial markets in Italy remain fragile following the political crisis.

Recent growth data out of the Eurozone has also been soft. The business activity PMIs have continued to fall short of expectations, while overall growth in the first quarter slipped to its lowest level since the third quarter of 2016. This has been reflected in Citi’s measure of Eurozone economic surprise, which has remained deep in negative territory and around its lowest level since 2009 (Figure 2).

Figure 2: Citi’s Eurozone Economic Surprise Index (2016 – 2018)

, We think the twin worries of mostly soft data and weakness in the Italian financial market are sufficient to delay the announcement of an end to QE for later this year, likely until the July meeting. Major policy changes from the ECB have generally been implemented gradually, with Draghi announcing preparations to change in one meeting, and then following this up with the actual policy announcement in the next.

We still think that with core inflation still well below target, a three-month extension in the bank’s asset purchases until December still remains possible. Even in the event that the ECB hints its asset purchasing programme could be brought to a close, we would only expect no more than a fairly modest, short term bounce in the Euro. The ECB has continued to stress in recent meetings that any interest rate hikes, which remain the key to foreign exchange market movements, are a long way off. Futures markets are currently not pricing in an increase to the bank’s deposit rate until mid-2019 which, at this stage, seems the earliest point we could see higher rates from the ECB.

On a longer time frame, however, the strong bounce back in inflation data we saw in May provides the first tentative evidence for an uptrend in this critical economic indicator and that the US Dollar rally against the Euro may be nearing its end.